The Metaverse and DeFi make Headlines as Congress Investigates Crypto

Hartmann Capital Newsletter, Friday July 30, 2021

In this issue

Facebook’s highly-centralized Metaverse strategy.

DeFi in Fortune Magazine and in Goldman’s “DeFi” ETF.

Congress investigates crypto assets.

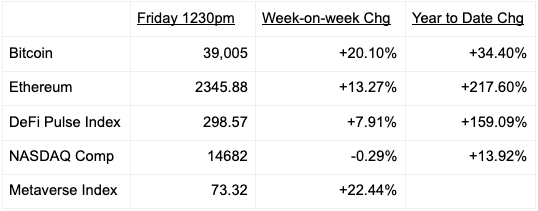

Market by numbers

Bitcoin catches a bid, while the Metaverse, led by Axie Infinity (+175% this week), continues its bull run.

Facebook’s highly-centralized Metaverse Strategy

Having already disrupted the fiat status quo with Bitcoin and traditional finance with DeFi, crypto has turned its attention to the internet (in the form of the DWeb) and the “metaverse”. In this week’s blog we see the metaverse as providing for virtual online multi-user spaces, for gaming, collecting, creating and socializing.

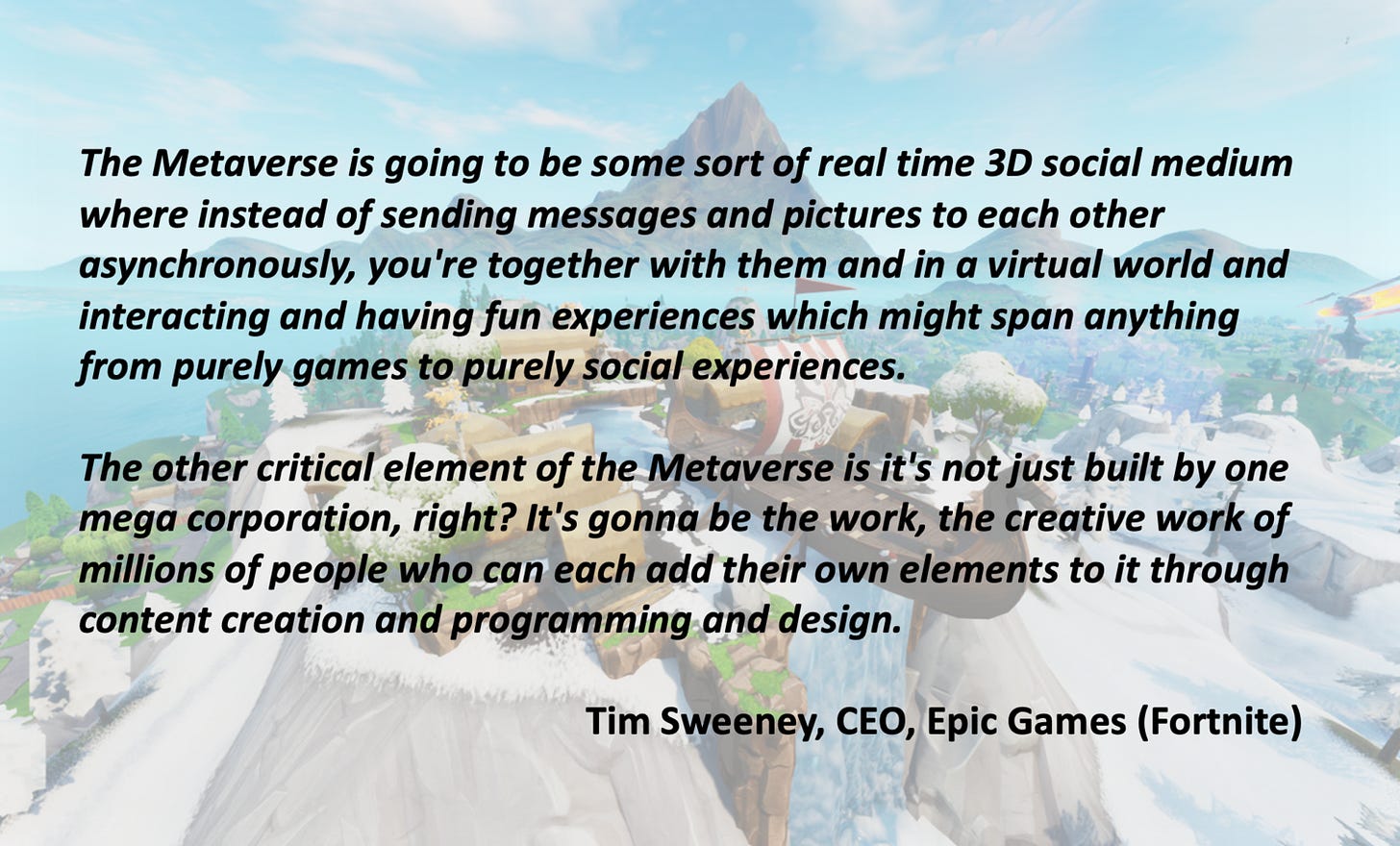

Tim Sweeney, president of Epic Games (creator of Fortnite), has been a very vocal advocate for decentralizing game spaces, believing that millions of users and creators will come together and cooperate to build a future that spans pure games to pure social spaces and everything in between. Companies will choose to open up their currently-centralized world to their users out of enlightened self interest: the people will demand it.

Mark Zuckerberg, unsurprisingly, has a far different plan, as he outlined during Facebook’s earnings call this week and in an interview with the Verge. While Mark has acknowledged that the metaverse won’t belong to one company, he told the Verge that he expects Facebook to use virtual and augmented reality to extend Facebook’s reach into business (e.g. meetings) and entertainment. Investing heavily in hardware increases the likelihood that Facebook can monopolize virtual experiences. An enhanced social network located in the metaverse, and a strengthened monopoly, is Zuckerberg’s goal.

On its earnings call, Facebook said it plans to profit from advertising and also the sale of virtual items and services.

I think digital goods and creators are just going to be huge.

In the long term, according to Zuckerberg, Facebook is spending billions on this transformation:

I think we will effectively transition from people seeing us as primarily being a social media company to being a metaverse company.

Facebook’s last plans should serve as a wake-up call to the builders of crypto-based decentralized games, collections and spaces. Bankless blogger William Peaster’s reaction epitomizes the view of all of crypto – that Mark’s announcements is the ultimate challenge,

Those of us building and using the underground metaverse today have a huge wake-up call on our hands. By underground I mean an open, user- and community-driven virtual universe as compared to something like Facebook’s presumable conception of the Metaverse™, which would undoubtedly be gated, siloed, and beholden ultimately to Mark Zuckerberg’s final decisions, so no real metaverse at all.

DeFi in Fortune Magazine & in Goldman’s “DeFi” ETF

Dominant TradFi institutions continue to embrace crypto assets, albeit to different degrees. The feeling on Wall Street that they are missing something big is apparent in this week’s cover story on DeFi in Fortune magazine.

Goldman Sachs revealed some of this TradFi FOMO this week when it announced its intention to launch an ETF linked to decentralized finance.

Confusingly, however, the ETF appears to be “DeFi” in name only. According to a filing with the SEC, Goldman Sachs Defi and Blockchain Equity ETF would reference the Solactive Decentralized Finance Blockchain Index. While this index does not yet exist, it is telling that Solactive’s benchmark (so-called) blockchain index consists of common equities of companies – such as Microsoft, Facebook and Accenture – that do not appear to have much of a connection to blockchains:

As the filing only contemplates the ETF investing in listed companies above $0.5 billion in market cap, it is unlikely that this DeFi ETF will contain any DeFi at all. Most if not all DeFi investments have been either tokenized or have been made by VC funds. Neither category is permitted in Goldman’s ETF. As such, this fund is not even a compromise between TradFi and DeFi. For exposure to Facebook and Google, there are perhaps better vehicles.

For crypto, the choices are the closed-end funds such as Greyscale, crypto-native companies, VC investments or crypto hedge funds. Of course, Hartmann Capital offers exposure to true DeFi crypto assets.

Congress Investigates Crypto

Also this week, the Senate Banking Committee invited crypto industry experts to a hearing titled “Cryptocurrencies: What are they good for?”. Senate leaders’ prepared remarks were mildly bullish for the sector.

Some senators, including ranking member Pat Toomey, were somewhat crypto friendly. Toomey highlighted the anti-censorship use case for crypto, citing Arweave’s storage of Apple Daily’s news after the police raids in Hong Kong. Other senators were less friendly. Senator Elizabeth Warren was the most vocal,

Instead of leaving our system, our financial system at the whims of giant banks crypto puts the system at the whims of some shadowy, faceless group of super coders and miners, which doesn’t sound better to me.

Systemic risk was considered a major risk, even though very little leverage is allowed to exist in the crypto ecosystems. Miners were also the subject of scrutiny.

The bigger issue, however, appeared to be the lack of centralized authorities and regulations. Senator Warren separately called on Janet Yellen and the Financial Stability Oversight Council to draft regulations for crypto assets.

The US government’s interest in crypto has clearly been piqued. This week also saw a hearing on ransomware by the Senate Judiciary Committee that contemplated crypto’s role and a meeting with the U.S. House Committee on Financial Services on Central Bank Digital Currencies. Regulation is coming. That might not be a bad thing.

This week’s blog: “Metaverse Summer”

In this week’s blog we take a deep dive into the decentralized metaverse. Online gaming, collecting, creating and socializing is rapidly being decentralized. Where is the metaverse headed? How is crypto’s version unlike Facebook’s vision? How do we intend to profit?

Final Call - Applications to Second Analyst Incubator close this weekend

After completing training and hiring the first cohort of digital asset analysts, Hartmann Capital will be closing applications for its second analyst cohort this weekend. Four new analyst in training will join the team from August till December 2021. Candidates are expected to have fluency in digital assets and DeFi or the Metaverse, however we do not require degrees or prior employment in the digital asset space. Candidates will work alongside the analyst team and will be assigned a full-time analyst to shadow. Remote and/or in-person, with weekly stipend. Apply here.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.