Layer-1 Incentive Wars as NFTs go Mainstream

Hartmann Capital Newsletter, Friday September 3, 2021

In this issue

Ethereum killers battle it out with incentives, Arbitrum One launches

Retail discovers NFTs as Sotheby’s hosts Bored Ape auction. Is Play-to-earn the future of NFTs?

This week’s blog: “Optimizing DeFi Privacy - The Birth Of ‘PriFi’”

In the Media - Felix Hartmann on Real Vision

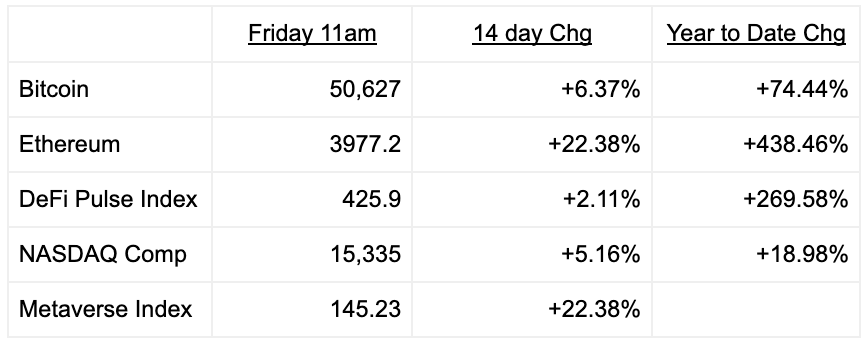

Market by numbers

ETH and metaverse assets had a good fortnight, up more than 22% in both cases. DeFi languished, however, underperforming the US stock market. Ethereum’s EIP-1559 upgrade is burning more native tokens than expected, while the largest non-fungible token markets are all ETH denominated.

Ethereum killers battle it out with incentives, Arbitrum One launches

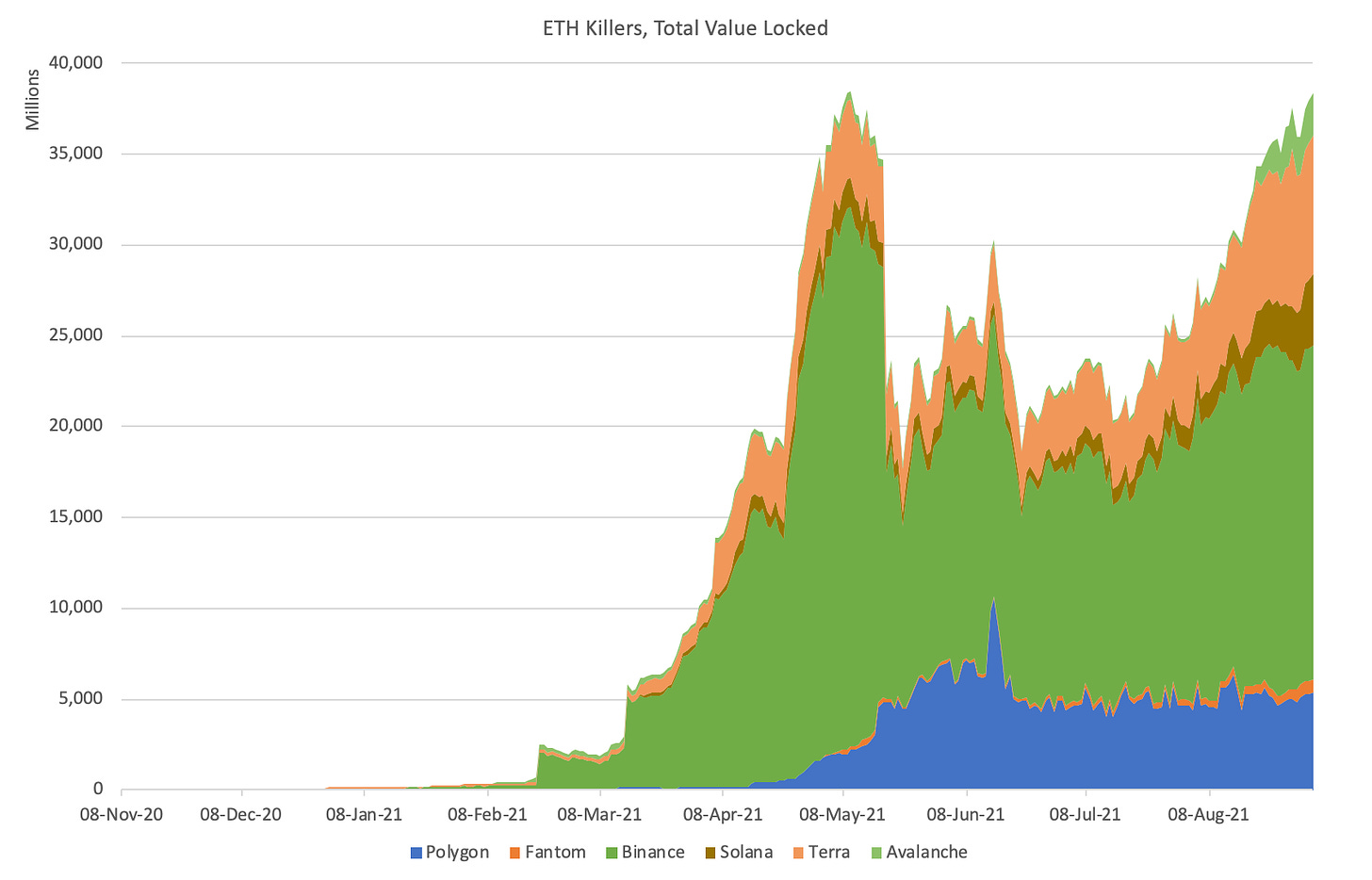

We’re still waiting for layer 2 summer, with Ethereum scaling solutions Arbitrum One finally launching this week and Optimistic Ethereum slow out of the gates. In the meantime, however, the battle for dominance among the layer 1 blockchains has been heating up. Binance Smart Chain (BSC), Terra and Polygon were the first movers in non-Ethereum DeFi, stealing market share from Ethereum earlier in the year (Polygon) and in late 2020 (BSC, Terra).

BSC, a simple fork of Ethereum, served as cheaper and less decentralized and secure blockchain. Sponsored by the largest crypto exchange by volume, it’s recently faded in importance due to several high profile exploits as well as the rise of new competition. Polygon took full advantage of the lack of layer 2s, attracting the major DeFi DApps Aave, Curve and Sushiswap and users with significant native token incentives. Yet both BSC and Polygon’s growth has stalled recently.

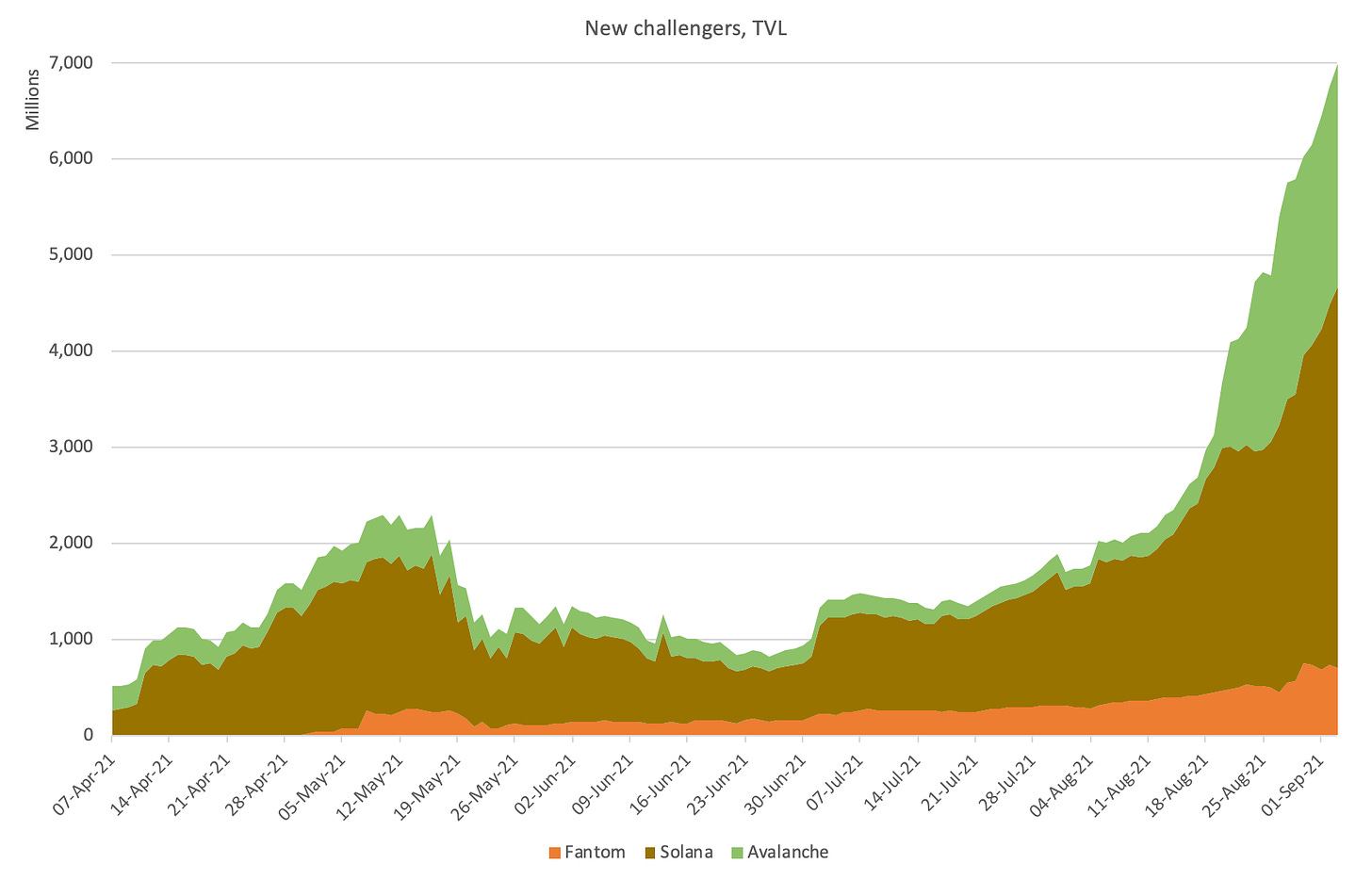

August serves as a reminder that there are other potential challengers, including Solana, Avalanche and Fantom. Avalanche is taking a page out of Polygon’s book, offering what was originally a $180 million liquidity mining program now worth almost three times that much with the rise in the native AVAX token.

As with Polygon, Avalanche users will soon find the well-known DeFi primitives, such as Aave for lending/borrowing and Curve DEX. The incentives have worked, with 2.4 billion TVL bridging in less than a month.

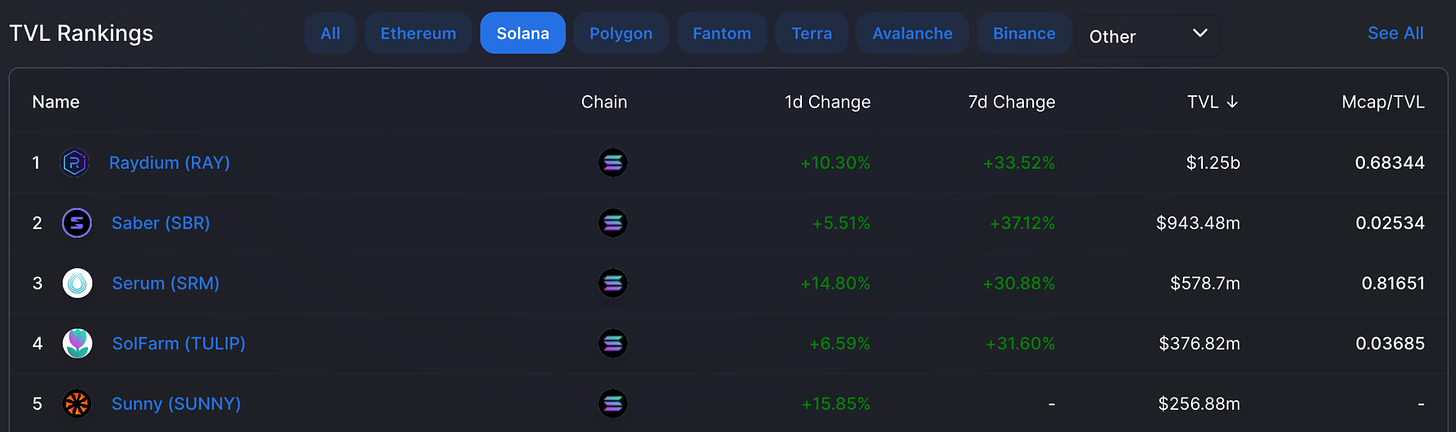

Solana is backed by Binance’s competitor exchange, FTX, and the irrepressible Sam Bankman-Fried. Solana is less decentralized than many other layer 1, but the tradeoff is extremely fast yet inexpensive transactions. Solana’s TVL has matched the growth at Avalanche, mainly due to an unparalleled order-book DEX UX as well as NFT mania. Raydium and Serum DEXs grew by a third over the month.

Will Fantom be next? The blockchain already hosts Sushiswap, Curve and CREAM Finance. On the back of Curve volumes, Fantom almost doubled its TVL this week. Fantom announced this week that it would distribute $330 million worth of its native FTM tokento DeFi DApps.

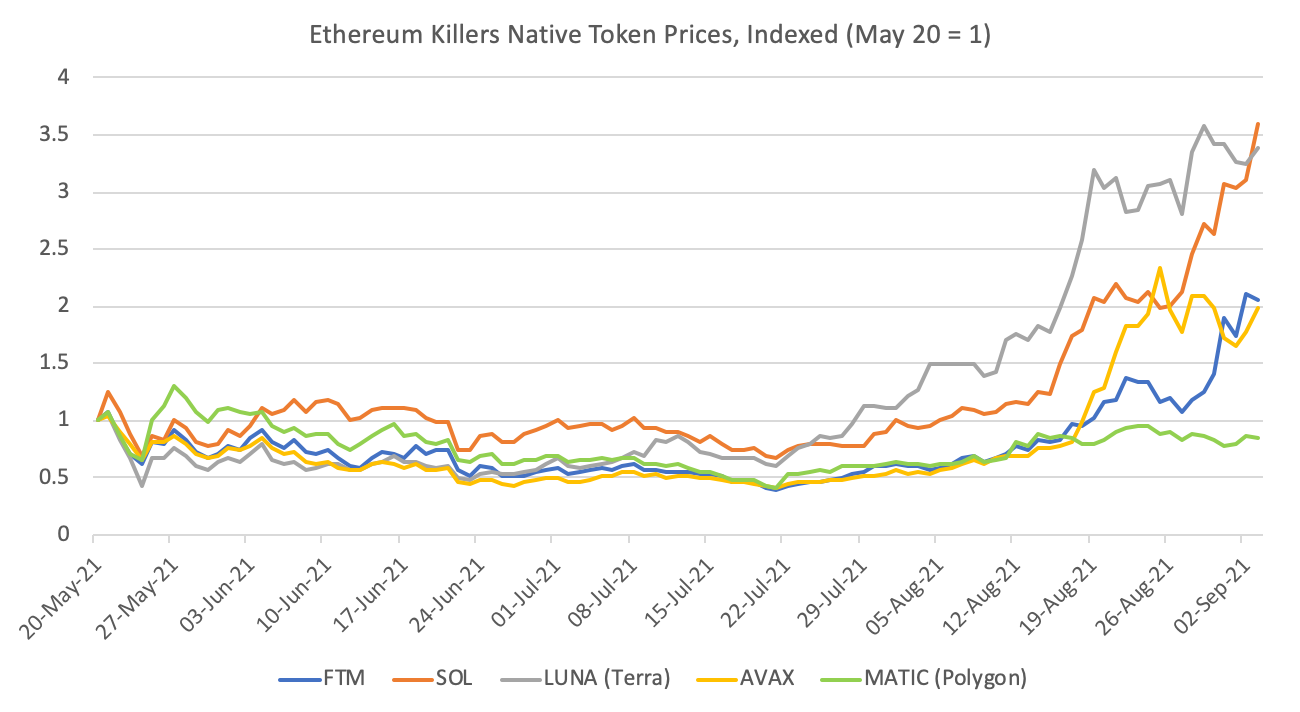

Ethereum killer tokens have performed well as TVL growth accelerates. Terra’s LUNA and Solana’s SOL have 3.5x’d since the May correction, and FTM and AVAX have doubled. Over the same time frame, DeFi is unchanged, as measured by the DPI Index, and ETH is up 50%.

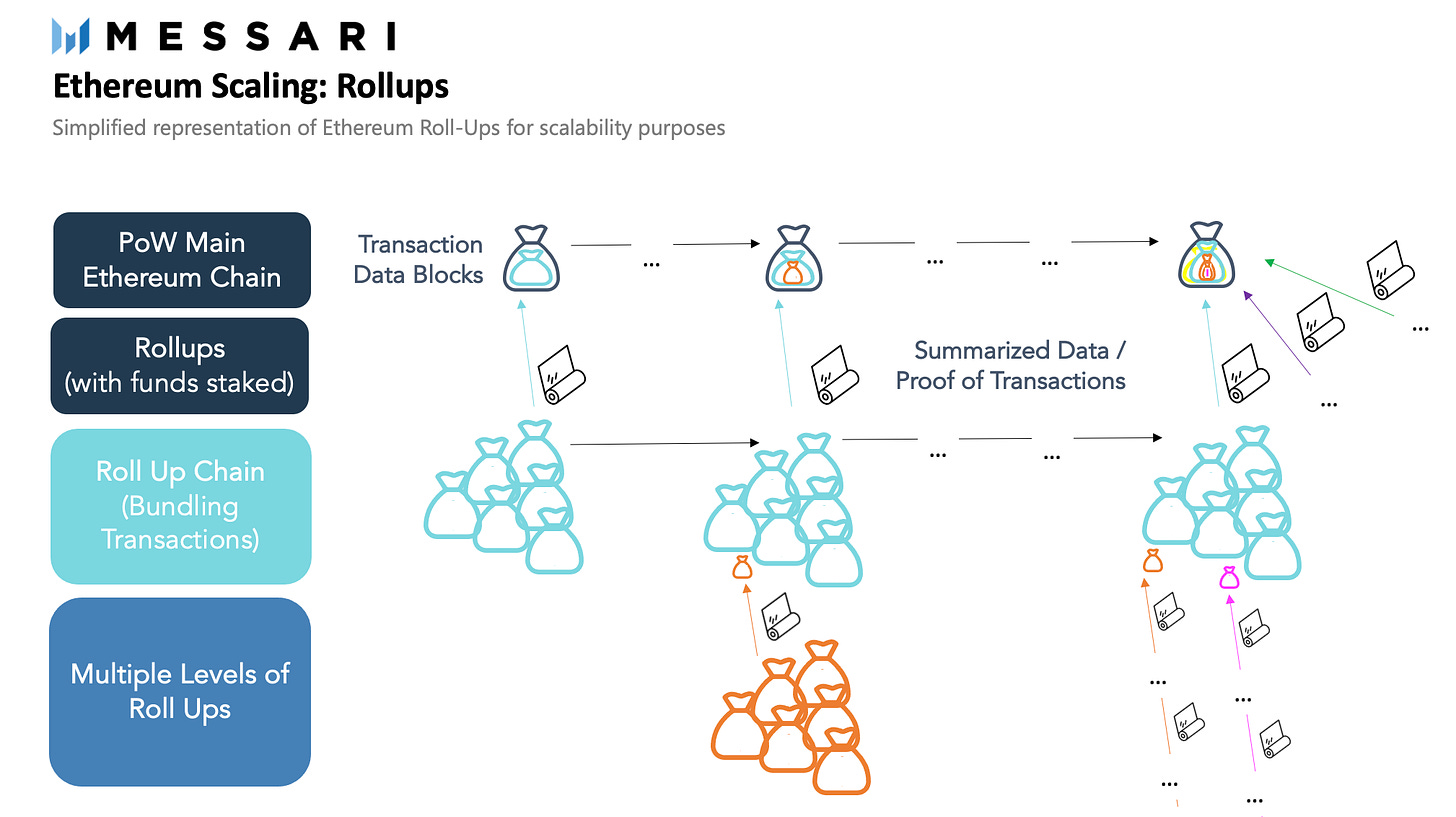

Layer 2 Ethereum scaling solution Arbitrum One finally launched this week. With lower cost transactions that share Ethereum’s security, layer 2s using optimistic rollups are expected to capture a high percentage of low value transactions.

Arbitrum launched with a full suite of DApps, including dominant DEX Uniswap, challenger Sushiswap, Perpetual Protocol, original crypto lender MakerDAO, stablecoin swapper Curve,and farming protocol CREAM Finance.

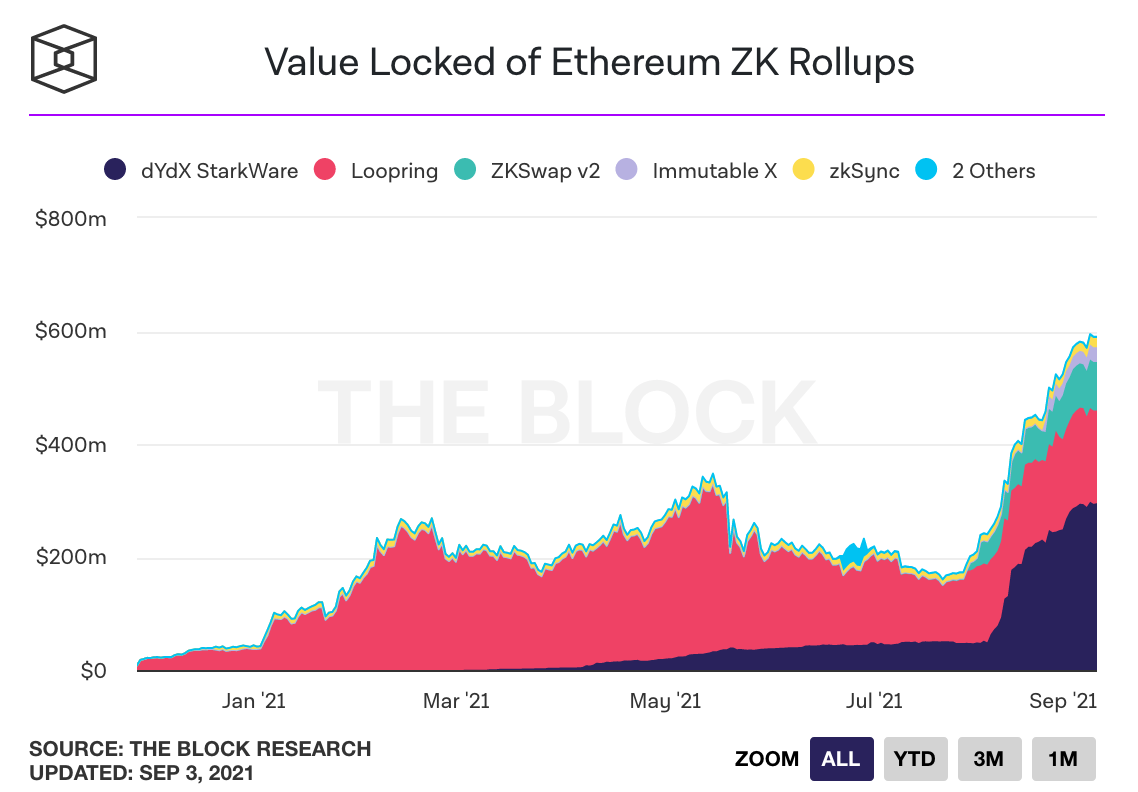

Another set of scaling solutions are also beginning to find traction with users. ZK rollups have grown to over $ 600 million in TVL, which is actually a poor measure of success as many of these DApp-specific rollups such as order book exchanges and games are volume driven.

It’s much too early to tell how much value will leave Ethereum killers for the security of Ethereum layer 2. It’s highly likely, however, that inertia, UX and network effects will work in favor of at least some of the challengers. We at Hartmann Capital are huge fans of the Terra ecosystem and LUNA tokenomics.

The bottom line is that Ethereum is no longer the only game in town for DeFi. Layer 2s offer alternatives that remain in the Ethereum ecosystem, but other layer 1s will not be going away soon: It’s a multi-chain world.

Retail discovers NFTs as Sotheby’s hosts Bored Ape auction. Is Play-to-earn the future of NFTs?

A newsletter is not complete these days without a report on NFTs. This week, Bloomberg reported that retail speculators previously obsessed with meme stocks have thrown their money into the NFT market. It’s not news to crypto natives that profile picture (PFP) NFTs and generative art are in the throes of a bubble-like speculative fever. The Metaverse index is up more than 100% in a month, while millions are being made by early adopters. Even twelve year olds are getting rich off of minting.

Sotheby’s is auctioning off 101 Bored Apes, one of the most popular PFPs, with bids as high as $4.5 million. One Ape has already sold for $ 2.4 million worth of ETH (600).

Crypto funds are getting involved, with 3 Arrows Capital partnering with pseudonymous NFT expert Vincent van Dough to launch a new fund, Starry Night, to invest in the highest value NFTs.

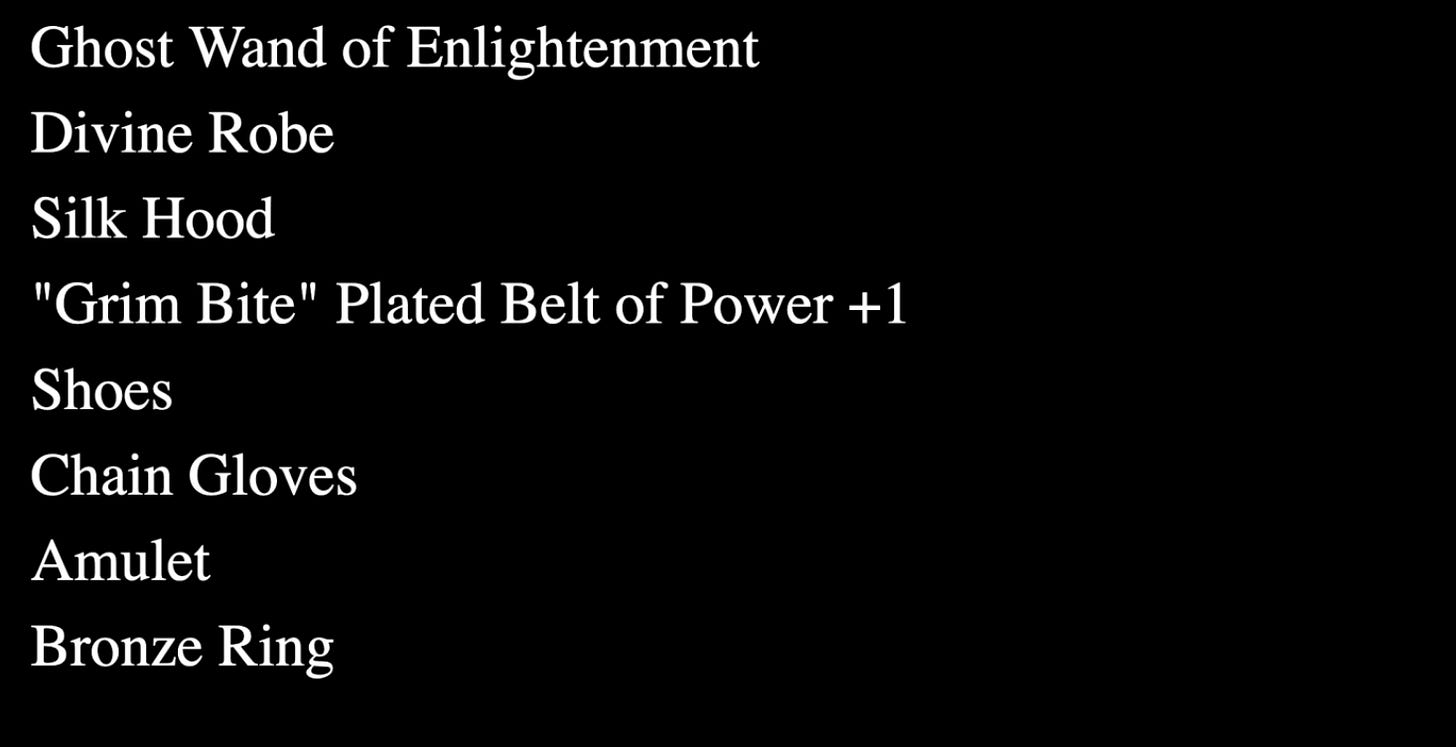

The latest craze involves NFTs of black and white words.

The Defiant put it best:

Now Loot is the hottest project in the NFT space. It’s already at the fifth slot on OpenSea in terms of trading volume with over $100M in the past 24 hours. The floor price, meaning the lowest someone is willing to sell a Loot bag at for, is 12.2 ETH, worth over $45K as of mid-evening New York time.

And one LOOT bag sold for 250 ETH, almost $1M on Sept. 2.

Are we in a bubble? It’s more than possible. However there is no doubt that the genie cannot be put back in the bottle. The metaverse is coming. Simple art will morph into virtual reality, and much of this is expected to live on chain. We at Hartmann Capital are especially keen on play-to-earn (P2E) projects such as Axie Infinity, made possible through the permissionless ownership of in-game assets and rewards.

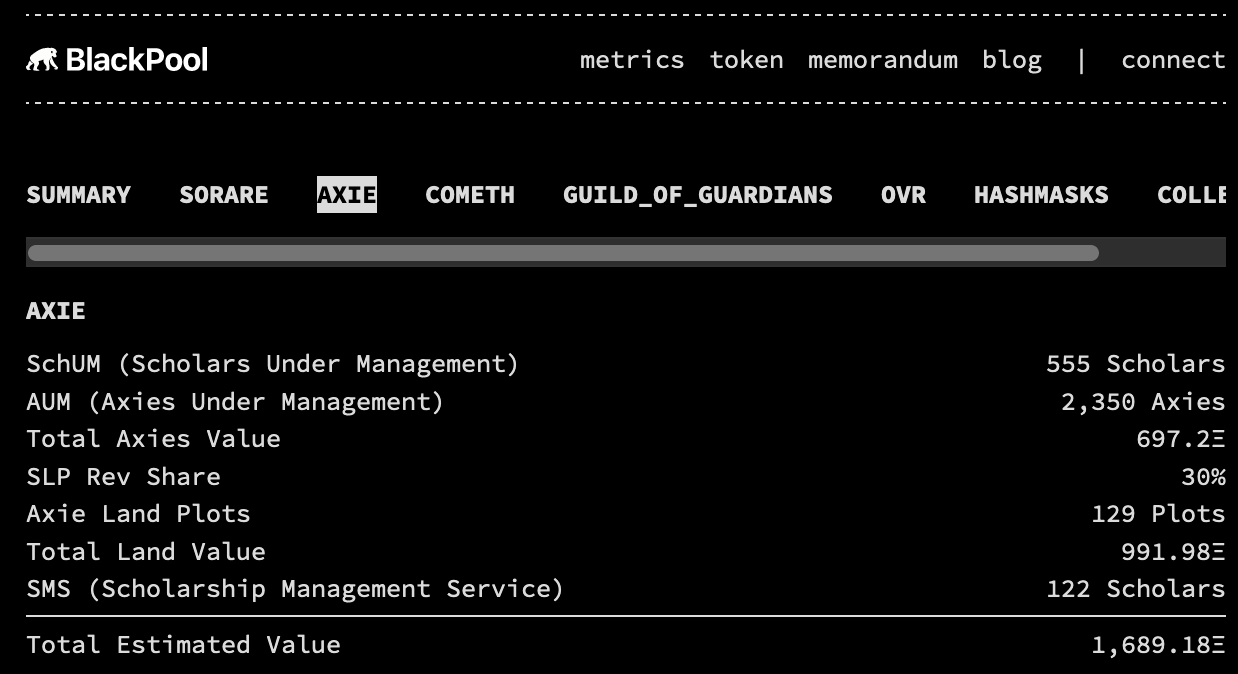

We foresee a future of play-to-earn teams emulating Yield Games Guild and Blackpool, adding value to crypto assets and collectibles through their in-game use by experts.

While the high-value assets in DeFi and the metaverse may continue to live on Ethereum and one or two other layer 1s, gaming and collecting will likely continue to migrate to DApp-specific chains such as Axie’s Ronin, layer 2s such as Immutable X (Gods Unchained) and layer 1s such as Polygon (Aavegotchi) and Flow (NBA Topshot).

Other winners, regardless of how the current price action plays out, will be providers of secure immutable storage for the digital art, objects and information used in games and social media. Arweave, for example, is where many of the top NFTs, including Hashmasks, will live, permanently.

Blog this week: “Optimizing DeFi Privacy - The Birth Of ‘PriFi’”

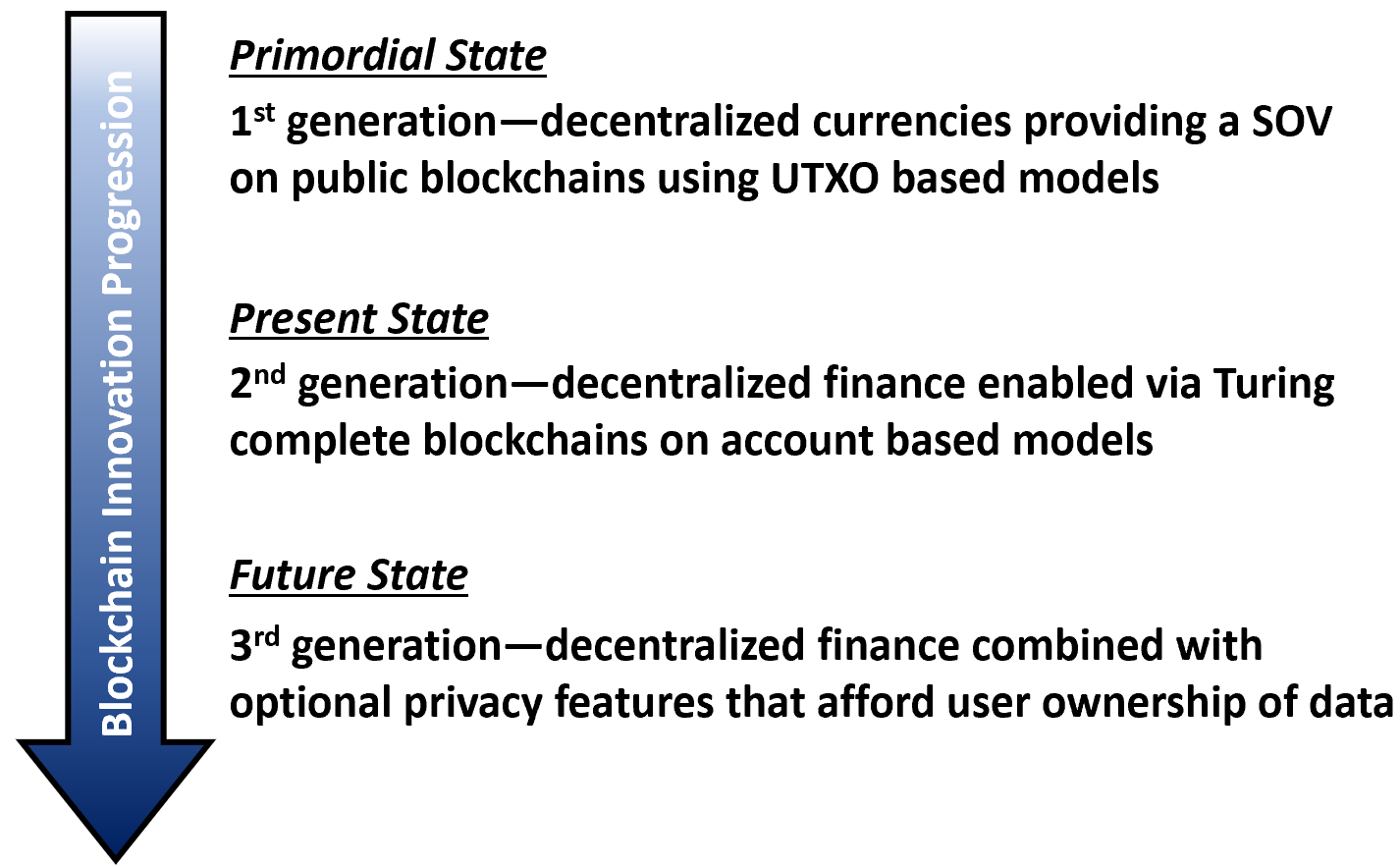

DeFi, non-fungible token and metaverse users have for the most part deprioritized privacy, as the unprecedented opportunities have dominated other concerns. At the same time, it is difficult to provide true privacy while retaining the composability required to participate in complex on-chain transactions. As a result, protocols offering anonymous transactions are only now beginning to evolve beyond the simplest privacy coins. This week we take a deep dive into privacy solutions and highlight some of our favorite secrecy protocols and chains.

In the Media - Felix Hartmann on Real Vision

Fund managers Felix Hartmann, managing partner of Hartmann Capital, and Ari Paul, co-founder and CIO of BlockTower Capital, come together to discuss how knowledge gaps can be leveraged to gain a competitive edge. They discuss the importance of participating in governance of proof-of-stake tokens, a task that is foregone by many investors and especially important for fund managers who potentially control a large portion of voting rights. Hartmann and Paul also jump into the conceptual realm of what the world could look like as a multi-chain, decentralized world and discuss how crypto is a global phenomenon yet very different from the traditional sense of the word "globalism". Filmed on August 27, 2021.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.