Web2 giants join the Web3 race, while DEX Volumes Skyrocket

Hartmann Capital Newsletter, Friday November 12, 2021

In this issue

Apple’s Tim Cook, Reddit, Twitter and Discord talk crypto

Exchange volumes skyrocket this year, while Coinbase disappoints in Q3

Crypto gears up for legislative battles

Axie Infinity adds DeFi to its “GameFi”

Blog this week: Is Money Dying? The Inflation Debate

Market by Numbers

New highs for BTC and ETH as global inflation fears rise. US CPI for the last twelve months came in at a record for the century of 6.2%. The metaverse finally took a break, down slightly after an 86% rise over the previous two weeks.

On Nov 10, Ethereum hit a new all-time high of $4,851, but quickly retreated along with the wider crypto asset markets.

This recent move puts ETH up 5x since the beginning of the year. BTC hit $68,721 around the same time. The original crypto asset has doubled since Dec 31, 2020.

Apple’s Tim Cook, Reddit, Twitter and Discord talk crypto

We often report here when big tech and investment leaders reveal that they or their firms are involved in crypto. This week it was Apple CEO Tim Cook who confessed to being invested in crypto as he thinks “it’s reasonable to own it as part of a diversified portfolio.” He added that Apple, unlike Tesla, was not contemplating investing in nor accepting crypto payments.

This news coincided with announcements by Reddit and Twitter that they were building crypto capabilities. Discord hinted at the same, but quickly backtracked when users complained about the poor environmental track record of Bitcoin as well as Ethereum NFTs.

ESG concerns seem like poor reasons to avoid crypto payments, especially given Ethereum will likely transition to low-energy proof-of-stake next year. But for now the gamers and other users have spoken.

Twitter seems furthest along, hiring Interchain Foundation (Cosmos) engineer Tess Rinearson, to build a team.

Twitter Crypto (as opposed to the vast opinionated and occasionally-alpha generating crypto Twitter (“CT”)) will “be exploring how ideas from crypto communities can help us push the boundaries of what’s possible with identity, community, ownership and more.” Twitter already has Bitcoin tipping, currently for iPhone iOS only. Twitter has already minted its own NFTs, including founder Jack Dorsey’s first tweet, which sold for just under $3 million.

It’s likely that these moves from two of the dominant “Web 2” platforms signal a realization that crypto’s decentralizing “Web 3” ethos is a threat to the incumbents, and they are beginning to wake. Decentralized social media is coming.

Exchange volumes skyrocket this year, while Coinbase disappoints in Q3

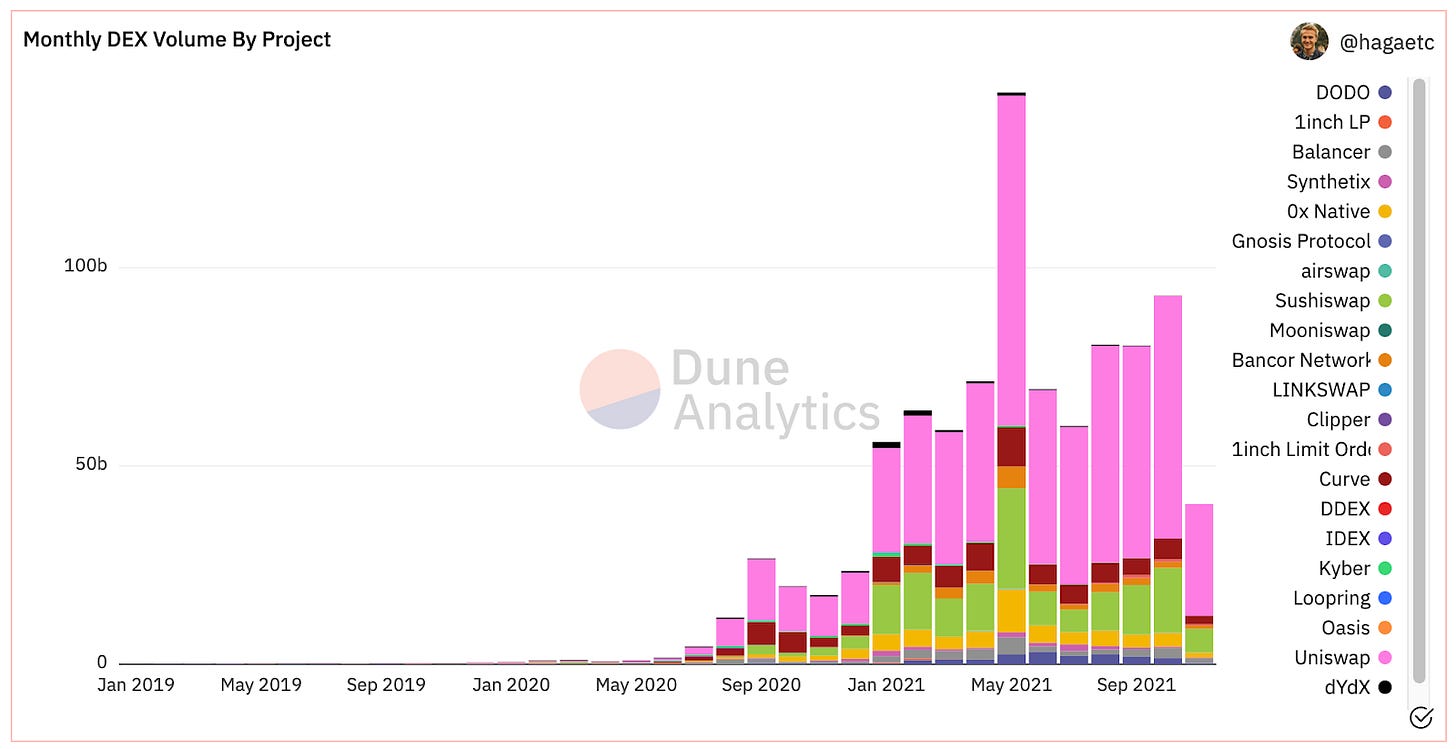

Exchange volume data shows a surprise divergence of fortunes between decentralized exchanges (DEXs) and traditional centralized exchanges. To be sure, monthly volume is down all around since the blow-off top and correction in May. Still, DEXs are holding their ground

Coinbase, one of the few centralized exchanges to go public, reported a fall in Q3 volumes of nearly 30% over Q2. Trading volumes fell to $327 billion from $462 billion, causing the stock price to fall 11% on the news, before recovering about half of the loss later this week.

The number one DEX, Uniswap, on the other hand, saw only a modest reduction in Q3 volumes of 12%, to $147 billion. Though DEX volumes still trail the biggest centralized exchanges such as Binance, Huobi and FTX, decentralized exchanges are a new phenomenon, coming alive only in the last year.

Chainalysis reported this week that large DEX trading volume has soared 550% this year. But even this number fails to really show how far DEXs have come. October’s DEX volume as per Dune Analytics is 50x June 2020’s level.

Though there are regulatory headwinds that need to be addressed by the major DEXs, they look to be mounting a significant defence. Indeed, the CEXs have regulatory troubles of their own.

Onboarding into a non-custodial wallet in order to use decentralized exchanges remains complex, risky, and generally must involve a centralized exchange in the first instance. On the other hand, CEXs and their order books are easy to use, and the basic centralized services like Coinbase and Robinhood are even simpler, albeit at higher fees.

That DEXs are so popular in spite of the headwinds suggests that there is room for them to gain traction, especially if retail customers become more discerning and meme-coins such as DOGE lose popularity.

Crypto gears up for legislative battles

The FATF recommendations on “virtual asset service providers” (VASPs) last month that threaten DeFi’s very existence as well as the onerous tax reporting requirements in the current draft of the US Infrastructure Bill have put the crypto industry on the defensive. The last straw for many, including vocal Messari CEO Ryan Selkis, was the serving of an SEC subpoena to Terraform Labs founder Do Kwan at Messari Mainnet in New York in September.

This week it was crypto’s turn to go on the attack. We previously reported on individual industry efforts, including those by Coinbase and leading VC firm a16z, to establish a platform and agenda to facilitate negotiations for regulatory reform for crypto assets.

The Blockchain Association an industry trade group backed by crypto businesses such as Genesis Mining, Ledger and Solana, announced two key hires: Jake Chervinski, a crypto OG who was head of legal at Compound Labs, and David Grimaldi, who has over a dozen years of policy experience. As Head of Policy and Head of Government Affairs, respectively, they will work with Executive Director Kristin Smith to continue to educate Congress and other regulators and policymakers on crypto markets as well raising awareness and voting power within the crypto community. As Smith said this summer,

The crypto community's use of Twitter is its superpower. It's what allowed us to mobilize and get 40,000 phone calls into the Senate over the course of five days. This is a highly communicative industry. They're used to collaborating. … It's something that makes lobbying and advocacy in the crypto space very different than any other industry.

The Association agrees that more regulation, especially for centralized exchanges, is needed, but disagrees with the approach the SEC and Congress have taken with respect to decentralized finance. The battle is on.

Axie adds DeFi to its “GameFi”

Axie Infinity is crypto’s pre-eminent game, pioneering the “play to earn” (P2E) concept where players earn crypto assets that can be traded outside of the game. Until recently, the easiest way to onboard onto the game was to bridge from Ethereum. More Ethereum users bridge to Ronin than any other chain.

At the same, the Ronin chain upon which Axie Infinity sits was without a governance or staking token.

Axie killed two birds with one stone by adding a decentralized exchange for swapping the native AXS and SLP tokens, while also incentivizing on-chain liquidity by paying providers in a new RON token, which is set to be the governance token for both the Ronin chain and the new Katana DEX. Katana is a classic automated market maker (AMM) which relies on two-sided liquidity to effect trades, in the same way as Uniswap v2, or Sushiswap.

Katana will play a key role in facilitating trades in and out of SLP and AXS, especially important in breeding and acquiring new Axies for game play. For now, the only way to accumulate RON is to farm liquidity on Katana.

Both of these factors have led to a significant growth in total value locked. The practical utility combined with RON farming has led to a major liquidity migration to the DEX in recent days. Since its launch on November 3, it’s attracted $1.3 billion in liquidity, catching up to such incumbents as Terra’s native Terraswap, at 15th overall. What is attracting yield farmers is the 10% of the total RON supply that will be rewarded to liquidity providers who stake their deposits in both SLP/WETH and AXS/WETH.

With the low fees on the Ronin chain, even small amounts of SLP, RON or AXS can be swapped economically, even down to under $1.

What happened to tokens? News sent both AXS and SLP much higher but towards the end of the week, both tokens settled back. SLP is suffering from a lack of use cases and motivated sellers who want to monetize winnings.

However, besides the improvement in UX and reductions in gas fees for users, adding a DEX to the Axie ecosystem introduces many who are likely far from crypto native into decentralized finance. Now Axie Infinity players can stake and yield farm as liquidity providers, several of the key primitives of DeFi. 2 million players will be onboarded this way:

Non-crypto natives are coming for our DeFi.

This Week’s Blog: Is Money Dying? The Inflation Debate

It’s been called the most important yet most controversial question, on Wall Street, Crypto Twitter, Bitcoin Podcasts and even among economists and economic historians.

Jack’s tweet did seem a bit aggressive, but a few weeks’ later yearly US CPI has hit a century-high of 6.2%.

In this week’s blog we ask, what are the prospects for US dollar inflation? And what does that mean for crypto?

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.