Announcing: Hartmann Metaverse Ventures I

Hartmann Capital Newsletter, Friday November 19, 2021

Before we jump into this weeks Weekly Market Update we wanted to take a brief moment, as we are excited to announce the launch of our second fund, Hartmann Metaverse Ventures I (HMVI).

We will be hosting an in-person educational & celebratory evening on the Metaverse on December 2nd in Miami for accredited investors only. If you are an accredited investor and would like to join us for the event please send an email to invest@Hartmann-Capital.com. We look forward to having you there! If you cannot attend, but would like to learn more and are accredited, send us an email as well.

In this issue

CeDeFi growth continues as institutions flex in crypto

Regulation Watch

Crypto community bids for Constitution

Market by Numbers

The metaverse had another strong week, doubling over the past 30 days, while the rest of the market experiences sell-off.

Virtual worlds have taken over leadership in the space. Decentraland (MANA) is up 5x this month, while P2E darling Axie Infinity is down over the same period. Sandbox (SAND) is up 60% in just the past few days after announcing the launch date for the first alpha version of its metaverse.

On November 29, the first users will be able to finally experience P2E in the Sandbox as well as other new features.

Virtual worlds have promised so much, but delivered so little to date. Outside of a few showcase events, Decentraland is a ghost town with a few awkward denizens. We, however, expect big things from Sandbox and Somnium Space. Hopefully, even Decentraland will grow alongside the others. Virtual experiences are improving, and, with Facebook, on their tail, the first movers in crypto will be fired up to improve their UX.

CeDeFi growth continues as institutions flex in crypto

With institutional investors needing to follow anti-money laundering and know-your-customer regulations as well as highly-restrictive fiduciary rules, mass adoption of DeFi will require centralized entities to gatekeep crypto markets. To that end, we expect to see more partnerships between fintechs and DeFi to protect institutions from the risk of accidental non-compliance. Institutional crypto custodian Fireblocks and DeFi borrowing/lending protocol Aave have teamed up to whitelist institutional users on the new permissioned Aave ARC.

Users will have to be in compliance with all regulations in their home jurisdiction as well as demonstrate KYC/AML and CTL policies. If the proposal passes next week, permissioned institutions will be able to trade Ethereum, USDC, Bitcoin and Aave.

In other news, Copper.co, a centralized trading firm that facilitates institutional business, is in the process of raising a half billion dollars on a valuation of $3 billion. This raise would make the founder Dmitry Tokarev, who holds 40% of the firm, a billionaire on paper. Copper’s API connects cryptocurrency exchanges, offering instant settlement along with prime brokerage services.

Real world assets (RWAs) are finally being tokenized decentrally on-chain, with the help of centralized entities. DeFi protocol Maple Finance provided financing for crypto trader Alameda Research to on-chain lend to its own clients. The initial raise was for $25 million, and included CoinShares, Abra, and AscendEX. Like many RWA programs, the fund has started small, but is expected to grow to $1 billion over time.

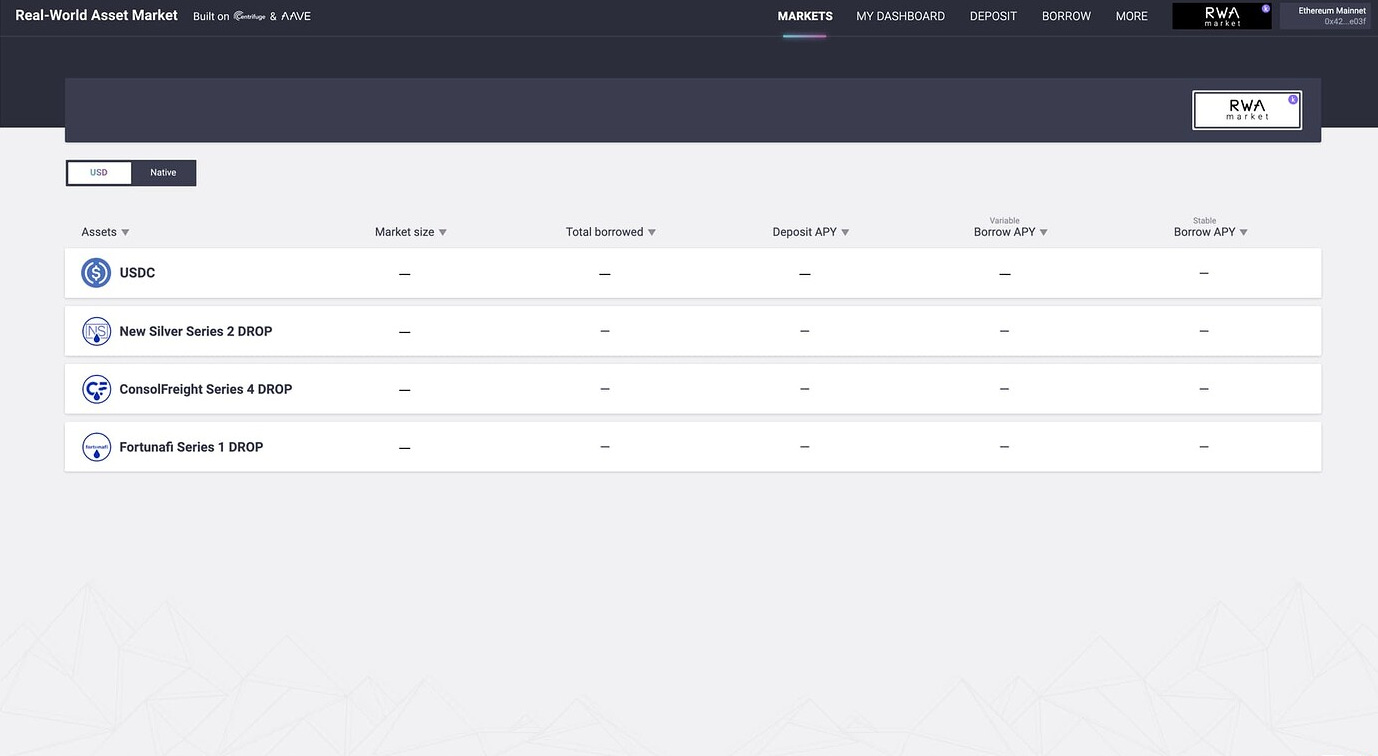

Other firms have been active in tokenizing RWAs. Centrifuge has worked with MakerDAO to finance a “fix and flip” US mortgage securitization and several other issues. Just recently they announced they are close to finalizing a collaboration with Aave to allow for lending and borrowing.

The institutions are not coming, they are already here. There may be a day when all RWAs trade on-chain, decentrally and without frictions.

Regulation Watch

A week after announcing key hires, industry lobby group the Blockchain Association raised $4 million to provide the needed resources for a long term fight with Washington DC. Only three firms participated, which indicates that not everyone is onboard with this effort. Centralized entities Kraken and Digital Currency Group (each contributed $1 million, which decentralized storage provider Filecoin Foundation provided $2 million, with $2 million more contingent on a larger fundraise.

The money is well-needed. The $1.2 trillion Build Back Better bill passed by the House on Thursday requires all digital asset transactions worth more than $10,000 to be reported to the IRS. The requirement, which would go into effect in 2024, would be devastating for the crypto community.

A few hardy legislators are fighting back, however. Representatives Patrick McHenry and Tim Ryan are backing a new bill – The Keep Innovation in America Act – that will restrict the language defining a “broker” from “any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.” to "any person who (for consideration) stands ready in the ordinary course of a trade or business to effect sales of digital assets at the direction of their customers."

In other news, Federal Reserve Governor Christopher Waller reiterated some of the conclusions from the President’s Working Group on Financial Markets. While he agreed that stablecoins needed new regulations to ensure financial stability, he added that such regulation would not need to be as stringent as the current banking regime. At a conference hosted by the Cleveland Fed, Waller said,

The regulatory and supervisory framework for payment stablecoins should address the specific risks that these arrangements pose -- directly, fully, and narrowly. But it does not necessarily mean imposing the full banking rulebook, which is geared in part toward lending activities, not payments.

Fully-backed stablecoins are similar to shadow banking products such as money market funds, which are regulated, but not to the same extent as chartered banks. How exactly over-collateralized and algorithmic coins are to be regulated remains a mystery.

Crypto community bids for Constitution

Decentralized Autonomous Organizations (DAOs) for collecting are evolving rapidly, channeling crypto’s new found wealth into digital and physical assets, new and old. While crypto has tokenized a Picasso and a wine collection, and DAOs have formed to collect digital art, this week the crypto community bridged to the real world with a bid for a rare, first-edition copy of the U.S. Constitution.

Though the DAO did not win the prize at auction at Sotheby’s on Thursday, the fact that over $47 million was raised for the project in very short order suggests that this trend is far from over. With KlimaDAO responsible for retiring 10 million tonnes in carbon credits to date, there appears to be no limit to what type of outcomes can be achieved through on-chain governance. The future belongs to DAOs.

Meet the Team: Art Basel 2021

There will be two chances for you to meet the team next week. If you are an accredited investor, please send us an email with your background, and we can send you more information on our private event on December 2nd where we will host an educational night on the Metaverse. Should you miss us there, team members will also be attending Dcentral Con on December 30th, where Managing Partner Felix Hartmann will give the morning keynote in the Metaverse Dome at 10:10 am. Use our code HartmannCapital100 for $100 off your ticket.

Hartmann Capital Weekly written by Head of Research, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.