The Trillion Dollar Market We Are Betting On

Hartmann Capital Newsletter, Friday December 10 2021

In this issue

Tech and Metaverse corrections, $LUNA strength

DeFi 1.0 woes continue with $SUSHI

Hartmann Metaverse Ventures I launch

Metaverse is a trillion dollar market opportunity

Market by Numbers

Tech stocks have taken an absolute beating last week, with Cathie Wood’s ARK Innovation ETF down over 18% on the month. According to CNBC, all but two stocks in the fund (Tesla and Trimble) are in a bear market. Crypto had a major correction over the last weekend.

Two weeks ago, ETH made year highs against BTC at 0.088 ETH/BTC and stayed relatively strong this week, down only slightly in dollar terms over the past 14 days.

LUNA bucked the dominant trend, hitting all time highs. Performance against the other L1s was particularly strong. Large token burns last week of more than 1 million LUNA per day provided a bit of a supply shock or, at the very least, some bullish news in an otherwise depressing news week. LUNA continues to be a dominant position in our portfolio.

DeFi 1.0 woes continue with SUSHI

Around the time of the May correction, we made a decision to overweight the metaverse and layer 1s and 2s, rotating out of DeFi (1.0 at the time) names including Sushiswap. We’ve always looked down on overly-aggressive token ponzinomics, and it now appears that DeFi 2.0 is mitigating some of the concerns we had with token minting and dumping. The original DeFi brands have suffered since their all-time highs in the spring, and the sector as measured by the DPI is down over a third in a month in dollar terms.

Sushiswap (SUSHI) appears to have additional idiosyncratic problems of its own. We unloaded the remainder of our position when we got wind of founder 0xMaki ‘s departure, and it seems that the situation there is worse than we thought.

The token actually briefly rallied after CTO Joseph Delong resigned and crypto hedge fund Arca co-authored a restructuring proposal.

Infighting at Sushiswap has sent $SUSHI down to year lows in ETH, and not far off year lows even in dollar terms.

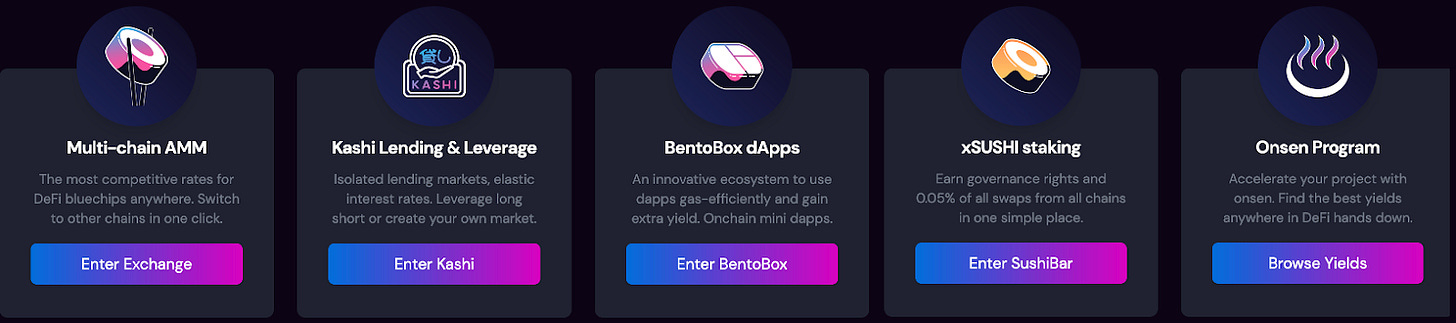

It remains to be seen if the chaos at Sushiswap can be overcome and the protocol can move from being a fork of Uniswap v2 to a one-stop platform for token issuance, lending/borrowing and trading. Are they spreading themselves too thin?

Delong believed they were very close to releasing the remaining “killer apps”.

DeFi is struggling to find new use cases. It appears that users are simply rotating to where the highest-yielding farms are or where an airdrop is expected. How many AMMs, lenders and stablecoins do we need? And are the tokens actually good for anything more than earn and dump? Until these questions are answered, we’ll be underweight the sector as a whole.

On the other hand we do believe in the many talented founders in the space. Can Sushi pull off the greatest comeback in crypto?

Hartmann Metaverse Ventures I - Kickoff Event

Last Thursday in Miami saw perhaps the most important event in Hartmann Capital’s history when some of our favorite new metaverse founders joined most of Hartmann Capital, our LPs – present and future – and other crypto enthusiasts at the launch of our newest fund, Hartmann Metaverse Ventures I.

We hosted founders involved in content creation (games and fashion), VR/AR and metaverse infrastructure, in keeping with our thesis that the metaverse lives at the intersection of all three.

Managing Partner Felix Hartmann chatted with Jamie Thomson from P2E ecosystem Vulcan Forged, Emma-Jane MacKinnon-Lee from fashion platform Digitalax (and Web3 Renaissance Council DAO), Sats from LandVault, and Todd Chernecki from Subpac, an audio focused AR haptics company.

Jamie recounted his many experiments in the crypto gaming space, and suggested that the fun in play to earn is in creating and interacting with virtual digital economies that have very real implications in the real world. Vulcan Forged continues to develop game play and game economics to motivate users to build and trade inside the VF ecosystem.

Emma’s mission is to remove middlemen in virtual fashion and to incubate an entire new generation of talented digital designers in the most decentralized and permissionless ways possible. While it’s news that major labels and celebrities are entering the metaverse, Emma believes that crypto economics will disrupt the current fashion monopolies just as DeFi threatens to do to banks.

LandVault founder “Sats” compared development in the metaverse to real life. Companies that want to maintain a presence in virtual worlds would be better off subcontracting design and real estate services to experts, and that’s where LandVault comes in.

While chatting with Todd from Subpac, Todd highlighted how most immersion tech is rather gadgety, instead of turning common environments, like a car, into a fully immersive entertainment center, citing the rise of self-driving cars, and their partnership with a number of carmakers, such as Landrover.

During the event, Felix announced the first batch of deals Hartmann Metaverse Ventures was able to secure. We will share these publicly over the coming weeks.

For the finale, all of the founders returned to the stage to answer questions from the audience.

As a group, they weren’t overly concerned with the difficulty in onboarding crypto natives into the metaverse, even if they acknowledged that work needed to be done to make crypto-based gaming, fashion and world building more accessible and seamless. The founders differed on the degree to which crypto economies in the metaverse will simply replicate power relations in the real world. Crypto will remove middle layers of control such as fashion houses and centralized social media platforms, even if economic incentives will drive development and users.

We are in the earliest days of the metaverse, panelists pointed out that Decentraland was still empty and soulless. The promised AAA crypto P2E games are still likely years away. Yet this is the time to invest in exciting and compelling projects for the future, and especially in the inspiring, tireless and motivated founders we hosted at the launch. As Felix concluded, this is a 10 year opportunity equivalent to the early days of the internet. While Web 2.0 revolves around the physical world (photos, videos and stories, but also music and delivery), Web 3.0 will be truly digital for digital natives.

The exciting innovations will come from games within virtual worlds, as leading crypto investor revealed this week:

Hartmann Digital’s PYR and Decentral Games investments fit with this theme.

The Road to a Trillion-Dollar Market

Land in the metaverse was in demand this week. A rare virtual “Genesis” plot in the yet-to-be-released Axie Infinity land game sold for a record $2.4 million. The plot is considered to be one of the world’s best, and is capped at 220 plots. Location is more important here than in other games, as in the Axie world movement between domains is slow at best.

It does appear that Axie (company) has been able to build on its record Axie (game play) volumes of over $2.5 billion in the third quarter of 2021.

While Axie’s world has yet to arrive, Decentraland has been one of the metaverses leading the way in P2E (Decentral Games), virtual concerts and land play. There has been so much trading in virtual land that an academic paper has been released studying its virtual real estate economics. The paper finds that:

prices of virtual land parcels are primarily driven by factors that are of particular importance in business applications. Land parcels in close proximity to popular landmarks, such as the city center, main streets, plazas and commercially-driven districts, as well as parcels with easily memorable address-like features were claimed at substantially higher prices.

Basically, its location, location, location, for now, even though in most worlds, users can easily jump across large “distances” in an instant. One property with a great location attracted an offer that matched the Axie land price, trading at a Decentraland record of $2.4 million. These are remarkable prices given that Decentraland’s user experience remains weak, and Axie has yet to launch. Is this the late stages of landlord capitalism? The traditional financial press believes it, with Forbes arguing that metaverse land investment is a must:

The mainstream is coming to the metaverse, and, besides the obvious virtual concerts, one of the first forays has been into NFTs. This week, virtual world Sandbox announced a partnership with Adidas, who owns 144 parcels of land.

We expect more mainstream brands to onboard to crypto. Adidas is leading the way here again, this time partnering with Coinbase on payments, though details are scarce.

With the public interest come the celebrities. To onboard the normies, Moonpay has quietly introduced a concierge service to facilitate access to the best NFTs. Many celebs have recently acquired NFTs such as Bored Apes, including Jimmy Fallon and Post Malone. The floor price is now around $190,000.

As the most exclusive NFTs continue to be out of the reach of new crypto entrants other than celebrities and billionaires, cooperatives and index products have developed to offer NFT fractionalization.

Now almost any profile NFT project such as CryptoPunks or Bored Apes is available for a very low entry price. Well known Fractional and PleasrDAO have allowed for the fractionalization of iconic works such as the Doge NFT, now valued at $222 million.

PartyBid allows any group to collectively purchase otherwise out of reach digital works, and made history this week by facilitating the purchase of Justin Aversano’s Twin Flames #49 for $3.4 million. Over 400 NFT enthusiasts were able to join together to coordinate the purchase.

Such fractionalization is needed in order to allow for the continued democratization of the digital art space in the face of rising prices in dollar terms as NFTs continue to go mainstream. Christie’s has accepted the inevitable and will partner with OpenSea to further connect the traditional and digital art worlds.

Beginning next week, the auction house that was founded before the American revolution, will curate an offering of rare NFTs that will be sold on the number one crypto art marketplace that was first established to trade CryptoKitties. That was four years ago.

We’re in good company in our drive to improve the metaverse space through our new Metaverse Ventures fund. Arca announced it is raising for its first NFT fund, while BitDAO has approved funding of up to $500 million for a P2E games accelerator, Game7. With new money entering, we are confident that the P2E space will expand upon the simple games available to date, such as Gods Unchained, Cometh v1 and Axie Infinity. We also believe that DeFi will infiltrate P2E even further in the coming years. P2E-DeFi crossover Wolf Game dropped a series of NFTs this month. Staking of the NFTs depends on in-game decisions.

In addition to the increasing number of functioning games, such as Vulcan Forged, big bets are being made on AAA games such as Star Atlas and Illuvium, long-burn but potentially groundbreaking projects. Additionally, as mentioned above, land speculation in P2E has increased with Facebook’s Meta announcement.

But new investment also risks putting the games out of reach for the majority of potential players. As a result, there are a growing number of solutions to make play affordable, following in the footsteps of Merit Circle and Yield Games Guild. This week, HumanDAO announced a token sale to fund scholarships for P2E gamers so that they can use the in-game assets of others to generate revenue. Also this week, Avocado Guild raised a $18 million Series A to copy Yield Guild Games.

Over the coming weeks Management will share our first set of deals with Hartmann Metaverse Ventures, our newest Venture Partners, as well as share our 10-Year thesis.

Hartmann Capital Weekly written by Head of Research, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.