To Investors and Colleagues,

Here we go again. Bitcoin is officially dead. In fact the media has already proclaimed so 23 times this year alone. Bitcoin has now died 416 times in the last 10 years according to mainstream media, and you can read every single one on Bitcoin Obituaries. If bitcoin is dead, it has to be a zombie, because somehow it keeps getting back up.

Humor aside, the digital asset space went through its annual crash last month, and while many newcomers were shocked, this was nothing new for the space. In November 2018 and March of 2020 for instance Bitcoin experienced two 50% thirty day corrections. This is not to mention the half dozen 30-40% corrections that Bitcoin sprinkles throughout its average bull run.

In today’s market update I will be dissecting four key health metrics of the digital asset space to determine whether this is a mere pullback amidst a bull run or the beginning of a bear market. We will review the following:

Fundamentals

Technicals

Sentiment

Market Structure

It’s times like these where it’s more important than ever to follow data driven decision making and not fall victim to emotions. Volatile markets can bring forth vast irrationality, both on the way up and on the way down. However navigating through the market’s irrationality is what can allow immense opportunities.

I hope you enjoy this update,

Felix Hartmann, Managing Partner

Digital Asset Market Health Check

1. Fundamentals

A: Bitcoin - SOV

In order to understand whether or not bitcoin continues to function strongly as a store of value, we have to study the holding patterns of its users. Continued holding of long term owners suggested a further cemented belief in the assets nature as a store of value. Sudden selling would suggest a shift in this narrative.

On-chain UTXO analysis proves that there have never been more Bitcoins held for a period of 3 years or longer. The selling that we have experienced did not come from early investors, or aged coins, rather, selling happened from coins purchased in the last three months, pointing at a speculator driven sell-off.

From an institutional appeal as a reserve asset, while Elon Musk received much heat for initially criticizing Bitcoin, Tesla continues to hold Bitcoin on its balance sheet.

Michael Saylor the CEO of MicroStrategy equally confirms the stance of sticking to Bitcoin as a reserve asset:

And Square soundly joined them:

So not only did all the major public companies holding Bitcoin re-affirm their support for the asset publicly after the crash, but we also saw new supporters join, likely after using the drop to build a position.

Notable new entrants into Bitcoin include no other than Ray Dalio, who stated “Personally, I’d rather have bitcoin than a bond” and acknowledged owning the digital currency, and the legendary activist investor Carl Icahn says he is getting involved in digital assets in a big way with over $1bn to be invested. And finally Goldman came out saying that it’s time to take Bitcoin seriously.

It stands to reason that while there was a lot of speculation, some of which we will address in our analysis of market structure, the fundamentals of Bitcoin have not changed. If anything, they have only gotten stronger.

B: DeFi - Value Accruing Tokens

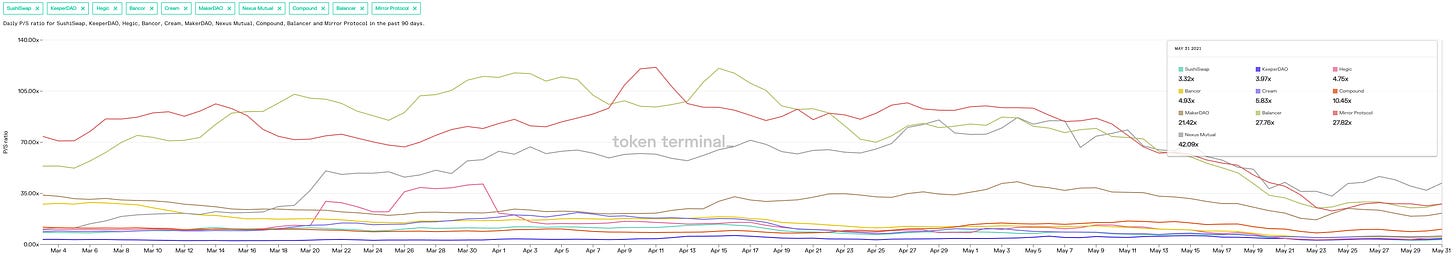

This section can be kept brief as I will refer to our market update from last month. In it I highlighted how many projects in decentralized finance had ridiculously undervalued valuations with PE ratios in the 20’s. After this crash the valuations have become even more ridiculous with some in the single digits and some in the 10’s. These hyper-growth assets are currently trading at multiples you’d find a utility company trading at.

Beyond the earnings and multiples, we once again saw DeFi survive a stress test of epic proportions. I genuinely doubt most commercial banks could survive a single day crash where every piece of collateral on their books gets wiped in half or even cut down by 80%. Well that’s exactly what every major decentralized lender from Maker to Aave to Compound went through over the last two weeks. And not only did they stay solvent, they made a killing doing so. Maker for example earned an additional $9.3mm just from liquidation penalties and as a result burned roughly 34bps of its entire supply just in May.

DeFi is alive and thriving, and neither earnings nor capabilities point towards these assets being overvalued at where they currently stand.

2. Technicals

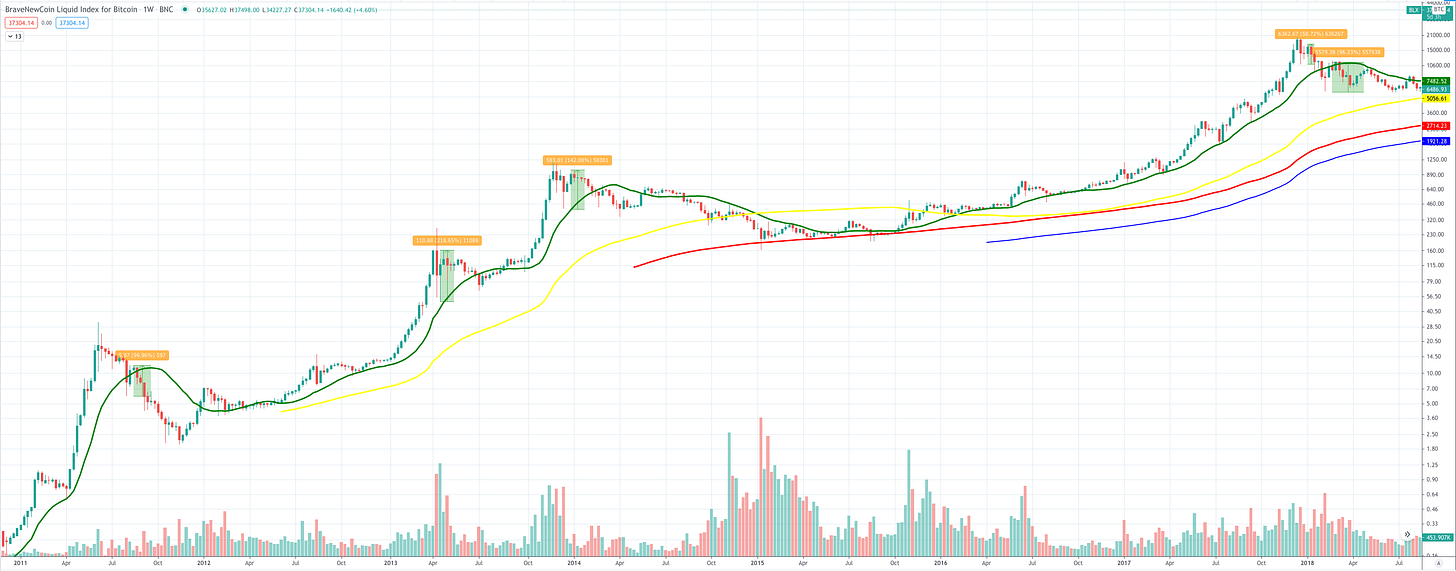

Sometimes it’s important to recognize that most market participants in crypto are not yet as educated on fundamentals as we are, and merely trade momentum. This means that fundamentals can be ignored in either direction for extended periods of time. While technical analysis is no dark magic, it does give us historical context particularly when we focus on larger time frames.

One of my favorite tools in particular for knowing where in a trend we are, is the RSI (Relative Strength Index). The RSI tells us when a trend is either overbought or oversold. Historically the daily RSI rarely goes into oversold territory, and the few times that it has in the last 5 years were some of the best times to accumulate as the bottom was either short lived, in, or almost there.

But lets say you want to play devils advocate and say this is the beginning of a bear-market. Even then, now is the time to be long. Every single top saw a 70-200% recoil after the initial breakdown. Short sellers will be caught with their pants down and liquidated, while many that chose not to buy the dip come back buying higher in a frenzy. The real test will be whether or not old highs are met with strength or weakness. That is the moment where paying attention is important.

3. Sentiment

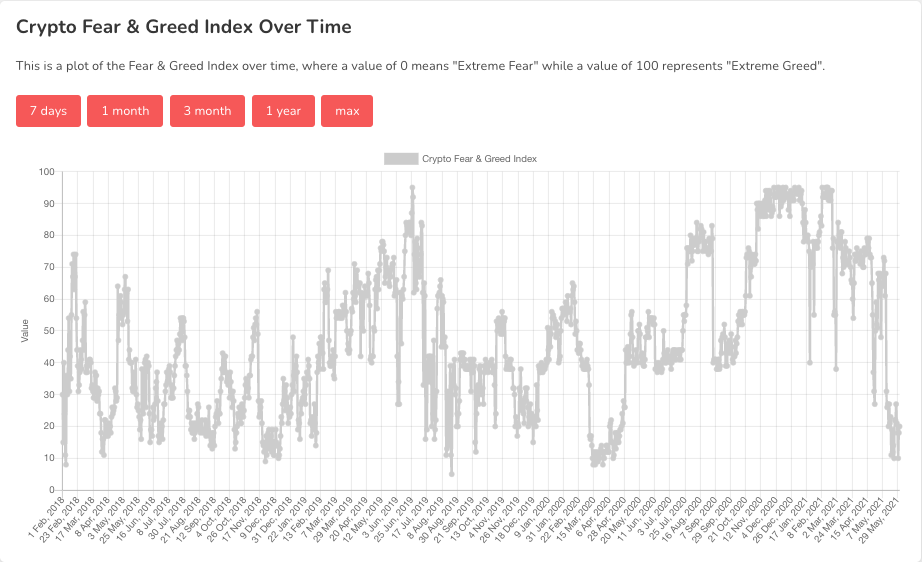

As the old saying goes, “Buy when there's blood in the streets even if the blood is your own”. The market flipped from euphoria to panic with the blink of an eye. Both emotional states are misguided.

As the Crypto Fear & Greed Index shows, we went from peak greed to peak fear. The last time the market was this fearful was at the lows of the lows of the pandemic crash of March 2020. Nearly every point of extreme fear has historically been an incredible buying opportunity. Not only that, but these wipeouts allow the market to re-calibrate and grow sustainably based on honest and real expectations. Opportunists looking for a quick buck leave, while the builders set up camp and continue to provide value to the industry with a long term mindset.

Zoom out. Nothing has changed.

4. Market Structure

Market structure is easily the most important facet to look at in order to understand the recent sell off.

On exchanges we saw billions of dollars wiped away by leverage liquidations. May 19th alone saw around $8bn in forced selling as borrowers had no choice but to close their levered long position in order to stay solvent on their futures contracts or margin balances.

On-chain we saw 7 of the 10 largest single day liquidations happen in May alone.

It’s glaringly obvious that the market was over-leveraged going into this correction and much of the selling that occurred was not intentional selling, as much as forced selling by parties that had borrowed too much. This ultimately led to a cascading effect dragging prices to lows not seen in months.

Massive liquidations often lead to capitulation wicks where all leverage wipes out, and funding rates are reset. We saw exactly this happen with many digital assets bouncing 50-80% off their capitulation lows, with funding rates either in the negative due to over-levered short sellers or at regular rates suggesting a fully flushed out futures market.

Final Thoughts:

The market can always stay irrational longer than you can stay solvent, but as long as you stick to spot investments there is no deadline to your solvency. That in itself is a massive advantage and source of alpha the few more veteran crypto funds like ours with over 3 years under our belt navigating these markets had to learn the hard way. Downside volatility is a necessary evil that comes with the beauty of upside volatility, and it will continue to express itself radically fast as long as the crypto market offers highly levered products such as 100-1 leveraged futures contracts.

While the short term will be determined by market participants, fundamentals, technicals, sentiment as well as market structure suggest to us that we are at or near the bottom of this short to medium term correction. Blood was spilled, and it’s time to buy.

In the News:

May 20th: English - The Pomp Podcast

May 21st: German - Der Digitale Minimalist Podcast

May 30th: German - Cash Magazine: «2025 wird der Kryptomarkt mehr wert sein als der Nasdaq»

TIMESTAMP 06/01 2021:

DJI - $34,570

S&P - $4,202

BTC - $36,300

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.

Share this post