The new Bitcoin ETF and the Rise of US Mining

Hartmann Capital Newsletter, Monday October 18th, 2021

In this issue

Bitcoin goes West, and becomes a (futures) ETF

Crypto leaders attempt to set the legislative and policy agenda

Edging NFTs towards the mainstream on Coinbase, and Disney?

Blog this week: A Token Market or a Market of Tokens

Market by Numbers

Bitcoin is back above $60,000, up almost 50% from the 30 day lows and outperforming ETH, likely on the back of a Bitcoin futures ETF listing for Monday. For the 4th week in a row, DeFi 1.0 (DeFi Pulse Index) underperformed the broader markets.

Bitcoin goes West, and becomes a (futures) ETF

While China seems to be winning the war against the remaining Bitcoin miners that refused to leave after the most recent ban, the US has been the biggest beneficiary of the recent mass emigration of hash power.

The most recent numbers out of the Cambridge Centre for Alternative Finance show that the US had over a third of all mining power in July and August, 2021. Canada and Kazakhstan have also seen their capacity increase, doubling over the summer.

At the same time, China has, officially at least, rid itself of all Bitcoin mining capacity, and the country seems determined to shut down every last miner. The Block reported this week that the government has been using sophisticated tech to weed out even the smallest GPU miners that accounted for less than 0.01 Eh/s.

A lovely animated interpretation of the migration can be found here. As we mentioned in a previous newsletter [link], mining capacity has started to recover from the loss of China, While the loss of China, accounting for ~ 73 Eh/s (exahashes per second) at its zenith, has not been completely offset, North America has increased its hashrate by 40% over the summer to 53 Eh/s, and Kazakhstan has added another 11 Eh/s. Friend of Hartmann Capital, Michel Rauchs, digital assets lead at the Cambridge Centre, confirmed that early October numbers show that global Bitcoin hashing power has almost entirely recovered the Chinese losses.

Anyone worried that an over-reliance on China for Bitcoin consensus was a risk to its unequalled security should be placated by this more even distribution of hash power.

Late Friday, we finally were treated to the first official listing of a Bitcoin ETF backed by futures. With cash ETFs still in regulatory limbo, the futures-backed version, with fees below 1%, is the best available way to access Bitcoin in a tax-efficient manner.

Crypto leaders attempt to set the legislative and policy agenda in Washington

The crypto industry is taking the moral and intellectual high ground in their fight with US lawmakers and regulators since being blindsided by the crypto-specific reporting requirements in the summer’s Infrastructure Bill.

Executives from giant venture capital firm Andreessen Horowitz, a major crypto investor also known as a16z, planned to meet with leaders in Washington. In anticipation of the event, the firm revealed its proposals for an improved regulatory framework for a new, decentralized Web (Web3). An a16z representative told CNBC on Tuesday that,

Web3 represents the alternative to a digital status quo that is frankly broken... It is the response to the challenges that have emerged out of web2. And for that reason, it is absolutely critical that policymakers start to undertake the steps required to get this right.

The proposals, that involve a national approach, include:

Tackling financial protection and inclusion with a disclosures-based regime under current authorities

Legal recognition of new decentralized autonomous organizations that are the backbone of digital asset protocols

An investigation into a new regulatory regime that should include

Harmonized regulation of Web3, including NFTs

An industry self-regulatory organization (SRO)

A single technical standards-setting body

Sensible tax reporting for decentralized entities

Two of the largest centralized crypto asset exchanges, Coinbase and FTX, separately, also revealed their proposals for regulation in the US this week. Coinbase are currently having discussions within the industry regarding their policy document, according to Cointelegraph. Like a16z, Coinbase also has four pillars:

Regulate digital assets under a separate framework

One dedicated regulator

Protect users through disclosure, fraud enforcement and market surveillance

Ensure that users have choice of decentralized and centralized platforms

FTX in its statement on policy goals chose to focus on investor protection. The primary tool, as with a16z and Coinbase, should be disclosure, by tokenized asset issuers as crypto platforms. FTX favours a harmonized system that focuses on establishing and enforcing market oversight and anti-fraud rules.

The stakes are high. There is a general perception that the US is losing ground due to its regulatory stance on crypto. All three policy-focused statements end with the key aim of all parties:

Taking action [now] will position the U.S. approach as the global benchmark and standard for crypto Ecosystem regulation.

The bottom line is that crypto investors and platforms welcome regulation that stops fraud, reveals the risks and provides for fair markets and appropriate tax policy.

Edging NFTs towards the mainstream on Coinbase, and Disney?

In still another sign that non-fungible tokens (NFTs) have gone mainstream, Coinbase has entered the market that is currently dominated by OpenSea. This week, in less than a day, almost a million users signed on to a waitlist for their new NFT exchange. Last week, exchange competitor FTX announced their Solana-based NFT marketplace. In a departure for Coinbase, the NFTs can be minted and held in non-custodial wallets, somewhat decentralizing an otherwise centralized platform. The NFT exchange should launch towards the end of the year.

Meanwhile, Citibank has suggested that entertainment and media giants will turn to NFTs in short order. Disney, Electronic Arts and World Wrestling Entertainment could be major beneficiaries. In other news ViacomCBS has reached a deal with crypto startup RECUR to create a platform for NFTs that could include SpongeBob and South Park.

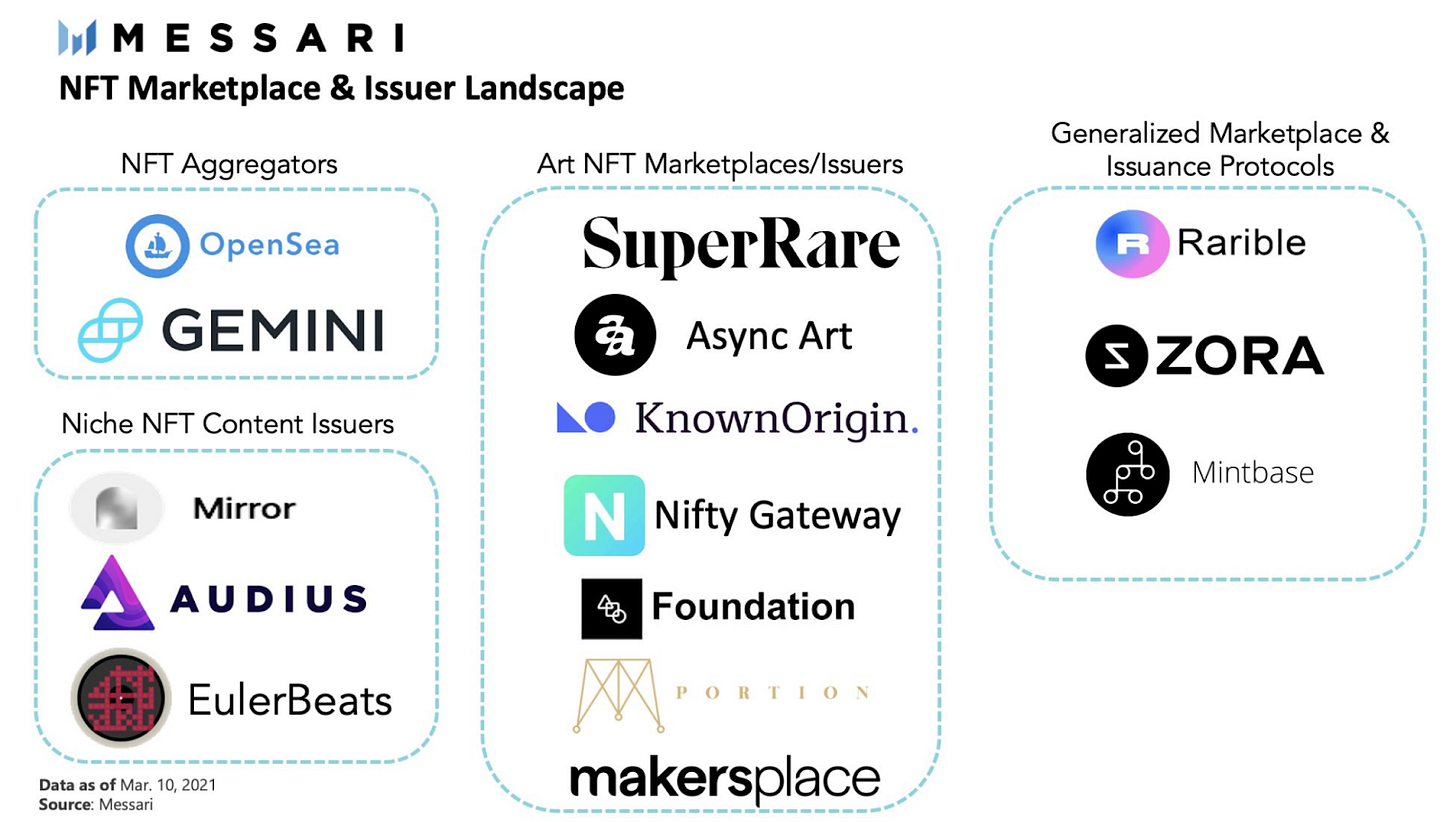

Between Coinbase and FTX providing seamless NFT platforms and more non-crypto companies joining the space, NFT collecting will be within reach of a much larger audience than just crypto natives. Previously, centralized options were limited:

The space has plenty of potential: In Q3 NFT sales were just over $10 billion.

This Week’s Blog: A Token Market or a Market of Tokens

We at Hartmann Capital believe that Bitcoin macro speculation will no longer drive the increasingly diversified digital asset markets that now cover so many sectors: gaming, collectibles, decentralized web storage, permissionless social media, and new financial primitives such as real world asset tokenization and decentralized options trading.

In the search for alpha in digital asset markets, therefore, we have found we need to quickly identify momentum shifts between crypto “sectors” when we allocate to the most promising tokens.

Hartmann Capital is focused on what sectors have the opportunity to shrug off weaknesses in the wider token markets. Previously we have highlighted our conviction in gaming/metaverse (is Vulcan Forged the new Axie?), the best of the best multi-chain ecosystems (especially on Terra, Secret and Solana) and tokens, and innovative DWeb competitors (e.g Arweave). We’ve recently added to our DeFi 2.0 positions in MPH, and RGT as part of the broader sector rotation from the original Ethereum-based DeFI protocols.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.