To Investors and Colleagues,

Crypto bull markets appear like the easiest game when observed from birds eye, yet they are one of the hardest beasts to tame when looked at up close.

On a monthly chart the 2016-2017 bull market is a picture perfect exponential slope. However when zoomed into the 3-day chart, one spots eight 30-40% market corrections within that time span on Bitcoin alone, the blue chip of the digital asset industry. Small cap digital assets often drop 50-60%, as they did in September.

These corrections may appear scary, but are a natural side-product of exponential growth. In fact, generally, they present ideal buying opportunities.

As explored in our last market update titled ‘The Calm before the Storm’, we are still in the first inning of this digital asset bull cycle.

While 2017 was a year of promises and white-paper dreams, 2020 has been a year of shipping product and delivering upon these promises from long ago.

The ICO mania surely came with its fair share of delusion and fraud, but it has also allowed countless teams to build for the last 3 years. Today the industry is reaping the fruits of those thankless bear market years focused on building.

In today’s market update we’ll address why the digital asset market is stronger than ever despite its September correction.

The world is in for a rollercoaster, socially, politically, and economically. We hope that our analysis can give you some guidance in order to be well prepared and protected.

Sincerely,

Felix Hartmann, Managing Partner

1. Anti-fragility:

As the world rides through the storm that is 2020, we have to ask ourselves whether our ship is made of wood or steel. With the election still looming ahead, and a non-peaceful transition of power from either side now looking to be more than just a tail-risk, the markets may be tested once more.

Instead of philosophizing, let’s explore how digital assets dealt with outlier stressors this year:

A global pandemic and financial liquidity crisis: March 6-12th 2020

Bitcoin: -59% / 61 Days to full recovery

Ether: -65% / 85 Days to full recovery

A top 10 crypto exchange hacked for ~250 million USD: September 26th, 2020 (the third largest hack in history, more than half the size of the Mt. Gox hack which brought the industry to its knees in 2014)

Bitcoin: Price unaffected

Ether: Price unaffected

Bitcoin: -4.3% / TBD

Ether: -6.3% / TBD

Nearly everything that can be feared has happened. A hack, a governmental crack down, a global black swan crisis. In each of those cases, prices took a hit, occasionally a hard one, but ultimately bounced back.

Digital assets have proven to be anti-fragile. Professor and author Nassim Nicholas Taleb explains anti-fragility as “a property of systems that increase in capability to thrive as a result of stressors, shocks, volatility, noise, mistakes, faults, attacks, or failures.”

Centralized exchanges presenting a custody risk? No problem, decentralized exchanges now have more volume than Coinbase.

Banks denying crypto firms banking services? No problem, a crypto exchange now has a US banking charter.

Love Bitcoin’s monetary policy, but Ethereum’s speed and versatility? No problem, there’s now over 1.3 billion USD worth of Bitcoin on Ethereum.

With every single blow that is dealt to the industry, it becomes more secure, resilient, and indestructible.

2. A Cambrian Explosion:

What was first? The chicken or the egg?

A similar Catch-22 existed for all too long in the decentralized finance space.

How can you get users without liquidity?

How can you get liquidity without users?

Ultimately this paradox was solved this summer with a real life, real time, social experiment of incentives of insane proportions.

Projects offered millions of dollars to users to simply use their products and provide liquidity. In fact, one project even air-dropped around $2,000 to each of its users.

While these types of incentives surely are not sustainable, in many cases they don’t have to be. All that was needed was to bring the industry out of its stalemate phase where there were no users and no liquidity.

Now there’s over a million users with Web 3.0 wallets in their browsers, savvy at engaging with smart contracts, and a healthy amount of funds to deploy on experiments.

More importantly, having talked with countless teams, we find treasuries replenished from token appreciation and renewed interest, which has allowed several teams to convert some of their reserves into stable values, ensuring 1-3+ years of guaranteed burn rate.

Not only does this de-risk project failure due to lack of funds, but it has also given them the needed fuel to attract more developer talent and expand their efforts. We have seen more recruiting and hiring in the digital asset space than we ever have since 2017. This fundamental growth early on in the cycle will likely carry fruit 6-24 months from now and could very likely extend this bull market into a multi-year cycle.

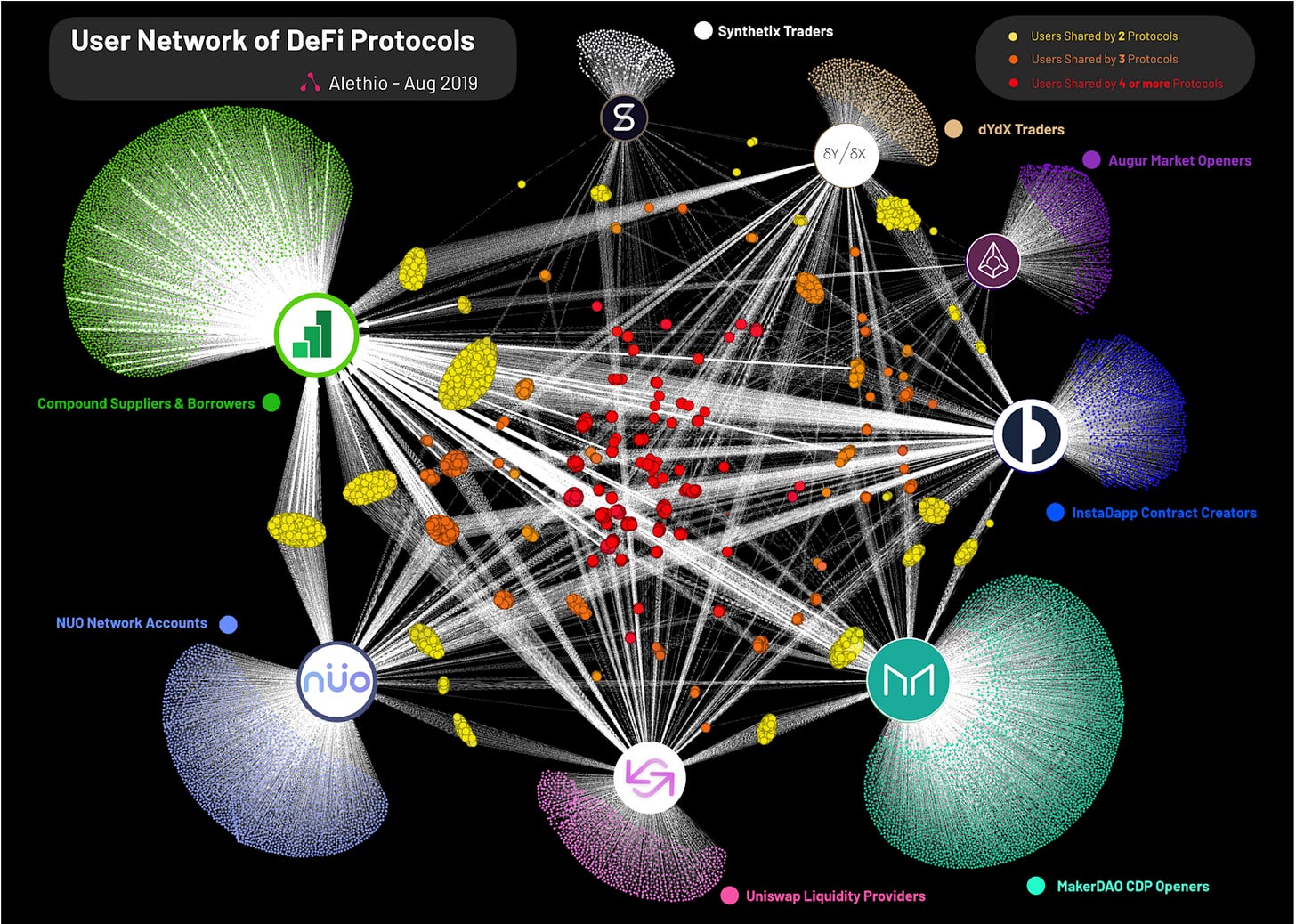

But perhaps the biggest paradigm shift is interoperability. While startups tend to work in silos, the open source nature of digital assets and their decentralized networks has led to more collaboration and a faster rate of innovation than anything we’ve ever seen before.

For example, our first activist investment Melon, which provides decentralized asset management, integrates with decentralized exchanges like Kyber Network and Uniswap. It’s governance is run through the decentralized governance protocol Aragon. And if you want a nice UI/UX you can pull up your Melon fund’s positions and performance on Zerion.

In the past startups would try to re-invent the wheel and build everything themselves. Today we see protocols niche down on perfecting one piece to the puzzle and integrate with others, and allow others to integrate with them freely. This way, any entrepreneur has lending, trading, insurance, and any other ‘money verb’ you can think of at his/her fingertips to build incredible financial infrastructure.

Will there be bugs and bad actors along the way? Sure.

But the open source and interoperable nature of decentralized technologies has proven to unleash a Cambrian explosion of innovation.

3. Follow the Money:

People speak louder with their wallet than with their lips.

TV and print analysts aren’t paid to be right. They are paid to get clicks and views.

If you still hold the news in high regard, ask yourself what people do with yesterday’s newspaper. Likely it’s in the trash, a bird cage, or used as a wrapping device for shipping.

So if words are meaningless all too often, we have to follow the money.

Here’s some of the most impressive bets we’ve seen on digital assets since ‘the bubble popped’ in 2017:

October 2020: Grayscale Bitcoin Trust, the most popular institutional ETP, approaches $5 billion in assets.

August 2020: Nasdaq-listed company MicroStrategy moves $425 million of its balance sheet to Bitcoin as its new reserve asset

May 2020: Multi-billionaire hedge fund titan Paul Tudor Jones allocated 2% of his assets towards Bitcoin.

April 2019: Harvard endowment fund invested $11.5 million into Blockstack’s initial coin offering.

February 2019: Morgan Creek Digital scores the first US pension funds to invest in crypto

Public companies, endowments funds, pension funds, venture funds, hedge funds, and institutional allocators have all began allocating to digital assets.

Nobody wants to be first on the dance floor. One misstep and you look foolish. Being first comes with reputation risk. But nobody wants to be last either and miss the party.

As a result you generally see a polar opposite make-up of early movers. Those with no reputation to lose, and those with such massive reputations that allocators trust their judgement even when they don’t understand the underlying itself.

Today it’s the Harvard’s, Andreessen’s, and Tudor Jones’s of the world.

Tomorrow it’s the mid-tiers.

And then eventually it will be the laggards.

Once every so often critics are saying that old Bitcoin investors are ‘dumping’ their Bitcoin on new unknowing allocators. They call it a greater fools game. However the blockchain tracks every single on-chain Bitcoin transaction. And the blockchain cannot lie. Not only are such allegation factually incorrect, but in fact the exact opposite is the case. ‘Aged’ Bitcoins are making up a larger portion of the total supply than ever before. Such long term holders are creating a supply sink, as the amount of Bitcoin circulating on exchanges grows smaller and smaller.

Around 45% of all Bitcoin have been held for more than two years. In fact, nearly 10% of all Bitcoin have not moved in over 10 years. This pattern of coin ‘aging’ (look at the light green band expanding downwards) can be seen both in the accumulation of 2013 as well as in the accumulation of 2016. Structurally we may be in the final stage of an accumulation before a parabolic run.

Final Thoughts:

The best performing assets - from Bitcoin to Tesla - are all volatile. The key is to pay attention to the holy trinity of asymmetric plays - position size, time horizon, and product delivery. One will keep you solvent, one will keep you patient, and one will filter the doers from the dreamers.

TIMESTAMP 09/30 - 10/2 2020:

DJI - $27,682

S&P - $3,355

BTC - $10,500

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.