Hedge Funds outperform BTC in 2021

Hartmann Capital Newsletter, Friday December 17, 2021

In this issue

Market by Numbers - ETH in a volatile spot. Hedge funds beat Bitcoin

Defi 1.0 not dead (yet?)

Big data raises at big money

Market by Numbers

The charts suggest that ETH is in a precarious position right now, breaking through a major weekly support zone after fighting hard to hold it for the last month. It is clear that buyers are stepping in at the $3,600 zone as the lower wicks on the daily candles all stop around that level.

If the $3,600 support does not hold, it could get ugly short term and continue its bearish chop until the new year. In the short term, for ETH to regain bullish momentum it would need to reclaim the weekly support/resistance and maintain its trendline. Longer term, ETH would remain in a bullish structure even if it were to retest the $3,000 zone, but such a move would cause panic in the markets.

ETH has been driving markets for some time, and without its leadership the crypto markets could be a dangerous place until year end. Layer 1s such as LUNA and AVAX have picked up the torch for a bit, but it seems they are stealing liquidity from others rather than leading the market anywhere.

The Eurekahedge Crypto-Currency Hedge Fund index of 18 equally-weighted offerings is up 170% for the 12 months ended November 30. With Bitcoin up around 80% over the same period

DeFi 1.0 not dead (yet?)

It’s now old news that the early pioneers in DeFi have not performed well in 2021. While the DPI is up 100% in dollar terms YTD, it is down 75% in ETH terms and continues to lag coming into year end.

But the index hides select outperformance by several of the early token as well as a few new entrants, all backed by attractive tokenomics and sound business models. CRV is the native token of a dominant stablecoin decentralized exchange (DEX) that also has economic value. Trading fees accrue to staked CRV, while the token can also be used to vote on which pools get the incentive rewards and boost those rewards substantially.

Strong demand for CRV’s voting and boosts have resulted in token outperformance, with CRV up 6x YTD is USD terms, and has kept pace with ETH.

But the protocols that leverage CRV rewards and voting have also done well. Yearn was the first to offer its depositors boosted Curve yield farming rewards. This innovation helped Yearn grow its total value locked by 10x over the past year.

However, the staked CRV needed to to vote and boost is locked in extremely capital-efficient vaults, yvBOOST and veCRV-DAO. As a result, both staked tokens trade at a huge discount to NAV and have attracted zero new interest in the past six months or more. With poor tokenomics, however, YFI has struggled this year. A recent buyback announcement has produced a rally, yet it’s only a small blip in the longer term downward trajectory.

Where Yearn has failed, however, Convex has succeeded. By improving on Yearn’s attempt at using CRV to allocate and boost rewards for farmers, Convex has become the largest yield aggregator by a wide margin.

That puts Convex in the top 3 protocols in DeFi, proving that protocols can still survive, and even thrive, on Ethereum alone.

One of the problems with many DeFi 1.0 governance tokens is that they are quickly dumped when farmed, putting pressure on prices. In down markets, this reflexivity feeds back on itself. The more the price falls, the more farmers are motivated to sell.

But another significant problem is that many tokens do not have any right to the revenue of the underlying protocol. Uniswap’s UNI token, for example, in theory has the right to trading fees, but this feature has not been turned on by the community. There are several token models where fees do accrue to tokens that are staked in the protocol. xSUSHI/SUSHI is one such model, as is CRV/veCRV. MakerDAO’s MKR token also accrued in a way. The DAO under certain circumstances uses stability fees from borrowers to buyback and burn the native token.

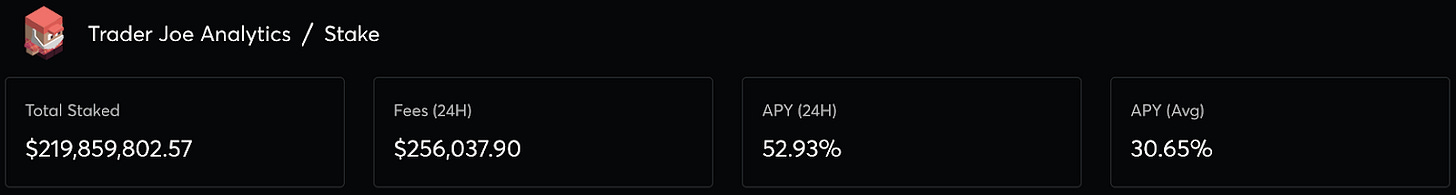

Trader Joe (on Avalanche) and Sushiswap (multichain) are both big earners, each accruing an average of over $1 million per day over the past 7 days. Much of those fees go to xJOE and xSUSHI stakers. JOE has had an APY of around 50% recently (ranging between 120% and 20%), paid in JOE tokens.

Such income is highly-prized, with 62% of JOE staked as xJOE.

SUSHI has similar economics, which needs some explaining. Token Terminal, the market’s source for comparative data on revenue and earnings, has SUSHI’s P/E (price-earnings) ratio as just under 18x.

However this does not take into account that only 56.5 million of the final capped token amount of 238 million are staked. Adjusting for this, xSUSHI’s P/E is closer to 5x.

Yet market technicals and chaos within the Sushiswap ranks continue to weigh on the protocol, as we mentioned last week. User numbers and revenues have not been hit much by the uncertainty at the protocol. Only time will tell if the narrative can be changed from viewing Sushiswap as a decentralized organizational catastrophe and a second-tier (to Uniswap) DEX to seeing the business as stable, profitable and innovating.

If you believe Daniele (MIM) and Do Kwon (UST), MakerDAO is a dinosaur DeFi 1.0 that has lost its ability to innovate, and is destined to be fully centralized due to its reliance on permissioned USDC as its collateral. It, indeed, has underperformed ETH, but actually not by much, and is up 4x in dollar terms YTD.

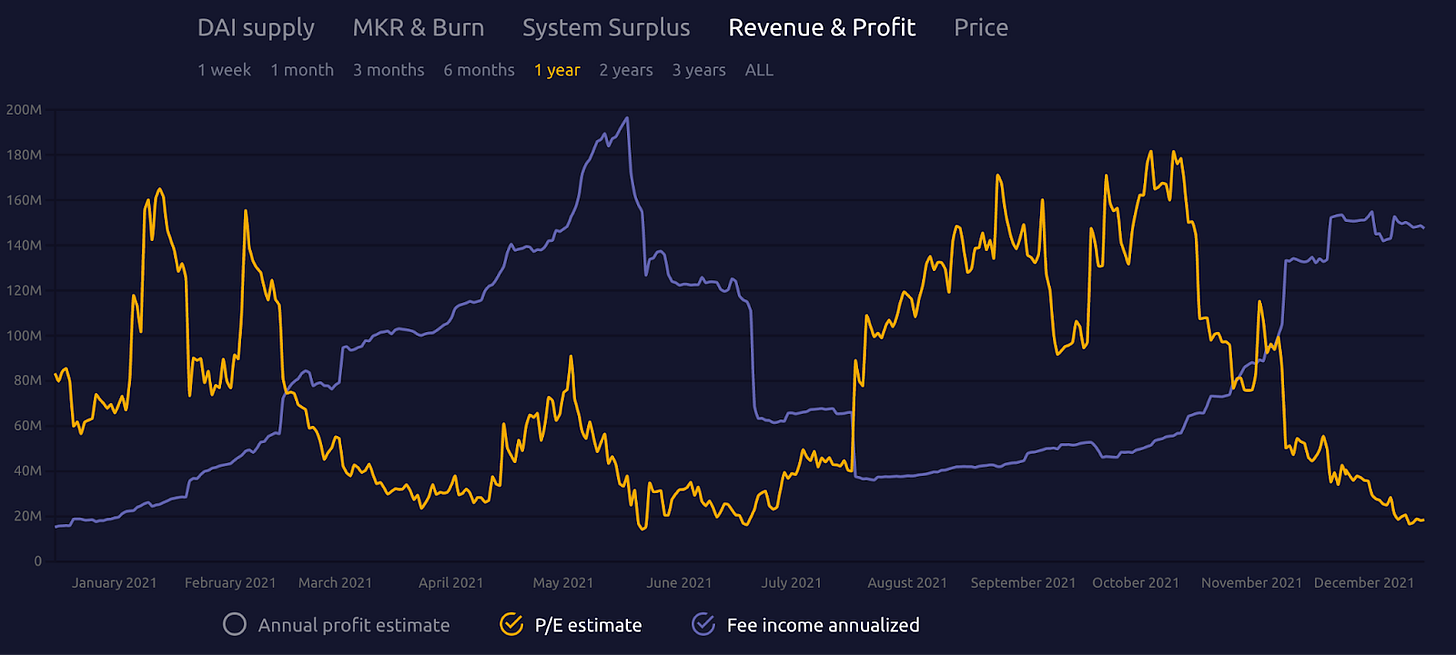

But it’s too early to mourn crypto’s most successful decentralized stablecoin. In fact, MAkerDAO’s DAI stablecoin is actually becoming less reliant on USDC while earning more fees. Token Terminal has MakerDAO’s P/E at around 16x.

Currently DAI is backed by $5 billion worth of tokens such as ETH and LINK, and by $4 billion in stablecoins such as USDC.

At the same time, revenue is back to $155 million annualized.

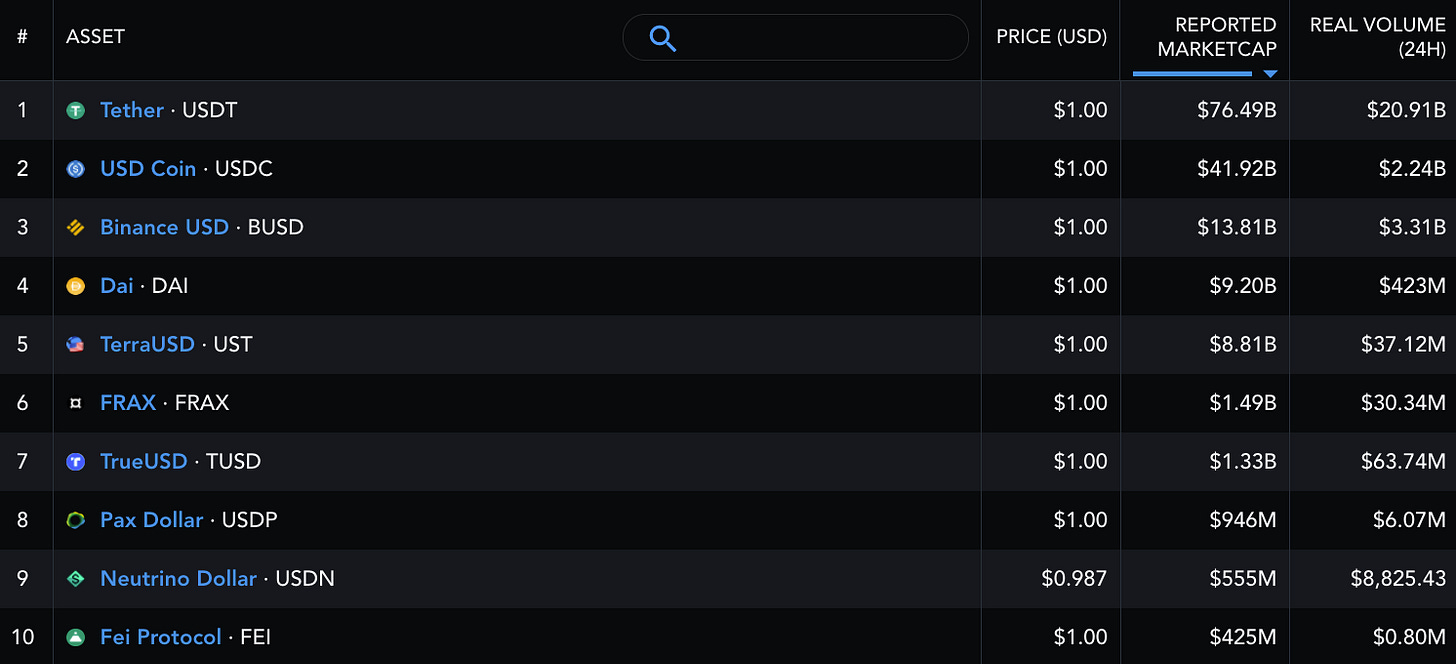

While DAI is losing ground to other stables in terms of market cap, DAI is still used many times more than the upstarts. DAI is traded 13x as frequently as UST, and has 500x as much volume as FEI. MIM is not listed below, but is about half the market cap of DAI.

Our conclusion is that certain aspects of many of the original DeFi governance tokens have combined with mercenary sales of VC rounds and farming rewards to create the perfect storm: Down only for many such tokens, in ETH terms and often also in USD. However, lasting tokenomic and economic models will survive. Not all of the so-called DeFi 1.0 tokens are dead. Business models are very much alive, and good tokenomics will always be in style.

Big data raises at big money

With almost all of the extremely large amount of blockchain completely transparent and visible, crypto data analytics companies have scaled rapidly to provide users like Hartmann Capital such important statistics as trading volumes, protocol usage and fund flows. Two of these companies raised at unicorn valuations this week, including Dune Analytics and Nansen.ai. We expect the data analytics sector to continue to heat up, as more businesses expand beyond Ethereum. Dune told The Block that it was planning to cover all EVM-compatible chains, while NFTs require more detailed analytical tools than traditional fungible tokens.

Hartmann Capital Weekly written by Head of Research, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.