Disclosure: Hartmann Capital and/or affiliates may hold positions, long or short in the assets discussed. Mentions are not endorsements.

It’s been just over two weeks since I shared with you the importance of Breaking the Regulatory Bottleneck, and as predicted, the cracks are starting to show. In just 17 days, the following events unfolded:

Ripple Labs notches landmark win in SEC case over XRP cryptocurrency

CBOE exchange to partner with Coinbase on bitcoin market surveillance in ETF push

Whether the regulatory bottleneck breaks is simply a question of time, as addressed in Part I of this series. Representative Ritchie Torres put it bluntly in a letter to the Commission, inquiring “if the SEC intends to come to terms with the folly of the Commission’s crusade against crypto assets in light of the latest decision by Judge Analisa Torres of the Southern District of New York.”

There's strong evidence that little will hold us back soon. Still, the question remains: What will move us forward?

For there to be a bull market, we need to see meaningful growth from cycle to cycle.

For there to be a bull market, we need to solve major friction points in adoption.

For there to be a bull market, we need to solve real-world problems that see real-world traction.

Today, we will examine the first two prerequisites by investigating the evolution of blockchain technology over the past four years, and determining whether significant friction points have been addressed.

From the Gilded Age to the Progressive Era

The 'digital world', or web3, refers to the part of the internet that operates and is governed through blockchains. We believe that this digital world is sovereign, not subject to the jurisdiction of any earthly country. The first nodes are already floating in space. While our homes won't accompany us aboard the next Starship, our digital assets will. And in Virtual Reality, digital assets reign supreme. The digital world, truly, is more akin to a sovereign digital super-nation that exists everywhere and nowhere simultaneously.

The historical similarities between the origin story of the United States and that of the digital world are striking. For instance, Bitcoin's whitepaper is celebrated among its followers like the Declaration of Independence, with Bitcoiners commemorating its publication and the block-size wars remind us of the feud between the Federalists and Anti-Federalists.1

The past cycle has been reminiscent of the United States from 1870-1900. In 1870, the United States was a young nation with an inflation-adjusted GDP of just around $200bn. After surviving its civil war and enduring reconstruction, it entered a period of rapid economic expansion known as the Gilded Age. Much like digital assets in 2020-2021, the Gilded Age saw rapid wealth expansion, technological innovation, lack of regulation, and a rise in speculation. Many innovations and speculations were infrastructure-centered, such as the burgeoning railroad industry, where speculation significantly outstripped demand. This mirrors the speculation in digital assets, largely placed on the underlying infrastructure of the digital world. As excesses grew too ostentatious, the Gilded Age ended with the Panic of 1893. The Philadelphia and Reading Railroad Company, one of the US's largest, declared bankruptcy following overzealous expansion and speculative financing. In a historical twist on Terra/Luna, the country also faced some of the biggest bank failures, as the value of silver had declined, causing people to run on the bank, swapping their bimetallic standard US dollars for gold, causing the price of silver to crater even further. The Panic of 1893 led to an economic depression, second only to the Great Depression that occurred forty years later.

After the 1890s Panic and Depression subsided, the Progressive Era began. Much like current times in the digital asset world, the Progressive Era focused on penalizing the corruption of the Gilded Age, reforming the country socially and politically, and further expanding infrastructure to level the playing field. While the Gilded Age was rife with ostentation and lawlessness, the Progressive Era faced prohibition yet saw a return to structure. Although the Progressive Era was a time of hard-earned change and progress, it set the stage for the Roaring Twenties that followed.

As we find ourselves in our own ‘Progressive Era’, following the Gilded Age of ‘20-’21 and the Panic of ‘22, what have been some of the core improvements that had previously been neglected?

If you were to ask the average person, or the media, about their issues with blockchain technology and crypto during any of the last cycles, their response would likely include one or more of the following:

“Blockchains are expensive and slow”

“Crypto is bad for the environment”

“Web3 is too complicated to use”

Let's delve into how these three core concerns have been addressed and/or improved over the last 18 months.

Scaling the Digital World

Cost and speed are two primary factors that determine whether a business will integrate public blockchains into their tech stack. This could include e-commerce related tools, credit via DeFi, or NFT loyalty programs.

During the last bull market, around 2019-2020, nearly all Web3 user activity took place on Ethereum. At that time, even Ethereum had only a minimal number of applications in production. But when the market heated up, as in 2021, the cost per transaction would skyrocket to more than $200 for a simple swap and over $1000 for more complex transactions. Ethereum became unusable for all but whales and funds moving significant volume over the chain.

However, between January 2021 and today, blockchains have evolved from being a one-way street to multi-planetary systems. Let me explain…

If Blockchains Were Cities - Scaling Explained (ELI5)

During a recent call with an LP discussing some of our positions, it became clear that my talk about Layer 0's, 1's, and 2's, interchain security, and bridges was met with glazed eyes. Whether due to my expertise or just being a Level 99 nerd, we often mistakenly assume that everyone understands the jargon and its nuances.

Now, imagine for a moment that blockchains were cities. Where you live and work dictates many things:

What opportunities are available around you?

How high are rent, taxes, and the overall cost of living?

How much traffic do we have to deal with?

How safe is our environment, both structurally and culturally?

One person might choose to live in Manhattan, where opportunities are limitless, costs are high, traffic is heavy, and due to its economic activity, safety is a dichotomy between high crime and the world's largest police force.

Another person might opt to live in a small town, where basic needs are met, but entertainment and business options are limited. Here, costs are affordable, traffic is a foreign concept, and while a small group of armed men could potentially topple the local government, the town generally remains peaceful due to the lack of anything worth stealing.

Now, imagine Ethereum as Manhattan. Ethereum is the most popular and longest-running Turing-complete Blockchain.

What opportunities are available?

53% of all stablecoins settle on Ethereum…

… and 58% of all DeFi liquidity is stored on Ethereum…

… and 60-90% of all NFT volume is on Ethereum too.

When viewed through the lens of potential activity, Ethereum, much like Manhattan with its extensive offerings, is the most desirable place for digital identities and assets.

However, when people around the world start flocking to "Manhattan," rent rises and congestion increases. Ethereum experienced the same phenomenon during the 2017 and 2021 bull cycles, with gas fees increasing from mere pennies to hundreds of dollars. An interesting statistic: in 1900, Manhattan's population was around 1.85 million (~2.5% of the US population). Today, it's about 1.7 million (~0.5% of the US population). Like Manhattan, Ethereum has scalability constraints. While Manhattan could not increase its population despite its high-rise buildings, it massively expanded its economy. By 2019, New York City's Gross City Product (GCP) of $884 billion exceeded the entire GDP of the United States in 1900 ($500 billion, adjusted for inflation).

Ethereum, much like Manhattan, must scale its economy despite technical constraints, maximizing the economic value of its transactions while accommodating as many people as possible. Meanwhile, it must direct lower-value transactions elsewhere.

Let's investigate how this concept has transformed into reality over the past 24 months.

Ethereum's initial scalability vision, sharding, was akin to implementing multiple lanes of flying cars to alleviate traffic congestion. However, like flying cars, sharding got scrapped in favor of more efficient and simpler solutions that could be quickly brought to market.

The industry's first successful scaling strategy was going multi-chain. This meant that Ethereum was no longer the only game in town, and assets could be moved using bridges to Ethereum competitors (hereinafter referred to as Layer 1 Blockchains or L1s) such as Solana and Avalanche. In the Manhattan metaphor, these bridges to other L1s are akin to airports, connecting us to other places with different languages (coding languages: Ethereum - Solidity, Solana - Rust, Sui - Move), governance, and token standards.

The first significant Layer 1 breakout success was Binance Chain in January 2021, followed closely by the emergence of Polygon (formerly Matic) as the first successful ‘side-chain’ to achieve mainstream success, banking nearly $10bn in decentralized finance, and onboarding house-hold names like Reddit, Disney, and Starbucks. These side-chains, unlike L1s, tend to be more interoperable, as they use the same Virtual Machine (EVM), share the same token standards, and are programmed in the same language: Solidity. If Manhattan/Ethereum ever gets too expensive for you, you can always cross the bridge and go to Brooklyn/Polygon. Or if you really want to save some money, you might as well take a plane to a less developed/less regulated island nation, i.e. Binance Smart Chain or Tron. But hey, you get what you pay for.

In late 2021, a new scalability solution went into production: Rollups (or Layer 2's/L2s). Rollups offer the benefits of the underlying Layer 1 while temporarily sacrificing a bit of security. To keep the technical simple, instead of recording every single transaction independently on the only ~15 transactions per second Ethereum, you transact on the Layer 2, which later settles with other transactions in batches on Ethereum (to keep our now extended analogy running… it’s like saving travel cost by cramming with strangers into a subway). Today, after the successful rise of Arbitrum ($ARB) and Optimism ($OP), L2s have enabled Ethereum to scale about 4.3x its original capacity. Other L2s like IMX ($IMX) offer alternative trade-offs, enabling as many as 9,000 transactions per second, targeted especially at gaming projects.

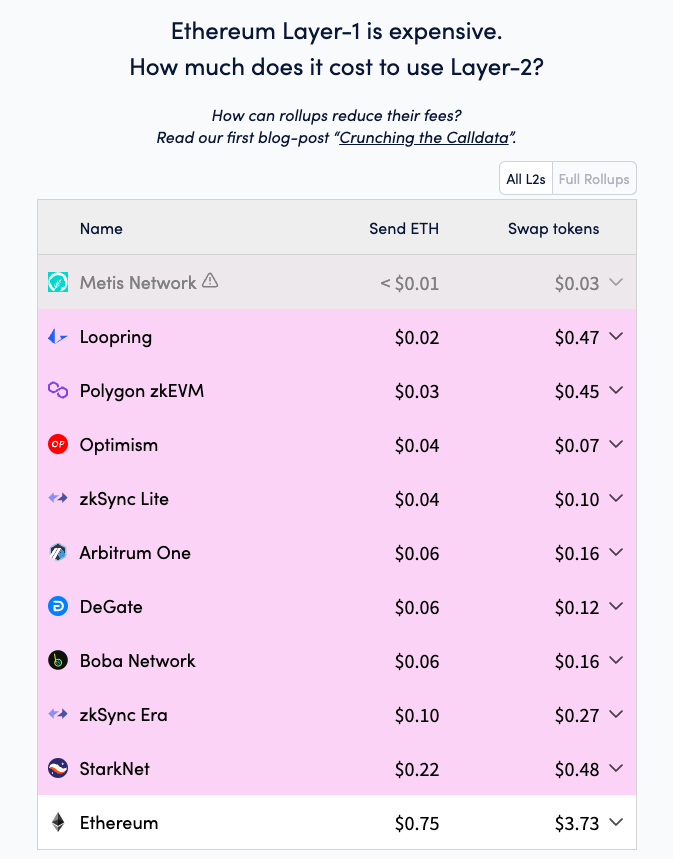

With increased scalability comes the benefit of cost distribution. Trading on the Layer 2 Optimism today could result in savings of about 98.2% in fees compared to trading directly on Ethereum. Here is a breakdown of fee costs for different sidechains and Layer 2s.

This expansion is remarkable, but the Ethereum Foundation has set more ambitious goals on its roadmap.

Aside from Ethereum, other projects also work on scalability, albeit with less traction. One of these is the Cosmos Ecosystem ($ATOM), a Layer 0 that application specific blockchains can connect to, providing core infrastructure such as interchain security and communication, yet leaving individuals zones autonomous. While its ecosystem is less mature than Ethereum's, it stands out as one of the most ambitious designs for decentralization, and has attracted unique teams such as Akash for computing, Secret for privacy, and Osmo for DeFi.

Crypto Goes Green

Despite the widespread misinformation regarding the environmental impact of digital assets, the reality can be simplified enough that a 5-year-old could comprehend it.

Within digital assets, there are primarily two forms of consensus/governance: Proof of Work (PoW), often referred to as mining, where more computation equals more voting power, and Proof of Stake (PoS), where more token ownership equals more voting power. In 2022, Ethereum finally retired its PoW mechanism and fully shifted to PoS. As a result it was able to reduce it’s energy consumption by 99.95%.

Remarkably, all the significant advancements we've discussed in this article:

Layer 1 blockchains such as Ethereum, Solana, or Avalanche

Sidechains like Polygon, Gnosis, or Metis

Layer 2 solutions like Optimism, Arbitrum or IMX

Layer 0 technologies like Cosmos or Polkadot

None of these, absolutely none, rely on proof of work. "Crypto Mining" is an archaic relic reserved for the Bitcoin devotees. While the concept of digital currency based on Austrian-economic principles is intriguing, it doesn't cover any of the web3 components that will actually be used by billions of people, such as Decentralized Finance, Stablecoins, DAOs, NFTs, Gaming, the Metaverse, Web infrastructure, and more. Virtually all of web3 is settled on proof-of-stake blockchains, resulting in a carbon footprint comparable to any other web service in use today.

Streamlining User Experience - Account Abstraction

The adoption of digital assets has been somewhat hindered by a user experience crafted with early adopters in mind. An individual familiar with the crypto world might claim it's simple, but even a tech-savvy person might spend a couple of perplexing hours attempting to grasp it, potentially making costly mistakes in the process.

A typical scenario for many newcomers involves trying to purchase an NFT on a new blockchain. First, you deposit your funds onto Coinbase, quickly transferring them to your wallet. As you attempt to buy the NFT, you realize it's listed on a different blockchain. Now, you must bridge your funds over. You find a bridge that you hope is trustworthy. However, you suddenly realize you need ETH for gas fees. Returning to Coinbase, you purchase some ETH and send it to your wallet. The bridging of your funds requires 3-4 separate transactions over the span of 60 minutes, including numerous time-consuming approvals, each of which incurs gas fees. Once the money arrives, you discover that you need the local blockchain asset for trading, prompting you to find a local decentralized exchange to swap your USDC for the local network token. Ideally, you would already possess a small amount of this token, otherwise, you must repeat the process from step one to bridge some over for gas fees. Finally, you're ready to buy your NFT. You locate the platform, approve a few transactions, and at last, the NFT is yours. (I trust you found that as exhausting to read as I did to write.)

For a seasoned crypto enthusiast, the process could take approximately an hour, largely slowed down by confirmation times. It might seem easy to someone like me, who has conducted thousands of on-chain transactions, but for anyone new, there are innumerable hurdles and risks for costly mistakes:

Send to the wrong address

Forget to write down your seed-phrase

Use a questionable bridge

Be unsure what transactions to approve and which not to trust

Incur unnecessary gas fees

Fortunately, the future looks promising. User-friendly smart contract wallets are on the horizon.

Traditionally, wallets require you to sign every transaction, an often cumbersome process. However, the industry has been tirelessly working towards a concept known as “account abstraction” to simplify the user experience significantly.

The Ethereum foundation lists a number of remarkable benefits that stem from account abstraction:

“Smart contract wallets unlock many benefits for the user, including:

define your own flexible security rules

recover your account if you lose the keys

share your account security across trusted devices or individuals

pay someone else's gas, or have someone else pay yours

batch transactions together (e.g. approve and execute a swap in one go)

more opportunities for dapps and wallet developers to innovate on user experiences”

The first of many upgrades to Ethereum to enable account abstraction has been implemented via EIP-4337, which allows users to bundle several actions along with signatures. This feature facilitates batched transactions, reducing the need to sign multiple separate transactions for slightly more complex operations.

Other chains and Layer2s are also in the race towards a more efficient user experience. For instance, Arbitrum recently passed its second Improvement Proposal, which supports this exact initiative.

Countless wallets are emerging that are hundred times more user friendly than anything we have seen as recent as a year ago. Some examples include Unipass, Sequence, or Ambire (mentioned as examples, not endorsements).

Vitalik Buterin, co-founder of Ethereum, recently delivered a keynote on account abstraction at the Ethereum Community Conference (EthCC) in Paris. If you want to nerd out for an extra hour, this video is for you. If you don’t, suffice to say, that account abstraction is a game-changing solution to a significant technical bottleneck in digital assets.

Conclusion - Paving the Roads of a New Digital World

The primary objective of digital assets and decentralization is to reconstruct the digital landscape on the basis of self-sovereignty – a monumental and ambitious goal. While it's easy to cast judgment and harbor doubts in light of the boom-and-bust cycles, the underlying technological advancements and expansions in network capacity are irrefutable. From reducing costs and increasing scalability, to adopting environmentally friendly practices and enhancing user experiences, blockchain technology is enduring the necessary growing pains to welcome its first billion users. The most dynamic period, our Roaring Twenties, are yet to come.

Up next…

Having addressed regulation and examined infrastructure transformations, we will delve into the application layer in our next piece. We'll explore which niches within the digital asset universe are showing early indicators of achieving a product-market fit.

If this article was shared with you, make sure to subscribe to receive future installments directly in your inbox.

Disclaimers:

This is not an offering. This is not financial advice. This is not legal advice. Always do your own research. Hartmann Capital and/or affiliates may hold positions, long or short in the assets discussed.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.

The Block-Size Wars centered around the maximum size of blocks in the Bitcoin blockchain. One group, analogous to the Federalists, advocates for larger block sizes to scale the Bitcoin network and handle more transactions. The opposing group, comparable to the Anti-Federalists, argues for smaller block sizes to keep the network decentralized and accessible to individual participants.

Share this post