Today we are taking a bird's-eye view of our digital asset outlook for the remainder of 2024, including a closer look at the two main catalysts at this current juncture—regulation and liquidity. A portfolio-level insight reviewing Q2 will be shared with Limited Partners in a separate email.

Crypto’s Six Year Rise out of Obscurity

6 years ago, Hartmann Digital Assets Fund had its initial close. We (or more properly ‘I’ at the time, as a twenty-three-year-old one-man show) came onto a very novel scene with perhaps no more than 100 crypto funds ever having been in existence. It was easy to know everybody and everything. There were only a handful of OTC desks like Circle and Cumberland, one or two custodians like Kingdom Trust, a singular bank willing to back the space (Silvergate), and virtually, and I mean this earnestly, zero actual products or users outside sending and receiving BTC. The industry was almost exclusively built on vision and ideals. This was an era before DeFi, DePin, Web3 Gaming, and everything that has been built in recent years. In fact, most of the ‘basic’ financial primitives that are taken for granted daily, like on-chain swaps, lending, and borrowing, were virtually non-existent—so much so that in that year all of global DeFi was banking approximately $300k. This number, for context, has since risen to north of $100bn.

2018 was also the year when BlackRock’s Larry Fink said that he can’t think of a single client on the globe that has asked for or wanted crypto exposure. Today, BlackRock’s Bitcoin ETF recorded the most successful ETF launch in history, hauling in $20 billion in under 5 months.

If we were to shrink down the entire trading history of Bitcoin and ETH into just 10 days, I’ve traded and witnessed around 5 for Bitcoin and 8 for ETH. Every candle and wick tells a story I fondly remember. Equally, being on the younger side of CIOs/GPs with a 6-year digital asset track record, this crypto journey already makes up 25% of my life in years or 64% of my adult life. Being in a nascent industry for this long, and as I like to say, growing up both in it and alongside it, has shaped my perspectives profoundly.

The industry has gone through many phases on this shared path to maturity. A fairly homogeneous ideal-driven community of libertarians has splintered into many subcultures—from the suit-wearing digital asset crowd pushing for institutional adoption, to the meme-coin casino millennial who lives on Twitter, and finally the original missionary crowd pushing ideals of privacy and decentralization while regularly being targeted by governmental agencies. The first has become my job, the second makes me question my job, and the third is why I get over the stench of the second and remember what brought me here in the first place.

The Regulatory Bottleneck is Heating Up… and is About to Burst

While the industry continues to build, particularly on the scaling front, innovation and adoption have been hamstrung amidst the regulatory battlefield in the US. It’s been nearly a full year since I published my letter on the regulatory bottleneck. While Ripple and Grayscale won their respective cases, and the Bitcoin ETF got approved as a result, as predicted, the regulatory war has not been won yet. The SEC has continued its crackdown on the industry’s most illustrious participants as recently as April with their Wells notice to Uniswap Labs, a US-based unicorn company that is used by millions and has not stolen a penny from anyone. Instead of going after the countless scams and frauds prevalent both in finance and crypto, they chose to go to war with pillars of the industry like Coinbase, Kraken, and Uniswap. It’s not a war for ‘investor protection’; it's a war against technology.

This war against technology has had real repercussions. A few challenges come to mind when thinking of how this current toxic regulatory environment has led to an erosion in fundamentals in the industry:

Unless a builder is willing to rot in jail for their mission, many are steering clear of crypto. Running a startup is hard enough; the last thing you need is the Feds threatening your liberties.

Regulatory pressure is unevenly skewed towards legitimate products. In other words, you are likely safe from the SEC if you straight up scam someone with a pump-and-dump meme coin, but God forbid you build a new technology that may actually change the financial industry. As a result, we are seeing more worthless crap being launched than truly valuable tokens that try to capture and return value to their holders.

DeFi has not really grown in 3 years. While we hit a mind-blowing $100bn in assets being banked on decentralized rails (down from $180bn in 2021), growing materially past this mark will require institutional capital, which is not going on-chain until there’s regulatory clarity.

The Digital Asset trade did not require regulatory support to climb from the innovators to the early adopters. However, the next leg of the Digital Asset trade, to go from Early Adopters to Early Majority, very much needs either regulatory support or a collapse of the old system.

In other words, Tokenization and blockchain’s rising adoption are technologically inevitable. But it’s in regulators' (and voters') power to decide whether we start utilizing this technology today or wait to build upon the ashes of autocracy and currency debasement.

Remove the time horizon, and there is only one correct trade to take: being long on decentralization and shorting the fiat system, institutional inertia, and any nation suffocating at the hands of bureaucracy.

Running a liquid fund, however, time horizons matter. The AI industry, for example, while today evidently shattering records in adoption speed, suffered through two multi-year winters in the '70s and '90s1. The last few months, as Bitcoin struggled to defend its all-time high, I’ve spent a tremendous amount of time thinking about whether or not the industry would win this regulatory war in the West or be shelved until a more friendly (or as the media likes to call it—radical) administration takes over.

But then, things started changing in the last three weeks… As former (and currently polling future) President Donald Trump publicly threw his support behind the digital asset industry2, we started seeing a sudden tone change in DC:

The Ethereum ETF, against all expectations, got streamlined for a rushed approval by the SEC.3

Congressional Disapproval for the SEC's harshly restrictive crypto custody rules under SAB 121 passed with votes from countless formerly crypto-hostile Democrats.456

The Financial Innovation and Technology Act, vastly welcomed by the digital asset community for providing more regulatory clarity and limiting the SEC's jurisdiction over the asset class, passed the House of Representatives and made its way to the Senate. 78

Noticing the sudden influx of support for the Trump campaign from the digital asset community, the Biden campaign suddenly began their own outreach to the community according to The Block. Biden lost all favors with the community days later, though, when he vetoed Congress’s repeal of SAB 121.

Ending the Gensler Crusades

To get a better look at the situation, two weeks ago, I found myself in the same room as most of the industry’s policy and/or leadership teams at the annual CoinCenter Gala in Austin, Texas. The energy was rather elated, with speakers acknowledging that “we are finally starting to win” in light of the recent victories in DC. House Majority Whip Tom Emmer greeted the audience, too, with a warning to SEC Chairman Gary Gensler: “Hear my voice, Gary - Your days are numbered.” As I was sitting there, I asked myself: “Is it really the time?”

The presidential election may just be the hammer that shatters the regulatory bottleneck. If Trump wins, expect Gensler to be resigned at worst or in jail at best. Beyond the autocratic abuse of power in his role as SEC chairman (which is now more frequently pointed out by courts), Gensler also used to serve as Hillary Clinton’s campaign CFO, which brands him as a foe to the Trump administration.

If Biden wants to win, canning Gensler may be his most straightforward path to winning the crypto vote and distancing himself from the radical left, particularly Elizabeth Warren, who has made it her mission to "build an Anti-Crypto army”. This dissent from Warren, who has served as the de-facto voice of the Democratic party on all things crypto, was visible in the vote on FIT 21, where even former Speaker of the House Nancy Pelosi voted in favor alongside Republicans.

I now place the odds of an end to the Gensler Era in the next 6 months at 70-80%. The day that happens, I expect the global digital asset market cap to appreciate by 30%+… or in other words, around a trillion.

Should the dice fall on the remaining 20-30% (or my estimate just be completely off), and we get another four years of Biden and another 2 years of Gensler before his term elapses, I would place my bets on a continual erosion of what Capo Gensler likes to call ‘crypto asset securities.’ The good guys will lose, and the only winners will be law firms collecting checks from crypto firms and US taxpayers as they go head to head for another four years.

Two camps of assets, however, remain mostly sheltered from this crackdown: officially deemed crypto commodities like Bitcoin and meme-coins that do not even attempt to generate value and are born as literal parodies yet evolve into being proxy trades on the cultural Zeitgeist. These two asset camps will continue to grow due to a mix of fiscal irresponsibility of central banks and financial nihilism of Gen Z and millennials. A treatise on exploring these markets is in the works too but will have to wait for another time.

A New Era in Digital Assets

The most meaningful graduation from being speculative assets to investable assets for the wider digital asset space beyond Bitcoin’s digital gold thesis occurs the moment tokens can accrue value without being at odds with regulators. While part of the debate is whether or not digital assets are commodities or securities, the other meaningful debate is how crypto assets can be compliant in a way that does not go against the underlying technology. For example, requiring KYC of each and every holder is a non-starter when the underlying principle is privacy and permissionlessness.

In the event of regulatory clarity, the digital asset market will likely transform in ways that unlock the greatest bull market yet. A few predictions stand out:

A shift from narratives to product market fit

Since there is currently no path for crypto assets to compliantly accrue value, most crypto asset issuers do not even bother creating products that capture value. Ironically, the ability to capture value is a great litmus test in determining whether or not a product itself is genuinely demanded enough for consumers to part with their hard-earned money. Instead, crypto founders have often built things that consumers care so little for, they had to pay their users in tokens to use them. So a few things happen. The quality of building goes up, and...

Projects will have more clear metrics to measure success by

Currently, many digital asset valuations appear to be free-floating numbers set purely based on sentiment and comps. While most markets certainly aren’t efficient, as even equities often trade far detached from their earnings, the equity market does do a fair job in raising the cream to the top. As such, the tokens with the most material product market fit and earnings are likely to start dominating both conversations and portfolios more frequently. This in turn leads to...

Easier funding environment for digital assets

Funding in digital assets is most heavily skewed towards the private markets, while the ability to raise post token launch tends to turn into a roll of the dice for founders based on what market regime they find themselves in. This has caused a cyclical rise and fall nature of ‘alts,’ where each new cycle brings with it a cohort of new projects that raise fantastic rounds while private, and often run out of money or fail to properly capitalize the next bear market, sometimes even if they actually built a fine product. Then the private markets rotate to the next cohort. There is a fair amount of duplicate costs and value being discarded through this rotation. As such, stronger fundamentals will enable protocols to raise funding more easily while at the same time enabling...

A thriving M&A market

Throughout 2022-23, we witnessed numerous DeFi projects fall by the wayside that could have been prime acquisition targets for better-funded DeFi projects. For example, a well-funded Uniswap or fairly well-capitalized AAVE may expand its offering and become a DeFi super app by acquiring some of the many well-functioning but under-capitalized players in the on-chain perps and options markets, or break more materially into real-world assets by facilitating a token swap with one of the leading real-world-asset (RWA) protocols that are trading at perhaps 1% the market cap of Uniswap. The maturation of crypto assets individually and of the market as a whole is likely to open the doors for truly savvy dealmakers and operators to build value in ways we have not properly seen executed before in Digital Assets and materially accelerate product development and innovation, which in turn leads us closer to adoption. For example, some Layer 1 blockchains are likely to utilize M&A to acquire highly desired products and turn them into public goods. This would reduce costs for users, while at the same time increasing usage and gas spend on the chain itself, driving value for the network token (the fat protocol thesis sends its regards). 9

Having traded catalysts and fundamentals in digital assets since the day they essentially arrived in the industry, this is perhaps the most promising era of this market that is yet to come. Such structural changes would also likely see the largest inflows in capital into the market as institutional allocators can apply similar models in finding true value as they have for a century in other asset classes.

At Hartmann Capital, our core digital asset thesis is that ‘Most Assets will be Tokenized’ in the coming decade. And while this was a contrarian take, Larry Fink and even Jamie Dimon (who can’t stand Bitcoin), are fond proponents of tokenization. While most of these leaders are focusing on the asset that could be wrapped in a token and the opportunities and savings it would unlock, we want to focus on and own a stake in the infrastructure that powers this whole process and could capture the fees of what will likely, in the endgame, be the market of all markets—from financial, to physical assets, to IP, and personal data.

Lighting the Fuse

The timing of the US presidential election, and thereby the regulatory fate of the digital asset space, happens to coincide with the looming central bank pivot. While the ECB took the first move in cutting interest rates, the Fed has yet to make its first cut, now projecting that it will cut rates once in 2024, with rates dropping to ~4% in 2025 per their June Economic Projections.

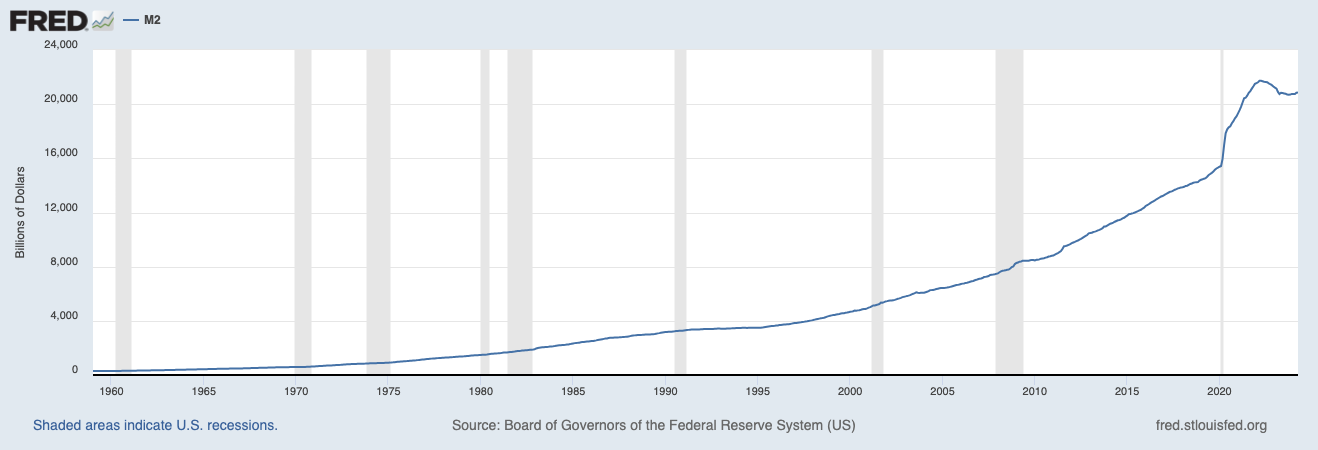

While the Fed has successfully reduced its balance sheet by approximately $1.7 trillion since the tightening started, M2 money supply remains near its all-time high.

By now, $6.44 trillion of this money supply are sitting in money market funds, earning a passive ~5% annualized. As rates get cut, not only are risk assets more attractive as access to capital becomes easier, but equally will the risk-free alternative become less attractive. When 2-3 trillion of sidelined cash re-enter markets, we are likely to see digital asset prices rise materially, both acutely during the early innings of easing, and throughout the entirety of the lower interest rate environment.

Conclusion

Rate cuts are on the horizon regardless of the political outcome. As such, money will flow. Where that money flows to is largely dependent on whether there will be changes to SEC leadership or mandate, or alternatively a loss of jurisdiction over digital assets through courts and Congress. The outcome remains binary, though, where under the current regime Bitcoin and memes thrive, while under a more constructive regulatory framework, the true innovations in digital assets can begin to serve trillions of dollars in financial value and capture hundreds of billions in value in exchange.

The trade remains two-fold—hold tight till the pivot & pick the right regime. Regardless of the outcome, either bucket can serve as a tradeable universe for the next four years with tremendous upside.

At the end, I’ll leave you with an excerpt from digital asset pioneer Erik Voorhees’ keynote speech at the annual CoinCenter Gala on the promise of crypto and why the battle for digital sovereignty must be won in America—a country founded upon the principles this industry most closely reflects.

https://www.reuters.com/world/us/trump-pitches-himself-crypto-president-san-francisco-tech-fundraiser-2024-06-07/

https://www.reuters.com/technology/us-sec-approves-exchange-applications-list-spot-ether-etfs-2024-05-23/

The main topic of Staff Accounting Bulletin (SAB) No. 121 is the accounting and disclosure guidance for entities that have obligations to safeguard crypto-assets held for their platform users. Specifically, SAB 121 provides interpretive guidance on how entities should account for and disclose these custodial obligations, emphasizing the need to recognize both a safeguarding liability and a corresponding asset measured at fair value (SEC.gov) (Viewpoint).

This guidance is pertinent to entities involved in the custody of crypto-assets, whether directly or through sub-custodians, and includes considerations of technological, legal, and regulatory risks associated with these activities (SEC.gov).

https://www.congress.gov/bill/118th-congress/house-joint-resolution/109

(Biden has since vetoed the Repeal) https://www.whitehouse.gov/briefing-room/presidential-actions/2024/05/31/a-message-to-the-house-of-representatives-on-the-presidents-veto-of-h-j-res-109/

The main topic of the Financial Innovation and Technology for the 21st Century Act (FIT 21) is the establishment of a regulatory framework for digital assets. This comprehensive legislation addresses the need for clear regulations in the rapidly evolving cryptocurrency industry, aiming to promote innovation while ensuring consumer protection and market integrity. The FIT Act represents a significant step toward bipartisan cooperation in creating a stable regulatory environment for digital assets, highlighting the importance of Congress in determining these regulations rather than leaving it solely to regulatory agencies (Congress.gov | Library of Congress) (CoinDesk).

https://www.congress.gov/bill/118th-congress/house-bill/4763/text?s=1&r=1&q=%7B%22search%22%3A%5B%22Financial+Innovation+and+Technology+for+the+21st+Century+Act.%22%5D%7D

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.