Multimodal AIs, Gamer Retention Methodologies, and the Rise of ETFs

Hartmann Capital Bi-Weekly, Friday January 12th, 2024

If you are attending iConnections in January and would like to book a 1-1 allocator meeting to learn more about our funds, please send us a message by replying to this email.

In this issue

AI: Beyond Text and Images: The Era of Multimodal AI by Daniel Derzic

Weekly Insight From Management: ETFs, Wikileaks, and the Apple Vision Pro

METAVERSE: What Pulls Gamers Back in? by JP Minetos

CRYPTO: The Unstoppable Rise of ETFs in US Financial Markets by Jonas Luckhardt

Beyond Text and Images: The Era of Multimodal AI

Written by AI & Metaverse Associate Daniel Derzic; Edited by Felix Hartmann

Imagine a world in which technology can not only understand our words but also analyze our pictures, interpret our movies, and even anticipate what we want. As 2024 progresses, generative AI is poised to become a valuable tool for regular consumers beyond the tech-savvy industry insiders. A growing number of people are likely to experiment with a wide range of AI models. State-of-the-art AI models like GPT-4 and Gemini, are at the forefront of this technological revolution. Unlike their predecessors, which were limited to processing text, these advanced models, known as multimodal AI, have the capability to understand and generate not only text but also images, and potentially even videos.

Unimodal vs Multimodal

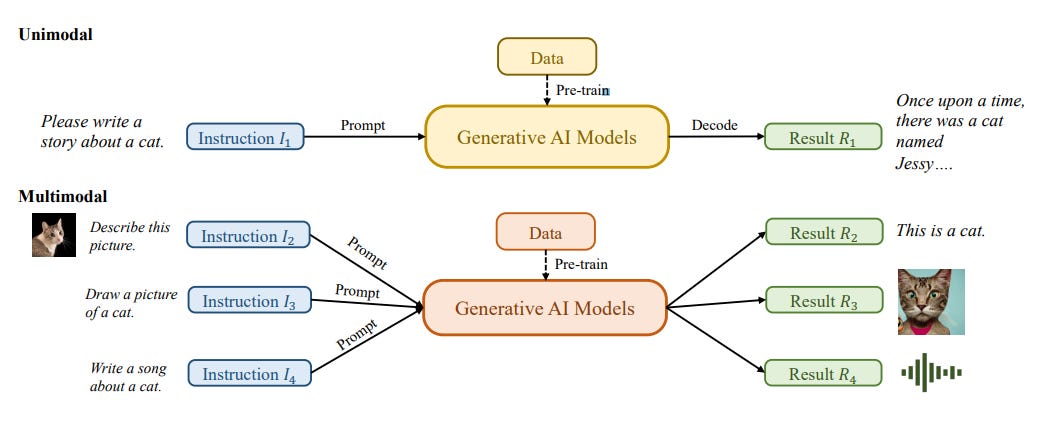

In general, there are two generative AI models: unimodal and multimodal. Unimodal models get instructions from the same modality as the created content modality, but multimodal models take cross-modal inputs and produce outputs from multiple modalities. It is a sort of artificial intelligence that does not limit itself to one type of data, such as images or text. Instead, it combines several sorts of data - such as pictures, text, audio, code, and videos - to better understand the situation. It's similar to how we utilize our eyes to see, ears to hear, and brains to process what's happening around us. A multimodal AI, for example, may look at an image while reading a description, allowing it to grasp what's in the picture far better than if it only had the picture.

The state of multimodal AI

One of the most substantial updates is Google's Gemini AI model, which was trained on several data formats before being fine-tuned using new multimodal data. Gemini beats older models in a variety of areas:

There are three different versions: Ultra, Pro, and Nano, each catering to a different set of requirements. The Ultra version outperforms human experts in massive multitask language understanding (MMLU) and outperforms 30 of 32 academic benchmarks. Google's chatbot Bard is powered by Gemini Pro and the Nano version is included within the Pixel 8 Pro phone, improving capabilities like Summarize and Smart Reply.

OpenAI's GPT-4 with vision, which was previously provided exclusively to a small number of users, has now been made broadly available. While it shows promise, there are still limitations and challenges. For example, it sometimes struggles with recognizing structural connections in visuals and can make mistakes while doing tasks such as copying mathematical formulae or counting things in images.

Apple's Ferret: A New Contender

This takes us to Apple's most recent achievement, Ferret. It shines in areas where GPT-4 falls short: In benchmark testing, Ferret outperformed GPT-4, particularly when it came to effectively detecting and summarizing small details in pictures.

Ferret's launch signals an important milestone in Apple's road toward complex AI applications, with the potential to change sectors such as computer vision, particularly in AR/VR experiences.

It will be intriguing to see how consumers adjust to these new multimodal AI systems in the future. The gains in accuracy and usefulness that these systems attain in the future will be equally fascinating. As we enter this new era of artificial intelligence, the possibilities are as boundless as they are thrilling.

Insights From Management

What Pulls Gamers Back in?

Written by XR & Gaming Analyst JP Minetos; Edited by Felix Hartmann

The Gravitational Forces of Re-playability: Unveiling the Three Pillars of Player Retention

1. High Skill Ceiling: Mastering the Art of Precision

Games like Counter-Strike 2 and Rocket League have earned their status as timeless classics by offering players a compelling blend of intricate mechanics and challenging learning curves. These titles go beyond mere reflexes, emphasizing the importance of mastering precision and strategy. Counter-Strike's tactical gunplay and Rocket League's acrobatic car movement foster an environment where continuous skill development is not just encouraged but essential. Players find motivation to refine their abilities, eager to showcase their prowess and feel dopamine from successfully performing their skill.

2. Endless Content: The Minecraft and Roblox Renaissance

The surge in user-generated content (UGC) has revitalized the realm of multiplayer gaming, as exemplified by the expansive realms of Minecraft and the creative hub of Roblox. Within Minecraft, players craft their adventures within procedurally generated landscapes, while Roblox provides a platform for players to construct and share their unique games. The limitless potential of UGC guarantees that every gaming session unfolds as a distinctive experience, cultivating a communal atmosphere where players collaboratively explore, create, and share content. This emphasis on player-driven content creation has transformed these games into dynamic universes that continually captivate players with the promise of fresh discoveries. Modded content has helped to drive life into titles that would have otherwise fallen short of their potential, whether in play-time, complexity, or fidelity.

3. In-game Rewards for ‘Grinding’: The Gratifying Journey of Progression

The path of progression has long been a captivating facet of gaming, and contemporary multiplayer games have mastered the craft of acknowledging players for their commitment and diligence, emerging as a predominant means to entice repeated engagement. Whether it involves unlocking new characters, obtaining rare items, climbing the ‘skill-tree’, or reaching in-game milestones, the allure of grinding for rewards has evolved into a potent motivator. Games spanning genres, from RPGs to online shooters, have introduced elaborate reward systems that not only elevate the gaming experience but also cultivate a profound sense of achievement and community connection. In this landscape, even venerable titles like World of Warcraft still draw in a regular userbase 20 years post launch exemplifying the art of progression, by showing the importance of incentives for sustained player participation.

As the gaming industry continues to evolve, the three pillars of player retention have proven to be the driving forces behind the resurgence of multiplayer games. Whether players are seeking the thrill of mastering complex mechanics, exploring limitless virtual worlds, or relishing the gratifying journey of progression, these elements create a dynamic and engaging multiplayer experience. As developers continue to innovate and push the boundaries of what multiplayer games can offer, it's clear that the allure of these three pillars will keep players returning for years to come.

The Unstoppable Rise of ETFs in US Financial Markets

Written by Crypto & Macro Analyst Jonas Luckhardt; Edited by Felix Hartmann

A significant shift is underway in the U.S. investing landscape: the growing dominance of passive investment strategies. About 42.9% of assets, totaling approximately $10 trillion, are managed passively, a notable increase from 31.6% at the end of 2015.

This trend, reflecting a broader shift in investor preferences, also influences the burgeoning interest in digital asset ETFs, particularly those for Bitcoin and Ethereum. As traditional and digital asset markets increasingly intersect, the rise of passive investment strategies is paving the way for innovative investment products like digital asset ETFs, offering new opportunities for investors to diversify their portfolios.

Survey Results: Bitcoin ETF Investment Readiness

The latest survey by Bitwise and VettaFi shows 98% of advisors invested in crypto plan to maintain or increase their investments in this area. Among advisors without crypto engagement, 8% definitely or probably plan to add crypto investments for their clients in 2024, while 21% are considering it. 50% of respondents see more explicit regulation as a critical factor in reducing their concerns, and 14% view the introduction of a Spot Bitcoin ETF as a reassuring signal.

Bitcoin ETF Market: Existing Future ETFs and Comparison with Spot ETFs

The market for Bitcoin ETFs already includes 11 existing Bitcoin Future ETFs with a total Assets Under Management (AUM) of nearly $1 billion. These ETFs offer an indirect investment opportunity in Bitcoin by betting on the future prices of the cryptocurrency. Compared to Spot ETFs, however, Future ETFs have some disadvantages, such as higher costs due to the regular renewal of futures contracts and a less accurate price representation. Bitcoin Future ETFs can play a role in integrating into diversified investment portfolios, albeit with limitations. For long-term investment strategies, as typical in 401(k) plans, Spot Bitcoin ETFs, present a better option, as they offer a more direct and potentially more cost-effective exposure to Bitcoin. The approval of Spot ETFs could, therefore, have a significant impact on the market and the way investors invest in Bitcoin.

Potential Impacts on Bitcoin Price Development and Integration into Existing Financial Products

Analysts, including Charles Yu from Galaxy Digital, predict that the approval of Bitcoin ETFs could significantly increase Bitcoin's price. Yu estimates that Bitcoin ETFs could see inflows of $14.4 billion in their first year of trading, increasing the asset's price by 74%. This forecast assumes that exposure to a Bitcoin ETF will be adopted by 10% of an initial addressable market, which is sized at roughly $14 trillion in assets, with an average allocation of 1%. In addition to the potential integration of Bitcoin into 401(k) plans, including Bitcoin in Commodity ETFs and Currency ETFs could also be of interest. Integrating Bitcoin into such ETFs could lead to significant capital inflows and further advance the acceptance of Digital Assets as a legitimate asset class. By integrating into existing financial products, Bitcoin could reach a broader investor base and further solidify its position in the financial market.

Transition from Bitcoin to Ethereum ETFs: Acknowledging Different Consensus Mechanisms

To take a closer look at a potential ETH Spot ETF, we must acknowledge the different consensus mechanisms of Bitcoin and Ethereum and their role in launching a Spot ETF.

Consensus Mechanisms in Bitcoin and Ethereum: Impact on Spot ETFs

While prominent cryptocurrencies operate on fundamentally different consensus mechanisms, Bitcoin and Ethereum have distinct implications for their respective Spot ETFs.

Bitcoin utilizes a Proof of Work (PoW) consensus mechanism, where miners use computational power to validate transactions and mine new blocks. This process, while energy-intensive, has been pivotal in maintaining Bitcoin's network security. However, the PoW mechanism doesn't directly impact the structure of Bitcoin Spot ETFs, which are primarily focused on tracking the market price of Bitcoin.

Ethereum operates on a Proof of Stake (PoS) mechanism, where validators stake ETH for transaction validation and block creation. This energy-efficient process is central to Ethereum's operation and pivotal for Ethereum Spot ETFs, offering staking rewards as a critical investment incentive.

Ethereum Staking and its Challenges: The Withdrawal Queue

The withdrawal queue is a significant challenge in Ethereum staking, particularly relevant for ETFs. In Ethereum's Proof of Stake (PoS) system, validators stake ETH to participate in network consensus. However, they enter a withdrawal queue when they wish to withdraw their staked ETH. This queue can delay accessing staked funds, as withdrawals are processed sequentially and depend on network conditions. For an Ethereum ETF, this presents a liquidity risk. The fund's ability to promptly meet redemption requests from investors could be compromised if a substantial portion of its assets are locked in staking with uncertain withdrawal timelines. This aspect of staking necessitates careful planning and risk assessment for ETF managers, ensuring that the fund maintains sufficient liquidity while benefiting from staking rewards.

Liquid Staking: Opportunities and Risks

Liquid staking offers a solution to the liquidity challenge posed by the withdrawal queue. In liquid staking, users stake their Ethereum and receive a liquid staking token in return. This token represents their staked ETH and can be traded or used in DeFi protocols, providing immediate liquidity not available in traditional staking. However, liquid staking tokens come with their own set of risks and challenges. The value of these tokens depends on the underlying staking operations and the overall health of the staking pool. Additionally, choosing a liquid staking provider is crucial, as different providers have varying levels of security, reliability, and governance structures. ETF managers must carefully evaluate these factors to ensure that the chosen liquid staking solution aligns with the fund's risk profile and liquidity requirements.

To maximize returns for shareholders, an Ethereum ETF should engage in staking, despite a its complexities. Liquid staking tokens seem necessary, as direct staking via validators may not be feasible due to the withdrawal queue.

Final Thought - Governance Risks for Proof of Stake ETFs

Another concern for the Ethereum network is the potential centralization risk. If Spot ETFs with liquid staking tokens choose a particular provider, that provider could control a significant portion of the staked ETH, endangering Ethereum's decentralization. For instance, Lido currently holds a market share of 31.6% and faces criticism from the Ethereum community.

Launching an Ethereum Spot ETF faces more challenges than a Bitcoin Spot ETF. The success of Ethereum ETFs hinges on balancing the complexity of providing investors full economic participation in their investment (staking), while at the same time ensuring that providers (i.e. BlackRock) don’t end up commanding 10-50% of the networks governance power.

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.