Over the past few months, I have been contemplating the future of digital assets. Today, I aim to present my predictions for what I believe will be the fifth major cycle in the digital asset markets. Initially intended as a single piece, the extensive length of this thesis necessitated its division into a three-part series. To highlight my conviction in this thesis, we've expanded our team with the latest addition of Hartmann Digital's first Information Systems Architect. This role will help construct the essential technical infrastructure to identify and act on opportunities more swiftly in the anticipated bull market.

Introduction - “This time is [not] different”

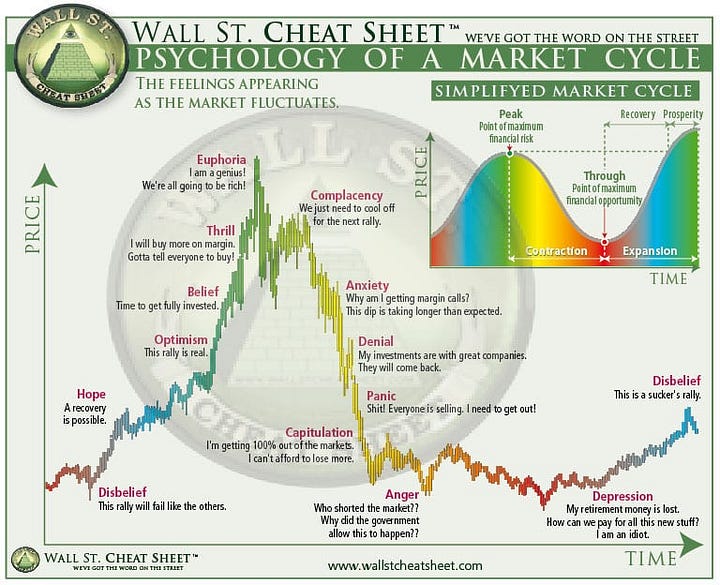

Though emotions have been fraught, given the unique challenges of the past year (such as the FTX scandal inciting regulatory backlash), the broader market structure remains consistent with both traditional and previous digital asset cycles. Crypto Twitter, a popular hub for industry insiders, closely mirrors the well-known 'Psychology of a Market Cycle' chart. Anecdotally (we will soon shift from anecdotes to data), many market players, myself included, seem to be mentally rebounding from the eighteen-month downturn and preparing for the next cycle.

As with the last cycle, the new one is initially led by Bitcoin. Below, you can see the total market cap of all tokens, excluding BTC and ETH (TOTAL3), retesting its post-FTX lows. This is similar to how TOTAL3 retested its December 2018 lows in the summer of 2019.

The progression is logical. As a bear market persists, liquidity decreases, teams sell portions of their tokens to sustain their burn-rate, and VCs liquidate their stakes to return assets to LPs. Consequently, most tokens outside BTC/ETH experience larger draw-downs. This triggers a 'flight to quality', as outlined in our Q3/4 'war rooms', where allocators consolidate their portfolios into Bitcoin and Ethereum. This creates upward pressure on these two leading assets and downward pressure on the rest.

However, the crowded trade is rarely the right one. In 2019, Bitcoin maximalism emerged and gained traction due to this price dynamic. Participants desired to distance themselves from the underperforming ICOs and commit to Bitcoin, which had outperformed all other assets in the downturn. But what happened next? The tide turned.

Over the next year and a half, Bitcoin was among the weakest performers in the space. Meanwhile, the real opportunities lay in the multitude of new technologies one could only get exposure to via token investments: DeFi, Stablecoins, NFTs, the Metaverse, decentralized Web Infrastructure, and more.

Price charts alone, however, don't provide the whole picture. Four questions need to be addressed to draw meaningful conclusions about both the investability of the space and the potential dynamics of the new cycle:

Will regulatory pressures stop the bull market in its tracks? [Part I]

Has infrastructure improved from trough to trough? [Part II]

What core opportunities have Digital Assets successfully tackled? [Part II]

Is the bottom really in? [Part III]

Breaking the Regulatory Bottleneck

It's not often that a regulatory body is either in court with or investigating half an entire tech industry. While we should question the motives over the long term, I'll leave the detective work to those with more time. Instead, as an asset allocator, the focus should be on potential resolution scenarios and their timelines.

Interestingly, a resolution wouldn't just alleviate issues for those currently under scrutiny, but it would likely also provide the regulatory clarity that this industry craves. Such clarity would accelerate both capital formation and innovation, as investors are hesitant to allocate funds at a time when many crypto startups and companies are using half their burn rate solely for legal retainers. Furthermore, young developers should not live in fear of legal consequences for simply trying to innovate.

Three likely paths could lead to resolution of the ongoing 'Salem Witch Trials' in DC:

Major Court Cases

Presidential Election

International Rebalance of Power

Let's delve into each in more detail:

Major Court Cases

There are three pivotal lawsuits I'm monitoring closely, each with significant implications for the entire digital asset industry. These cases could clarify several key issues:

SEC v. Coinbase

Summary of Complaint:

The SEC alleges that Coinbase, the largest crypto asset trading platform in the U.S., has been operating as an unregistered broker, exchange, and clearing agency. This is based on Coinbase's platform merging these three roles, traditionally separated in securities markets, without registering with the SEC for any of the three functions.

The SEC further asserts that Coinbase has been providing these services for crypto asset securities, thus bringing their operations within the scope of securities laws. As such, Coinbase, according to the SEC, has defied regulatory structures and evaded disclosure requirements set for the protection of national securities markets and investors.

Moreover, Coinbase is accused of knowingly making available for trading crypto assets that have the characteristics of securities, thus prioritizing its profits over compliance with the law and the interests of its investors.

Additionally, since 2019, Coinbase has offered a staking program that the SEC deems as investment contracts, and hence securities. However, the SEC argues that Coinbase has never registered this staking program, violating the Securities Act of 1933.1

Regulatory Clarity to be Achieved

The outcome of this court case is likely to provide clarity on several vital issues, enabling the industry to progress and attract new participants:

Are digital assets considered securities, and if so, which ones and why?

How should digital asset exchanges be structured? Does the traditional securities exchange model of brokers, national securities exchanges, and clearing agencies apply to the digital asset space, which fundamentally differs due to on-chain issuance and custody?

Do staking and stablecoin yield products constitute an investment contract, thereby falling under SEC jurisdiction?

How the Dice are Falling

On June 28th Coinbase filed its official answer to the SECs complaint2:

As the largest U.S. digital asset exchange, Coinbase is contesting the SEC’s accusation that it has failed since 2019 to register as a national securities exchange, broker, and clearing agency. In 2021, the SEC had allowed Coinbase to publicly sell its shares after intensive review and dialogue, without implying the need for registration. The SEC now claims that 12 out of 240+ tokens traded on Coinbase are "securities", a claim not made in 2021. Coinbase asserts the SEC's new position is legally untenable, violates due process, and disrupts the constitutional separation of powers.

Coinbase emphasizes that it has always cooperated with U.S. regulators and complied with all applicable laws, welcoming regulation. However, the SEC's recent actions are seen as an expansion of its own authority to regulate digital assets, done arbitrarily without congressional mandate. Coinbase states none of the assets that the SEC identified are securities. It also mentions the ongoing congressional debate about the best approach to regulating digital assets.

Coinbase argues that the SEC's new interpretation of "investment contract" requires formal rulemaking rather than punitive enforcement actions. The company asserts that the SEC's claims are both imprudent and unlawful.

Furthermore, Coinbase disclosed its 11 defenses (Page 173 & 174). While many were anticipated, such as 'no authority to regulate' or 'no securities trade on Coinbase’s spot exchange', there are some particularly intriguing and compelling defenses. The 10th defense claims, "The Complaint is barred by Plaintiff’s unclean hands". Without additional details, it's intriguing to speculate whether the Coinbase legal team possesses a 'smoking gun' that indicates corruption within the agency.

However, it's the third defense that could potentially resolve the issue of US regulation. This is Defense 3, 'The Major Questions Doctrine', which originated from a recent US Supreme Court Case in 2022 between West Virgina and the EPA.3

The major questions doctrine, holds that in “extraordinary” cases involving matters of great “economic and political significance,” federal agencies must be able to point to specific Congressional authorization for their actions.

Shifting decision making on these key issues away from the SEC and towards Congress would be a major win for the industry. It's no secret that the SEC has faced intense scrutiny from the US Congress, as members from both parties grow increasingly concerned that Chair Gensler's actions are driving businesses overseas. This concern has even led to the introduction of the SEC Stabilization Act4 which seeks to remove Chair Gensler and fundamentally restructure SEC governance.

Grayscale v. SEC

Summary:

Grayscale Investments has challenged the SEC's decision to approve futures-based Bitcoin ETFs but disapprove its application for a spot-based Bitcoin ETF, claiming unequal treatment of two related products. The SEC, however, maintains that the lack of robust surveillance in unregulated spot markets where Grayscale’s proposed product would operate prevents it from ensuring protection against fraud and manipulation as effectively as in futures markets (on the CME). The SEC argues its differential treatment of the products is reasonable and in line with Exchange Act requirements.5

The judges on the D.C. Circuit panel appeared skeptical of the SEC's claim that they had sufficient grounds to approve futures-based bitcoin ETFs while denying spot-based ETFs because they would be harder to oversee. They questioned the SEC's claim about the correlation between the bitcoin spot and futures markets and seemed concerned about potential consequences of revoking Grayscale's decision.6

Why it matters:

The Grayscale case is incredibly important for two reasons.

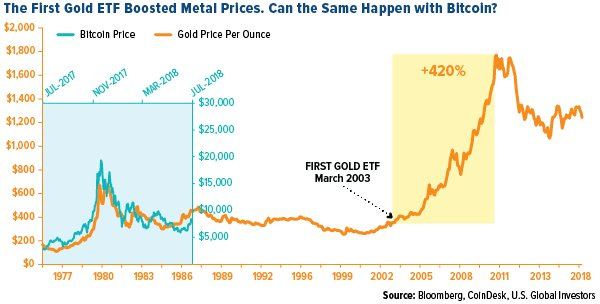

It could enable the launch of the long awaited spot Bitcoin ETF, which historically has dramatically improved capital infusion into assets like Gold.

The Grayscale Trusts are currently trading at 30-50% discounts to NAV due to a lacking redemption mechanism. ETF conversion would enable markets to close the mispricing.

How the Dice are Falling

Rumors suggest that Grayscale is likely to win this case, and this view isn't merely anecdotal; it's shared by many on the street, as recent ETF filings suggest.

In just a month, two of the world's three largest asset managers and a renowned tech investment firm have filed for a Spot Bitcoin ETF. This synchronicity shouldn't be mistaken for mere coincidence; it's another sign that the SEC's case against Grayscale may be weakening. The contention was never truly against Grayscale itself, but against the integrity of Bitcoin spot markets themselves, which the judges are raising their brows at.

As for BlackRock's ETF? In its entire history, BlackRock has only had one ETF filing denied, while 575 were approved.7 With a contentious election year looming, it's unlikely that incumbents would want to mar this near-perfect record, especially considering BlackRock's status as one of the largest political donors in the US.

SEC v. Ripple Labs

Summary

The SEC's lawsuit against Ripple Labs is arguably the most significant case addressing whether digital assets are securities. Thus, selling them via public methods, such as an Initial Coin Offering (ICO) or modern launchpads, may constitute the unregistered offer and sale of securities. The Commission also criticizes the lack of disclosures and the near $1.4 billion in sales by the founders and the entity.8

How the Dice are Falling

After two years and seven court orders, the SEC was finally compelled to reveal internal documents that challenge the credibility of the infamous Hinman speech. This speech has been touted by the Commission as one of its only pieces of 'Regulatory Clarity'. However, it appears that Hinman, serving as the Director of the Division of Corporation Finance at the time, was warned by several staff comments that his interpretation and statements were exceeding the scope of the Howey test. In other words, he was more liberally labeling things as securities than was appropriate. For a complete breakdown of the Hinman emails, refer to the tweet below by Ripple Labs' Chief Legal Officer, Stuart Alderoty.

The verdict for this case is now expected to arrive in late July 2023. This decision could become a landmark for the entire industry, potentially affecting other cases, such as SEC v. Coinbase.

Major Court Cases - Conclusion

Cases like SEC v. Coinbase and SEC v. Ripple Labs could be among the most pivotal and industry-defining legal battles we've witnessed. Outcomes for these cases are expected within the next 1 to 24 months. The longer these cases persist, the greater the chance that a change in leadership at the SEC could result in a dismissal or settlement. In the case of Grayscale v. SEC, the recent surge in ETF filings suggests a resolution may be nearer than anticipated.

Once founders are able to launch tokens without fear for their freedom and livelihoods, we can expect the next wave of innovation. Indeed, countless teams have developed entirely new startups and are eagerly waiting on the sidelines. Based on the advice of their lawyers and VCs, they're ready to launch their tokens as soon as they get the green light from regulators.

Presidential Election

Although Gensler's term as a commissioner doesn't end until 2026, it's well-known that the tone of the commission is set by each administration. After all, it's the President who appoints both the commissioners and the chair to lead the SEC.

So, what are the stances of various contenders on digital assets? For a moment, let's view this through the lens of a 'Single Issue Voter'.

Democrats

Lead - Joe Biden:

Whatever-is-popular stance (Pro-Crypto9 , Cautious-Crypto10 , Anti-Crypto Propaganda11)

2nd - Robert Kennedy:

Hardcore Pro-Crypto (Keynote at Bitcoin2023, Interview)

Republicans

Lead - Donald Trump:

Recent Convert (From throwing harsh words to launching several NFT collections on polygon.)

2nd - Ron DeSantis:

Hardcore Pro-Crypto & Anti-CBDC (On his campaign launch event promised to protect crypto)

Follow the Money

It's also insightful to consider who the major donors are and where their interests are vested.

The Block reports:

“Soros Fund Management CEO Dawn Fitzpatrick is bullish on crypto, even with the recent headwinds including the U.S. Securities and Exchange Commission suing trading platforms Binance and Coinbase amid a prolonged downturn.

“Crypto is here to stay,” she said during a Bloomberg investment summit. “What’s happened is clearly a setback. But right now I actually think it’s a huge opportunity for the incumbent financial firms to actually take the lead.””12

Soros, having placed substantial bets on crypto throughout the bear market, is unlikely to back the obliteration of the asset class. Similarly, Ken Griffin, a heavy-weight Republican donor and founder of Citadel, recently supported the launch of EDX, a new digital asset exchange backed by Citadel, Schwab, and Fidelity.

Presidential Election - Conclusion

From the perspective of a single issue voter, all current candidates appear more favorable than Biden. This implies that the current situation can only improve. Interestingly, even as an incumbent, Biden struggles to maintain a lead against Trump, despite the latter's indictment.

However, a victory for either DeSantis or Kennedy could instigate an immediate reversal in the US stance on digital assets. With such a shift, the next cycle could genuinely find the support needed to drive mass adoption.

International Re-balance of Power

Assuming the worst-case scenario: the SEC claims resounding victories across all its legal battles, Biden wins the election, and the Sith take over the galaxy. In reality, the United States' significance in the digital asset space diminishes with each passing day, rendering its decisions increasingly less impactful.

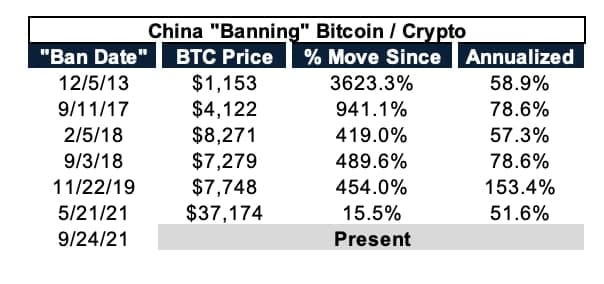

During my recent trips to Asia and Europe, what seemed like a life-or-death situation in the States was often met with a shrug overseas. It's true that the United States, as an economic superpower, would be a valuable ally for any industry. However, the same could be said for China. Countries such as China and India have previously banned digital assets, and yet, the industry still flourished.

We've seen a significant shift recently in the international balance of power concerning the leadership in the digital asset space. Some of the biggest names in the industry have begun their transition overseas. Here are a few announcements from the month of June alone.

In essence, if US regulatory leadership can't find a way to carry out their responsibilities without stifling innovation, the industry will simply relocate overseas.

Conclusion - Breaking the Regulatory Bottleneck

Digital assets will succeed with or without the United States. Either we secure victory in the courts, we triumph in the elections, or we relocate our operations elsewhere. For months, I grappled with the potential outcomes and the complexities that some of the proposed bills could introduce, ranging from outlawing DeFi to unattainable requirements for qualified custodians.

Nonetheless, the truth is apparent when looking at California's situation. Its anti-business policies and the resulting migration trends serve as a fitting benchmark for what could happen to the United States if it persists in adopting anti-crypto regulations.

Up next…

Now that we've dismissed the fear of regulation annihilating the industry, I will delve into the next two critical questions in Part II of my thesis on the Fifth Crypto Cycle:

Has infrastructure improved from trough to trough? [Part II]

What core opportunities have Digital Assets successfully tackled? [Part II]

If this article was forwarded to you, ensure you subscribe so you can receive the next installment directly in your inbox.

Disclaimers:

This is not an offering. This is not financial advice. This is not legal advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.

https://www.sec.gov/litigation/complaints/2023/comp-pr2023-102.pdf

https://assets.ctfassets.net/c5bd0wqjc7v0/4oVJN5EioULD0QnSyg01b8/2b1f34594a800c727fb61a384f37e74a/SEC_v._Coinbase__Coinbase_Answer_to_Complaint__As-Filed_.pdf

https://www.supremecourt.gov/opinions/21pdf/20-1530_n758.pdf

https://emmer.house.gov/2023/6/emmer-davidson-introduce-sec-stabilization-act-to-remove-chair-gary-gensler

https://www.law360.com/dockets/download/63dd563d984cdc9934813ee9?doc_url=https%3A%2F%2Fecf.cadc.uscourts.gov%2Fn%2Fbeam%2Fservlet%2FTransportRoom%3Fservlet%3DShowDoc%2F01208491118&label=Case+Filing

https://www.law360.com/articles/1582575

https://www.ft.com/content/1886c3a3-3fb8-411a-b95a-e4667de560d1

https://www.sec.gov/litigation/complaints/2020/comp-pr2020-338.pdf

https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/09/fact-sheet-president-biden-to-sign-executive-order-on-ensuring-responsible-innovation-in-digital-assets/

https://www.whitehouse.gov/nec/briefing-room/2023/01/27/the-administrations-roadmap-to-mitigate-cryptocurrencies-risks/

https://www.forbes.com/sites/kellyphillipserb/2023/05/11/biden-calls-for-end-to-tax-loopholes-that-benefit-wealthy-crypto-investors/?sh=794a2efa5114

https://www.theblock.co/post/233561/soros-fund-management-ceo-crypto?utm_source=twitter&utm_medium=social