(Disclosure: Hartmann Digital Assets Fund, LP and Hartmann Ventures, LLC may be allocated to some of the projects mentioned in this market update.)

To Investors and Colleagues,

As the Digital Asset markets keep accelerating, crypto asset managers like myself often have to pause and scratch our heads at the unbelievable dichotomy between what the masses and media view as the digital asset space, and what really is happening in the trenches.

If you tuned on the news, or for that matter ‘Saturday Night Live’, you’d believe the future of Digital Assets are meme-coins named after dogs, from Doge (worth $66bn) to Shiba Inu (worth $15bn).

Claiming that these projects which openly started as jokes, represent the Digital Asset space, is like claiming that the mac ‘n’ cheese you heated up in the microwave is the future of fine dining.

In today’s market update we are going to dive deep into a select number of projects that we are backing in order to highlight the vast differences between what is perceived as the trend in Digital Assets, and what funds and institutional allocators are actually looking at. These of course are neither buying recommendations, nor is this financial advice, as we may change our stance at any time. It is rather meant to give you an insight into the modern day analyses of crypto assets.

You’ll find that while the projects highlighted by the media are nothing but ‘greater fool’ plays that are boiling in bubble territory, many of the projects in the decentralized finance space are so undervalued that even Ben Graham or Warren Buffet would like them.

Let’s dive into it,

Felix Hartmann, Managing Partner

Fun-damentals v. Fundamentals

The crypto space as covered by main-stream media or as we like to call it the ‘meme-token’ space could not be more different from the Decentralized Finance (DeFi) space.

Neither Bitcoin, Ripple, nor Dogecoin accrue value for their users. They all serve as potential currencies. Currencies traditionally are not great investments unless there is a demand for said currency that outpaces its inflation.

Dogecoin for example has a current annual inflation rate of 3.85%, so you might as well hold dollars.

XRP on the other hand has Ripple labs and its founders control more than 50% of its entire $120 billion supply. I wouldn’t trust a currency who claims to be decentralized yet is more centrally controlled than quite a lot of fiat money.

And here is where Bitcoin shines, Bitcoin has a fixed supply schedule making it a strong store of value beyond being a pure currency. Additionally Bitcoin ownership is more fairly distributed than the likes of XRP with 50% sitting in the hands of over 16,000 wallets rather than 1 centralized entity (not to mention that many of these 16,000 wallets likely represent exchanges and lost early wallets spreading 50% ownership likely to the hundreds of thousands).

But that’s where the conversation also stops. Beyond fixed supply economics leading to supply sinks due to holding behaviors, these type of assets have little fundamental value that is permanent or can lead to asset appreciation beyond the hopes of continued buying by market participants.

Decentralized Finance protocols have stood out from the rest of the market for being value accruing assets. Many of them have revenues, profits, and treasuries that enable us to fairly value them similarly to equities. Here are four Decentralized Finance networks that make it evident that we are neither in a bubble nor anywhere close to being overvalued:

MAKER DAO ($MKR) - The De-Central Bank

MakerDAO is not a new kid on the block(chain). Quite the opposite, since March 2015, the Maker team has relentlessly worked on creating the first successful decentral bank and decentralized stablecoin. While the past 6 years presented the team with countless trials and tribulations, the 2020 global liquidity crisis being the latest major challenge to the protocol, Maker has successfully found product market fit and is scaling at unbelievable speeds.

At the heart of it, Maker enables anyone to borrow money in the form of DAI, the protocol’s stablecoin, in exchange for providing collateral. Maker then charges an interest rate, the proceeds of which are used to buy and burn the MKR token.

A few noteworthy achievements:

Since December 2017 DAI/SAI has successfully traded continuously at a close to 1-1 peg against USD, without being dollar backed.

Since launch there was only one major instance where CDPs were under-collateralized in the wake of the 2020 liquidity crisis. The decentral bank resolved the issue via decentralized governance by issuing new MKR tokens.

Maker has now issued close to $5 billion worth of its own decentralized stablecoin.

Despite rising a cool 713% this year, Maker continues to be undervalued as its fundamentals have risen even faster. With a P/E ratio of 19.99, you will be hard pressed to find a hyper-growth tech stock with orders of magnitude of growth left trading at such a low multiple.

One fun fact for the road: In 2020 Deutsche Bank made 624mm Euros in profit with 1.3 trillion Euros in assets with close to 85,000 employees. MakerDAO is on track to surpass Deutsche Bank in profits this year, already now making roughly 30% of Deutsche’s profits with just $14 billion in assets and just a little over 100 team members.

Code is eating finance. Step aside dinosaurs.

NEXUS MUTUAL ($NXM)- Decentralized Insurance

What happens when all the sudden $155 billion are being banked in smart contracts?

People smarter than the original developers try to find ways to exploit those smart contracts and run off with the money. Goodbye bank robberies, hello smart contract exploits.

Every month some project gets attacked for millions of dollars. Quite naturally this comes at the cost of trust. How can anyone ever feel comfortable enough to put their life savings into code that may or may not be vulnerable to attacks?

Enter smart contract insurance.

Nexus Mutual is the biggest decentralized insurance provider, currently focusing on both smart contract exploits and bugs, as well as centralized exchange hacks.

Who would use such a niche product?

Currently there are over $1.1 billion in on-chain funds insured via Nexus Mutual.

Nexus has thus far collected over $40 million in insurance premiums.

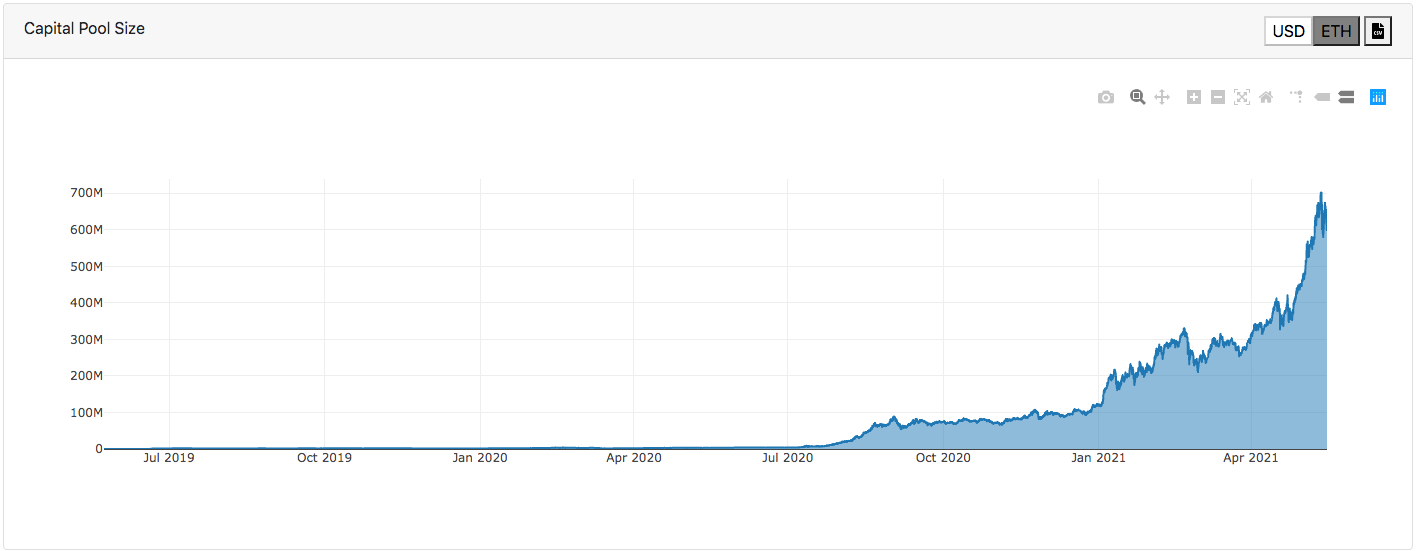

The way it works is that NXM token holders stake their NXM against projects they deem safe. In exchange customers pay these stakers their premium. In the event of an exploit, stakers would have their NXM slashed and the insured would receive ETH as a reimbursement from the capital pool.

While NXM sports around a 25 P/E ratio based on the past 12 months premium collected, it’s worth noting that half of NXMs premiums were collected in the last 45 days alone. Yes the last 45 days were as profitable as the 11 months preceding it.

NXM is also unique for the fact that it uses a bonding curve with a locking mechanism to ensure a minimum capital pool balance. Currently NXM valued at $1bn in market cap, is backed by $620mm worth of ETH, making it one of the few projects with a tangible book value.

Like MakerDAO, as long as Nexus keeps collecting insurance premiums, and ether maintains some value, it has both upward price pressure due to earnings and a price floor due to book value.

BANCOR ($BNT) & SUSHI SWAP ($SUSHI) - Decentralized Exchanges

After watching Coinbase IPO near $100bn, I don’t think I have to explain the value or demand of a crypto exchange. However what if I told you there are entirely decentralized exchanges that allow you to trade any crypto asset in existence for any other crypto asset, without underlying any jurisdiction or depending on third party custody. Enter decentralized exchanges.

Ever since last year decentralized exchanges have experienced massive growth in the decentralized exchange space, to the degree that a few decentralized exchanges have surpassed Coinbase in daily volumes at times.

While not all decentralized exchanges successfully capture value for token holders, two stand out lately.

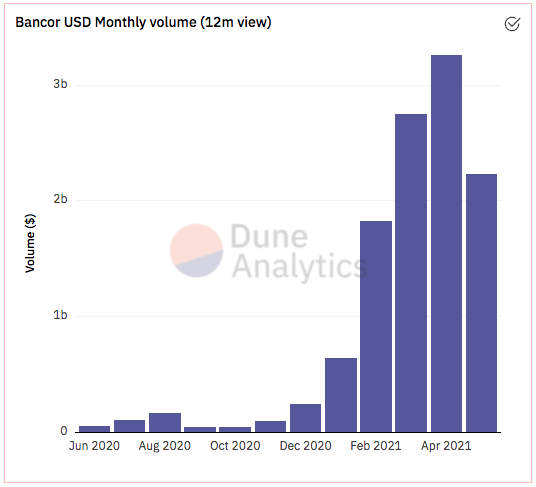

5% of the trading fees of Bancor are used to permanently reduce the supply of BNT. This new structure was introduced in the beginning of April and has already locked up $1mm of BNTs supply forever. Annualized this is close to $12mm, which would cause an annual deflation of around 1%, not taking further growth into account.

Sushiswap another popular decentralized exchange does as much as $1bn in trading volume a day, surpassing the likes of Kraken on some days. Sushi distributes .05% of all trading volume to Sushi token holders who stake the token. In April for example, Sushi did $11.5bn in trading volume, leading to $5.765mm in profit for Sushi token holders that were staking their tokens (only 31% of all holders, multiplying earnings for those staking by about 3x). Annualized we are looking at $70mm in earnings, which at a $4bn market cap leads to a 57 PE ratio. Considering that just 31% of sushi token holders are staking their tokens, this means that the adjusted PE ratio is 17.7.

Final Thoughts:

A few things should become vastly evident:

DeFi is incredibly real, with earth shattering profits and growth

DeFi is very very very far from being in a bubble

Several DeFi protocols are quite literally a steal with PE ratios half of that of the S&P 500 (which is deemed a conservative investment)

DeFi presents the rare opportunity of being allocated to both value and growth at the same time

You are likely under-allocated DeFi and real digital assets (and hopefully not exposed to the popularized trash that is Doge, Shiba, Safemoon, XRP, ADA and so forth)

The Digital Asset market has matured a lot over the last 12 months, and it is time we start looking at individual sectors therein, rather than continuing the outdated trends of bundling them all up under misnomers like ‘crypto currencies’ or ‘alt coins’. DeFi presents a generational opportunity, only comparable to Bitcoin itself, and we are still unbelievably early. Single commercial banks hold over 100x the assets that the biggest DeFi protocols holds, so we have not even scratched the surface of what’s possible. And instead of fancy skyscrapers and million dollar bonuses, the value accrued by DeFi goes right back to the token holders.

In the News:

May 20th: English - The Pomp Podcast

May 11th: German - Block52 Podcast

May 7th German - FAZ (Frankfurter Allgemeine Zeitung): Krypto-Welle beherrscht die Blockchain

April 22nd: English - Java with Josh Podcast

TIMESTAMP 05/15 2021:

DJI - $34,382

S&P - $4,173

BTC - $48,000

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.

Share this post