To Investors and Colleagues,

Digital assets have had a banner year in the last 12 months. Not only did the emerging asset class recover swiftly from the liquidity crisis a year ago, but more importantly we saw a major shift from a narrative driven market around ‘promise’ and ‘potential’ to a market that’s slowly driven by hard fundamental factors such as total value locked, price to sales, and book-value. We are no longer just seeing Bitcoin dominate the headlines for being the world’s most desirable store of value, but are now also starting to see the DeFi and NFT space gain their first mainstream mentions.

We’re among the first firms to take a quantitative fundamentals first approach and believe it will eventually become the standard in valuing this emerging asset class, as it has been the standard in equities for decades.

In today’s market update I’ll be sharing with you why I believe this is a super cycle rather than yet another 4 year cycle, how the landscape has drastically changed over the last few years, and what headwinds and black swans we are paying attention to.

Sincerely,

Felix Hartmann, Managing Partner

What if it’s 2003? Exploring the Super Cycle

I’ve spent more time than I’d like to admit studying the past cycles of crypto assets. They work like clockwork. But one has to wonder why that is.

For 12 years we had near perfect 4 year cycles resulting from the following chain of events:

It all starts with curious innovators building cool tech.

They ship.

A paradigm shift occurs (2010: Non-sovereign internet money, 2014: Silk Road and adoption, 2017: ICOs & Smart Contracts, 2020: DeFi & NFTs).

Investors enter the market.

Price goes up.

Speculators enter the market.

Price goes parabolic.

Hype enters the market.

Price becomes grossly overvalued.

Fundamentals cannot keep up with price appreciation, investors take profits.

Price corrects.

Speculators panic sell.

Long leverage liquidates creating lower lows.

Team funding dries up, speed of innovation slows, and some devs quit.

Investors get disillusioned and sell.

A long valley of death forms on the chart while innovators continue to build.

Finally they ship their next release… and we start all over again.

How can we end this cycle of hype and disillusionment?

The key is to keep shipping new releases at a fast pace and not give disillusionment a chance to slip in.

And that’s exactly what we have been observing over the last 12 month.

Every single day a new feature, V2, or main-net goes live. Every single day there is new genuine reason to be excited about the digital asset space, and every single day there is more and more hard fundamental value backing up the seemingly lofty valuation numbers.

The question I started asking myself and my team is: What if it’s 2003?

After the dot-com bubble burst and tech experienced a long bear market similar to the digital asset bear market of 2018-2020, dot-com has been in one continuous bull market super cycle.

Just like digital assets currently developing at a break neck pace, so did the tech giants over the past 2 decades. And while tech experienced occasional 30-50% deleveraging and corrections, anyone with a long enough time horizon made life changing money.

While we stay conscious of some of the headwinds that could invite such a 30-50% pull back (explored in part 3), we firmly believe that anyone with a > 5-year time horizon should take an honest assessment of their digital asset allocation. It is most likely too small if we consider the perspective that digital assets are an evolution of most traditional asset classes. In fact I am willing to wager 1 BTC that the digital asset space will be larger than the Nasdaq by 2025.

Playing a super-cycle requires a handful of different mindsets:

Betting on teams that build to last

Not getting caught up in the hype of the day but doubling down on sound theses

Putting traction and value driven analysis before promise and potential

Ensuring teams have the drive, desire, and the financial resources to last a decade

Trading a super-cycle on the other hand requires mainly one thing:

Managing risk above all else as we will be given countless thematic rallies to trade.

Now that we know what a super cycle could look and feel like, let’s explore who will be some of the players partaking in it.

Digital Asset Thematic Sectors

The biggest misnomer this industry has not seemed to be able to shake off is the term ‘Crypto Currency’. What started as an innocent summary until no later than 2014, has become a fairly ignorant classification as perhaps less than 5% of all digital assets are meant to be a form of currency or money.

So before we get into what thematic sectors we are exploring, let’s quickly redefine what asset classes exist within Digital Assets.

Crypto Monies: From digital gold like Bitcoin to the dozens of algorithmic stable-coins we have a few serious players aiming to take a bite out of both gold’s market cap as well as M2. Arguably the two players are approaching it in opposite ways. Bitcoin is a store of value first and foremost and a medium of exchange second. Most algorithmic stable-coins are media of exchange first and foremost and stores of value second depending on their rebasing mechanism.

Crypto Commodities: While BTC is purely money, ETH is closer to being a crypto commodity. In fact that’s how the team framed it when they first ICO’d and the CFTC agrees. Ethereum in a way functions like oil in the real world. You pay a ‘gas fee’ (yes that is what it is actually called) anytime you do a transaction on the Ethereum blockchain. And with a future proposed upgrade titled EIP-1559, some of those gas fees will actually be burned and destroyed (similarly to how oil is used up). Many base layer protocols that offer smart contract infrastructure for Layer 2 protocols and dApps use a crypto commodity model.

Non-Fungible Tokens: All the craze in 2021, NFTs have been around for several years and represent all unique values on the blockchain, whether that is art, collectibles, or even digital plots of land within virtual worlds.

Pass-Through Tokens: As most projects are fully decentralized and have no central entity behind them, many projects have started passing governance rights as well as earnings of a network on to token holders. This is the sub-category of digital assets we focus on in particular. These tokens, giving you ownership of a network are incredibly powerful as they have real value and growth as part of their token structure.

Within the pass-through token landscape there are countless thematic sectors we are paying close attention to as we find they will be the focus in the next few years. In each scenario, we find that owning the infrastructure will be the most valuable asset:

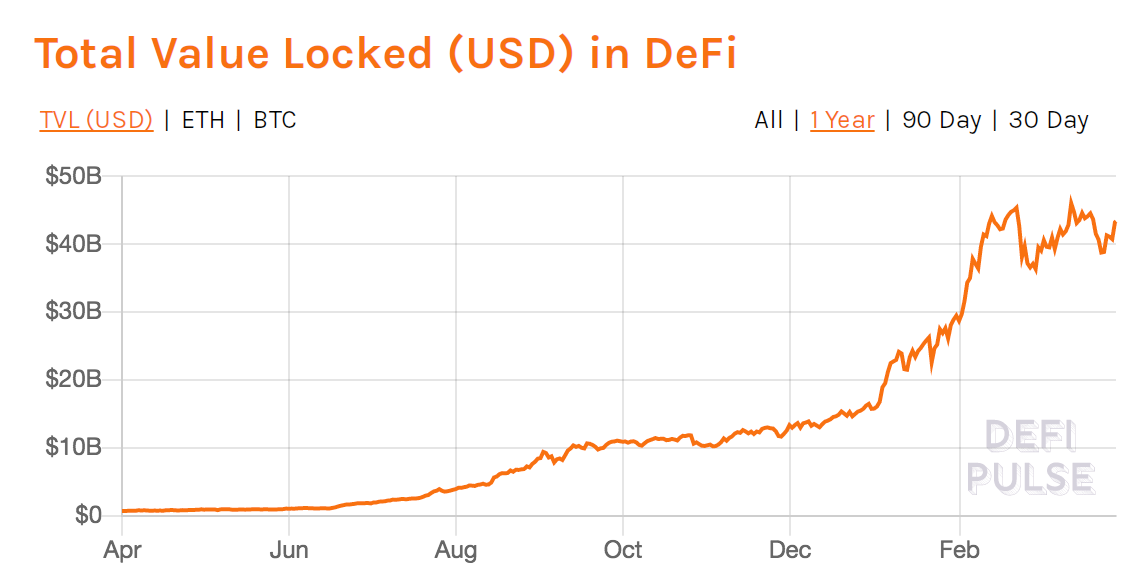

DeFi - Decentralized Finance: DeFi provides the infrastructure that enables every single financial service to be offered as freely and borderless as Bitcoin. Already today you can swap, lend, borrow, insure, and even utilize advanced financial products like perps, options, tranches, and more all without a middleman via the countless decentralized finance products that now bank over $43 billion in assets.

dWeb - Decentralized Internet Infrastructure: What good is DeFi if it’s all built on AWS? dWeb is an emerging sector we are paying close attention to that aims to decentralize the entire internet infrastructure, from connectivity, to DNS, VPNs, browsers, storage, hosting, encoding and more. The idea is to own unstoppable infrastructure that enables decentralized technologies to become immortal like Bitcoin.

The Metaverse - the Decentralized Social Fabric of the Internet: The Metaverse while sounding quite abstract is incredibly interesting. Whether its gaming, virtual realities, digital identity or NFT platforms, the Metaverse encompasses the digital world from the angel that it is a reality of its own. When you realize that virtual realities will eventually be of the economic size of nation states, it’s a no-brainer to own the infrastructure that enables the Metaverse.

DAOs - Decentralized Autonomous Organizations: DAOs are like global, borderless, and decentralized LLC/corporations. In a globalizing world, I’d be happy to bet that by 2030 there will be more DAOs than LLCs. And that by 2024 the average startup will launch as a DAO (either instead of or as well as through an LLC). So much of the trust issues like share ownership and company bank accounts can be solved via tokenization and multi-sig wallets. We are paying close attention to the protocols that will enable this transformation and usher in the age of DAOs.

Privacy Infrastructure: If you ever used DeFi, the first thing you will realize is how awesome it is, the second thing you may notice may be the high gas fees on Ethereum, but the third thing that most are not paying attention to just yet, is how transparent they are. On-chain analytics make you publicly auditable. That’s great for a publicly traded company, but you wouldn’t want your bank statements to be on google updating real time. We are exploring both natively private blockchains as well as tools that can bring privacy to existing chains.

With these 5 themes in mind, we see an avalanche of investing opportunities awaiting us in the coming years.

Risks, Headwinds, and Black Swans

As the famous saying goes, “The most dangerous words in finance are ‘this time is different’”

While I am excited for the future and think that abundance is in store for the digital asset space, it’s always important to pause, reflect, and ask oneself what the blindspots may be.

While there are a few, that I will briefly address, I genuinely do not see the risk of nation state bans. This is a thought experiment I’ve gone through several times, and 10/10 times it ends with the loser being not the digital asset space, but the nation attempting to ban it. Nobody has ever successfully banned digital assets, many have tried. And the ones that do try to ban digital assets only fall further behind in relevance and economic power as tech talent leaves their country for a more forward looking home. Innovate or die.

In terms of genuine risk we are actively monitoring, here is what we are paying attention to:

Rising interest rates and overall tightening fiscal policy leading to a risk-off market environment. The Fed’s tone has started to shift, but there seems to be no intention of the current administration to do anything but provide more stimulus.

New widespread financial regulations. In the aftermath of Archegos meltdown, Melvin Capital fiasco, and the entire GME saga is likely going to lead to some form of overhaul in the financial sector that is still unclear. While a risk, this is also an opportunity, as over-regulation of equities is only going to make digital assets more interesting.

Negative Skew Tail Risk. Whenever there is a crowded trade that is guaranteed, something is bound to go wrong. The famous Grayscale arbitrage is one of them. The short version is following: Institutions had the ability to buy GBTC at NAV and then market sell on brokerages after a lockup where it was trading at a significant premium. This premium existed for years and everyone assumed it would always be there. What followed is several crypto institutions doing this trade synthetically via leading lending platforms, utilized leverage to play this ‘guaranteed’ trade. GBTC is now not trading at a premium but rather a double digit discount. This situation could still end poorly for a few firms in the space and we are actively monitoring the ripple effects, whether that is a lender filing for bankruptcy or a major fund failing, being forced to unwind a massive book of positions with limited liquidity. Either way we are monitoring the situation actively given the fact that Grayscale makes up over 3 percent of Bitcoins market cap.

Final Thoughts:

While the market has been on an incredible rise, and individual sub-sectors such as digital monies and the Metaverse could use some cooling off, we find that the space has likely entered a super cycle in which money will rotate within, while new allocators are joining the space daily. All risks currently assessed may lead to short term pain at most, but the market as a whole continues to be healthy and growing. Teams are working overtime to ship new product in what has become an incredibly competitive space, and capital is flowing into the markets like never before from smart and institutional money.

TIMESTAMP 03/30 2021:

DJI - $33,066

S&P - $3,949

BTC - $58,658

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.