The Rise of Terra & The Largest Hack in DeFi History

Hartmann Capital Newsletter, Friday August 13, 2021

In this issue

Can Terra challenge Ethereum?

Major hack highlights both the strengths and weaknesses of crypto

Coinbase and Fireblocks seeing record demand

This week’s blog: “Crypto Regulation is Coming. Some Historical Context”

Announcement - Hartmann Capital welcomes four new analysts in training

Market by numbers

A rising tide carries all ships: Almost all tokens were up on the week, with the Metaverse continuing its epic run, more than doubling in four weeks.

Can Terra challenge Ethereum?

Pretty much ever since the DAO hack in 2016, many in the crypto markets are betting on any number of potential “Eth-killers”. In the meantime, so many chains have fallen apart, languished or are late in delivering. Cardano is still promising smart contracts. XRP is under attack from regulators.

The limited scalability of Ethereum, however, combined with the delayed arrival of scaling solutions has opened the door for new layer 1s to claim some of the key growth areas. NBA TopShot is on Flow and Axie Infinity has its own Ronin side chain. Solana has an early start on order book exchanges. Binance Smart Chain is also making its mark. Polygon’s side chain has incentivized users to give up Ethereum-level security in exchange for extremely low fees. Nevertheless, no-one would deny that Ethereum is holding its own, with full blocks and new innovative protocols launching every day. The recent NFT boom is happening mostly on Ethereum.

Any successful layer 1 will need competitive advantages to either nurture its own markets or compete with the others.

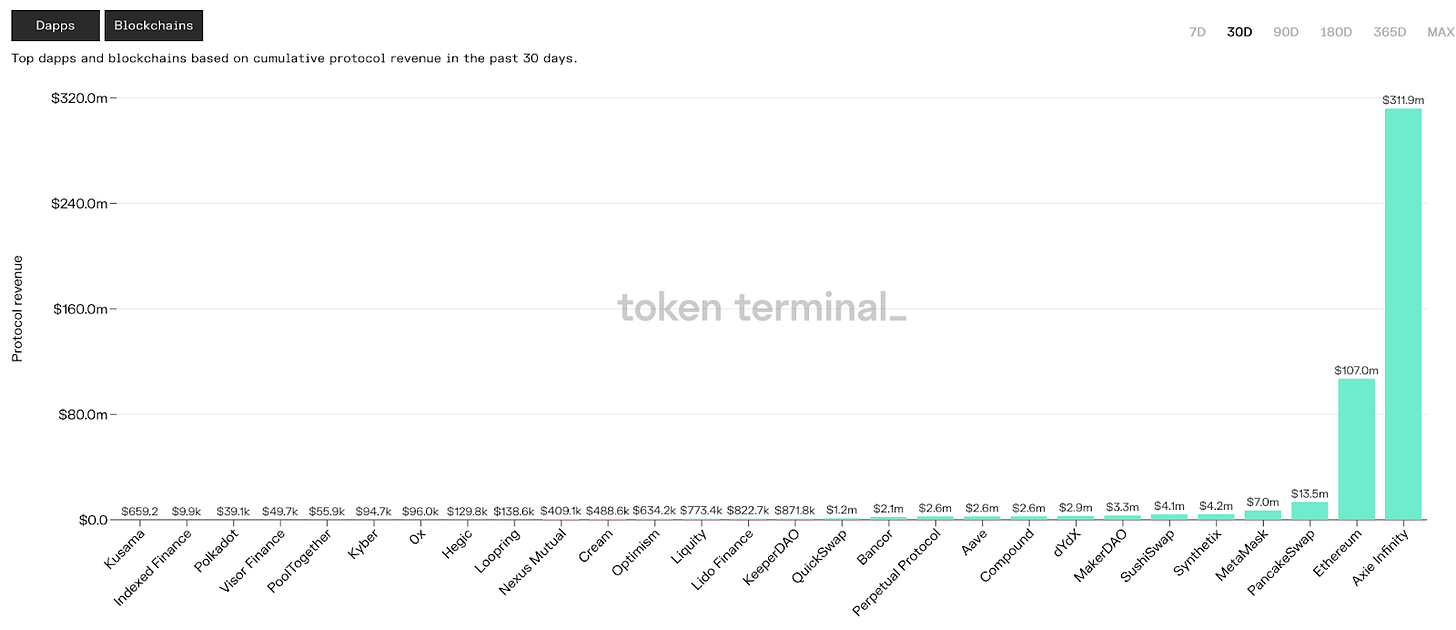

The recent focus on regulatory and legislative headwinds in the US, the UK and even China blinds us to the growth outside of the West. Yet East and Southeast Asia can not be ignored. Axie Infinity has relied on growth in Asia to make it number one in revenue, surpassing Ethereum.

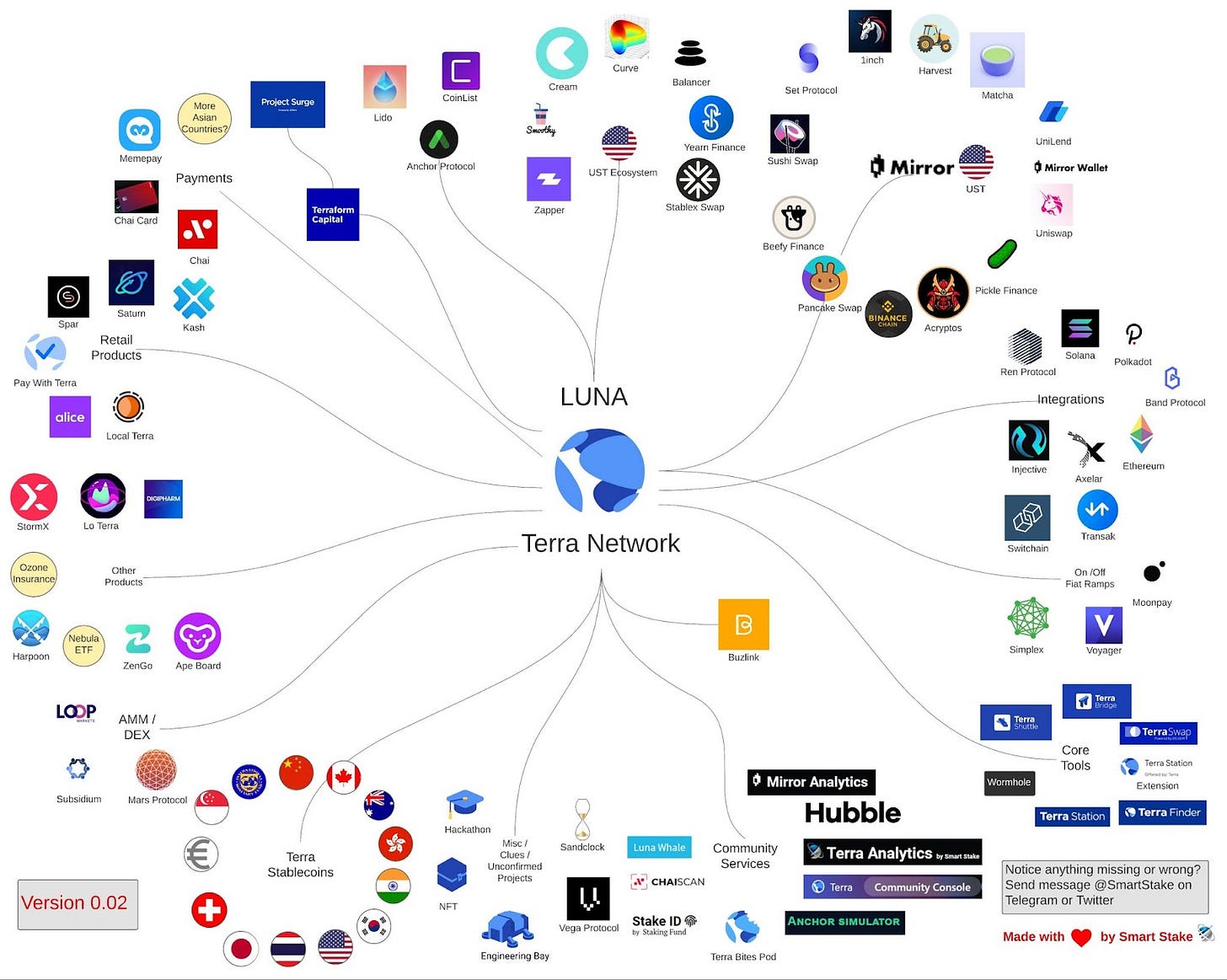

The Terra blockchain has developed solutions for these growing markets. It’s Chai app allows Koreans to shop using its stablecoin and retailers to avoid long waits and high interchange fees. Terra’s UST dollar stablecoin is truly decentralized, while recent censoring of USDT stablecoin transactions calls into question the permissionless and immutable nature of many stablecoins.

UST drives Terra’s lending application, Anchor. But it’s Mirror that is likely the most misunderstood of the protocols from a Western perspective.

Mirror provides access to synthetic versions of popular stocks and funds. For those who have access to Robinhood or even a discount broker, Mirror’s ability to provide permissionless decentralized trading is not compelling. However, many in the world do not have access to the benefits of investing in US growth stocks, and so will miss out on future Googles, Teslas and Facebooks. This is Terra’s target market.

Terra is developing several advantages over Ethereum, adding potential value for its native token, LUNA.

Terra may not actually be an ETH-killer, as it is more likely that we will live in a multi-chain world. Terra has planned for this. UST and “mirrored” assets are available on Ethereum and BSC. Terra allows the staking of ETH in its lending platform. Bridges are important, and Terra’s bridges are expanding with the coming addition of Wormhole to Solana. Terra’s goal is for its assets to live on all chains and for composability to be possible from other layer 1s to Terra.

Cross-chain interoperability is not enough, however. To scale crypto, seamless and effective bridges to TradFi are needed. This is where Terra has been focusing much of its energy. Besides its Chai app (and similar in Mongolia), Terra is committed to adding DeFi directly into its Terra Station wallet.

The most interesting development is the imminent arrival of Columbus-5 (C-5), the latest iteration of the Terra blockchain. Like EIP-1559, C-5 adds a deflationary element to a native token by “burning” all seigniorage from minting Terra stablecoins rather than sending it to the community pool. It also pays swap rewards to existing LUNA stakers.

As LUNA is burned through minting UST and staking rewards rise, LUNA staking will be more productive than ETH.

Terra’s successes remind us not to maintain a US-focus and remember that it might be Asia where crypto’s potential to reach mass adoption occurs first.

The largest ever hack highlights both the strengths and weaknesses of crypto

The largest hack ever occurred this week in crypto, which might at first seem like terrible news for the space.

Of course, a hack of over half billion dollars’ worth of tokens does reveal that crypto is risky. We at Hartmann do our best to mitigate the risk of an exploit, through diversification, prioritizing tested and audited protocols, due diligence or even protocol insurance.

The end result of the hack exposes a strength and a weakness of the crypto ecosystem. The weakness is that Tether was able to easily blacklist the USDT dollar stablecoins stolen, so that they are now unusable. This might discourage someone from hacking USDT, but more importantly it shows that the stablecoin is far from permissionless and immutable.

On the positive side, the crypto community quickly went on the offensive, tracking down the whereabouts of the stolen tokens, forcing the hacker to agree to give back all but the Tether-censored assets. Crypto is pseudonymous at best. Transparency is one of its key features.

Coinbase and crypto custodians seeing record demand

Coinbase’s results reveal that Ethereum trading demand is skyrocketing at the same time that institutional investors are demanding more Ethereum services from custodians NYDIG and Fidelity. Will Ethereum flip Bitcoin with institutions?

Coinbase’s Q2 trading volume was a record $462 billion, up from the $335 billion in the previous quarter, and $80 billion more than street expectations. ETH trading demand was driven by interest in NFTs and DeFi governance tokens that live mostly on Ethereum. Interest in NFTs is at all-time highs. Crypto is still growing.

This week’s blog: Crypto Regulation is Coming. Some Historical Context

Crypto is new and for all the concern about Facebook’s Diem and uncontrolled stablecoins, the sector has pretty much stayed off the radar of the US Congress. That’s changed recently, and so this week we use historical cases of financial innovation that attracted regulator attention to tease out any hints of what is to come out of Washington and what the crypto industry can do about it.

Announcement - Hartmann Capital Welcomes 4 New Analysts in Training

Hartmann Capital saw around 50 candidates apply for our coveted analyst in training positions, and after two weeks of a three phase hiring process, selected four qualified individuals that will be joining us for the next four months as they train to become full-time analysts. Their backgrounds are diverse and range from big tech at Google, to strategy at PWC, to TradFi at Goldman, continuing our trend of being a firm that operates at the intersection of tech and finance. Each candidate has an obsession with the digital asset space and a depth of knowledge only acquired by being a super-user/early adopter of the space. We wish the new analysts a successful first week with the firm starting Monday!

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.