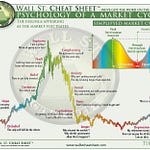

In the spring of 2020, global markets experienced one of their greatest mispricings. As the S&P recorded three of its twenty worst days since 1923 in the span of a week, the Federal Reserve evaporated interest rates down to 0 while Congress signed off on some of the most aggressive monetary and fiscal easings in modern history. While many in the digital asset space, myself included, pointed at this and foresaw the impending economy-disrupting inflation, everyone, including Fed Chair Powell, was sure that inflation would stay closely within the 2% target, and when it suddenly was not, it was nothing but transitory, until again, it was not.

What ensued was one of the most accelerated bull markets in recent history across asset classes. And the only thing that could slow it in its tracks was the very thing that first ignited it. The Fed. As the pendulum swung aggressively towards easing, it now swung equally forcefully back with the fastest rate hikes in 35 years.

Yet when zoomed out, it all does not look that odd. Since 2020, the S&P has appreciated to the tune of 18%., not far off from its annual average compounded return of 10.7%. But if you zoom in, you’ll be hard-pressed to miss the rollercoaster the market has been through - from shaving off 35% during Black Thursday 2020 to regaining 118% the following 24 months, only to once again give back over 20%.

The rollercoaster the market has experienced naturally leads to heightened emotions, and we currently find ourselves deep in the valley of despair. If you listen to the news, you’d think it’s the end of crypto, the end of tech, heck the end of growth investments altogether. “Experts” on TV call for the top in globalization and predict that global progress and productivity are going to decline, and things will never be the way they were. I wish I was kidding.

In today’s writeup, I want to unpack why I believe the very premises of most macro analyses today are off and fail to take into account the increase of global productivity due to AI, the decreased reliance on commodities and physical goods due to the rise of the metaverse, and the decrease in inefficiencies and middle-men due to blockchain technology.

Today we will leave the doom headlines behind us and take a data-driven approach to the future. So grab a coffee and buckle up. The future may just be brighter than you think.

Paradigm Shift 1:

“High Inflation with Strong Labor-Market” will become “Deflation with Rising Unemployment”

We will look back at this time with awe. A 50-year low in unemployment, the same year that AI finally became so smart it may just kill google.

We’re at the dawn of the digital age.

Coding is taught in schools and becoming commoditized.

Virtual worlds are no longer sci-fi but the latest land grab amongst tech giants.

AI is no longer just a semi-philosophical topic for late-night musings, but an easily accessible technology for millions of builders.

Crypto is no longer a fringe technology but is used by everyone from JP Morgan, to Paypal, to Meta.

Most of these technologies will provide deflationary pressures while making countless industries and careers obsolete.

Technology can impact deflation in a few ways:

Improved efficiency: Technology can improve the efficiency of production processes, which can lead to lower costs and potentially lower prices for goods and services. This can contribute to deflationary pressures.

Increased productivity: Technology can increase the productivity of workers, which can also lead to lower costs and potentially lower prices for goods and services. This can also contribute to deflationary pressures.

Increased competition: Technology can make it easier for new firms to enter markets, which can increase competition and lead to lower prices for goods and services. This can also contribute to deflationary pressures.

Reduced demand for labor: If technology leads to significant job losses, this could reduce the overall demand for labor and lead to downward pressure on wages. This, in turn, could reduce the cost of production and potentially lead to lower prices for goods and services.

It's worth noting that the impact of technology on deflation will depend on a variety of factors, including the specific industries in which it is being implemented and the overall state of the economy.

Oh, by the way… that italicized part was written by AI…

Inflation will be a worry of the past in short order with interest rates this high and technology progressing at its breakneck pace.

Paradigm Shift 2:

“Rising Commodity Prices & Forced Austerity” will become “Digital Abundance & Rising Quality of Life across Socio-Economic Strata”

A common theme amongst financial commentators is that they always expect more of “the current thing”. Markets boom. They assume they will keep booming. Crypto exchanges fail. They assume more will fail. Commodities rally. They prognosticate commodities must keep rallying till we trade our firstborn for oil.

In a recent interview I listened to by macro investor, Felix Zulauf, he cites that commodities will rise again in prices in late 2023 and 2024, due to scarcity in production (e.g. Russia withholding oil from the West). While I have countless issues with these claims, such as the US’s vast shale oil reserve that certainly would be tapped long before US Oil gets to the $200 mark he predicts, there is a much bigger paradigm shift I want to hone in on when it comes to commodity pricing.

The world is going digital, and the cost of physical goods simply matters less.

How much gas does your car consume going to a zoom meeting? Zero.

How much kerosene do you consume traveling in VR? Zero.

How much fabric do you use for digital fashion? Zero.

How much lumber & steel goes into the construction of your digital home? Zero.

Alas, while I understand we are not living in Ready Player One just yet, the reality is that we are on the road of efficiency rather than austerity. From hyperefficient ghost kitchens and food delivery to remote work and virtual schools, the average family can have a better life with less.

It’s worth noting that the two biggest categories in the CPI are housing and transportation - yet both housing and transportation become more variable in a digital-first world.

In an age where most work is remote, classes are virtual, grocery stores offer free delivery, and Amazon exists, owning a car is for leisure unless your job requires it. Equally, given the same dynamics, it is no longer necessary to live downtown. Urban sprawl will keep sprawling, as people just need to live ‘close enough’ to the action a city provides. Match that with ever-improving transportation (from the Boring Company to supersonic travel) and you may just be fine living 1-2 hours outside the city when the tunnel can take you at 150mph.

The pandemic accelerated this trend already tremendously. Even today, traffic is down 22% from pre-pandemic levels due to the rise of remote work.

Physical work will soon be fully automated, and nearly all intellectual work can be done remotely.

While it might sound utopian that in the metaverse everyone can be rich, it’s worth noting how the standard of living has risen across the board over the last centuries thanks to technology. In most western countries, even the lowest socio-economic classes have access to better health care, technology, and information than US presidents had as little as thirty years ago in the pre-internet era. The best way to highlight human progress may just be life expectancy as it’s a cumulative result of progress in medicine, agriculture, infrastructure, and more. The economy is clearly not a zero-sum game.

In the Metaverse, you can have world-class experiences for a fraction of the “real-world” cost.

Instead of a single $300 college textbook, students can buy a VR headset and unlock learning environments that put the most expensive private schools to shame in VictoryXR.

Instead of a $600 Coachella ticket, those seeking entertainment can buy two quest headsets and have access to music festivals and digital experiences in Redpill VR that make Coachella look low production value. Individual experiences will likely cost you less than parking at a real-world venue.

Instead of spending hundreds of dollars on apparel (Apparel making up about 3% of CPI), people can spend pennies or dollars on building out a digital closet on DressX that they can wear on zoom, social media, on their avatars, and more. Before you think it sounds silly, more people are likely to see you on zoom or on social media than see you in the flesh already today.

We are not quite there yet, but we are maybe 2-3 years away from where the digital unequivocally matters more than the physical, which will throw the average macroeconomist into a tailspin because this was an angle they did not consider.

When you can work from anywhere and can access infinite worlds from within a $300 headset, real estate too will have some long-held assumptions challenged.

Paradigm Shift 3:

“Web3/The Metaverse/AI will take longer than we think” will become “There is an Ever-Shortening Window of Opportunity to have a Stake in the New World”

It’s easy to let silly appearances distract you - Bored Apes, Dogecoin, the clunkiness of a VR headset. The reality is we are at a unique junction as a species that cannot be stressed enough:

Crypto - Coinbase has surpassed over 100mm KYC’d users and the Ethereum blockchain is processing more transactions a day during market capitulation and depression than it did nearly the entirety of the 2017 mania despite the rise of multi-chain and layer 2s.

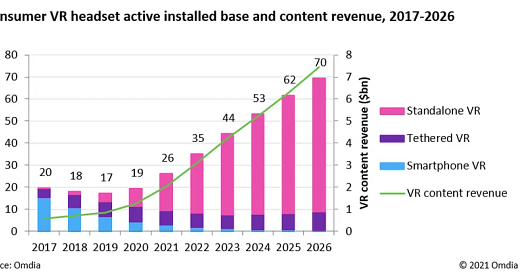

Metaverse - The number of VR headsets is growing exponentially and so is VR content revenue.

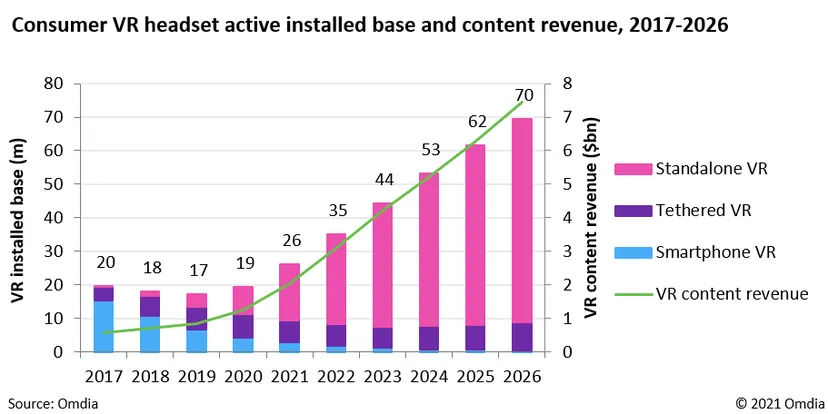

Space - The cost of transporting goods to space is on a logarithmic decline. Today the cost of transporting things to space costs 1% of what it cost in the 80s. By 2050, it will be 1% of what it costs today.

AI - Natural Language Processing (NLP) has exploded logarithmically in how many parameters it can use.

Technology is not growing linearly. Most of these trends are growing exponentially if not even logarithmically. Sitting out an active logarithmic trend and hoping for a better entry is equal to collecting shells during the ebb when one sees a tsunami on the horizon.

At the risk of sounding young and naive - I am not worried about near-term market fluctuations and interest rates being 3%, 5%, or 7%. We will be a globally connected, space-faring, digital-first species that over time will merge more and more with AI. Investing in anything but that is short-sighted.

Similar to the discovery of America, these opportunities only arise every so often. It’s not every Millenium that our civilization creates alternate digital realities. It’s not every Millenium that our civilization finds a way to create a global immutable ledger for truth and currency. It’s not every Millenium that our civilization creates ‘life’ smarter than itself. It’s not every Millenium that our civilization finds ways to become multi-planetary.

2022 has been ridden by economic woes that naturally make people lose their vision enabling them to look no further than the next three months. The un-levered investor would be well advised to take a pause and think long-term. Where are we? And where are we going?

The only thing that is future-proof is the future itself. In a high-interest rate environment, you will find fewer tech companies operating like theme parks, that is for sure. But progress does not stop here, nor does it slow. Visa is getting into crypto payments on Ethereum. Paypal integrates with Metamask. Former Activision President becomes Yuga Labs CEO. That was all just this week in crypto while the market was too caught up reading about FTX.

It’s an odd time to be bearish on the future, and perhaps the greatest and perhaps final decades to back builders as technology accelerates toward the singularity.

2022 was not without its challenges, but Hartmann Capital will keep paving the way as an emerging frontier tech investment firm. In Q3, our crypto fund was the #1 performing crypto hedge fund in the world (per Galaxy & CFR), and our metaverse venture fund has quickly made itself a name finding its place amongst the most desired XR cap tables. In 2023, we will continue to expand our offering, to keep funding and supporting founders building toward a thriving future. This outlook may give you a taste of where we are looking. I thank those, on whose behalf I get to steward capital for the last five years and look forward to connecting with those who aim to join our mission next year.

As our mantra goes, the future belongs to those who invest in it.

Best,

Felix Hartmann, Managing Partner

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.

Share this post