Going Crypto: Dolce & Gabbana, Société Générale, and Visa

Hartmann Capital Newsletter, Monday October 4th, 2021

In this issue

High fashion house Dolce & Gabbana cashes in on crypto

More traditional firms go crypto 1: Société Générale

More traditional firms go crypto 2: VISA

US crypto ETFs imminent?

This week’s blog: Views from Messari Mainnet, Part I: The rise of multi-chain ecosystems

Market by Numbers

All crypto markets were higher this week, with most of the gains coming overnight on Friday. Axie Infinity news drove the Metaverse higher, offsetting the losses from the previous two weeks but not yet back to early September highs. BTC bounced back from last week’s correction, but ETH and DPI did not rally as hard.

High fashion house Dolce & Gabbana cashes in on crypto

So we have decentralized finance on the cover of the mainstream media: Fortune and the Economist. Creatives from rapper Snoop Dogg to top artist Damian Hirst are entering the metaverse with NFTs, games and concerts.

Street clothes and sneakers are also primed for mass digitization, and will likely find homes in virtual worlds such as Decentraland and the Sandbox.

What has been missing to date, however, was adoption by high end designer fashion houses. That changed this week with Dolce and Gabbana’s NFT sale. As British Vogue reported:

Would anyone – even someone from the rarefied world of couture – spend six figures on something so intangible? Evidently the answer was yes.

In fact it was seven figures. The “Glass Suit” was auctioned as both an NFT and a physical garment on NFT platform unxd.com for $1.15 million, while a completely virtual tiara sold for $ 300,000. The suit was purchased by crypto commerce protocol, Boson, who plan to use the NFT as the cornerstone of a digital-physical collection in their Boson Portal, launching in Decentraland in November.

Taking advantage of the flexibility offered by NFTs, the auctioned items come with experiential bonuses, though these have yet to be announced.

It does remain to be seen if other top fashion houses follow suit. With the earnings as well as PR potential proven by this first entry by D&G, it appears to be only a matter of time before a cryptopunk will be wearing Chanel in Decentraland.

More traditional firms go crypto 1 : Société Générale

Wider adoption from fashion houses might make headlines, at least in crypto circles, yet the big gains will come from the mainstreaming DeFi.

Some may remember that the French investment bank Societe Generale (SocGen) issued an ERC-20 token referencing an otherwise traditional covered bond underwritten by its investment banking subsidiary in 2019. In 2020, the European Investment Bank followed up with a tokenized bond underwritten by SocGen, Santander and Goldman Sachs. While the early tokenization of a very small fraction of the overall Eurobond markets was news, there was little follow up in the crypto markets. Until now.

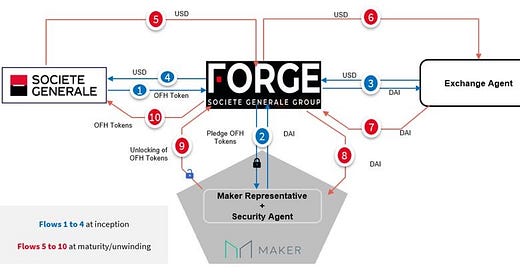

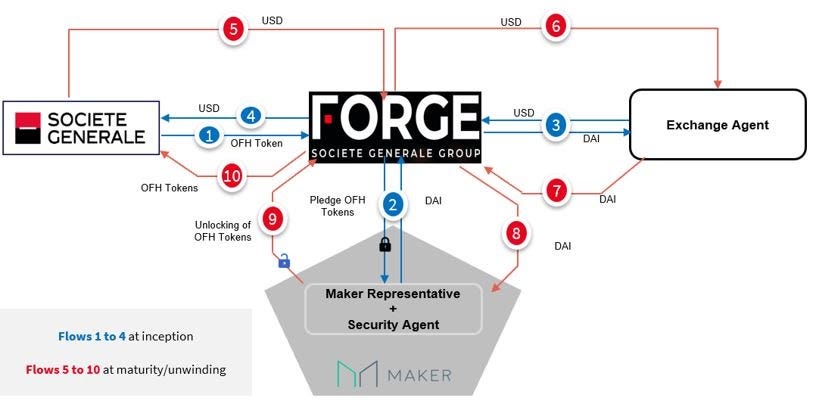

The big news is that SocGen has approached MakerDAO, the fully-decentralized and crypto OG issuer of the DAI stablecoin, to refinance the covered bond directly. MakerDAO has already invested in two real world assets (RWA in their lingo), acting as a true TradFi bank by issuing DAI in exchange for the positions held as collateral.

Under the MIP (Maker Improvement Proposal), SocGen would borrow DAI from MakerDAO in return for a pledge of the issued OFH tokens. The pledge but not the tokens, themselves, would be held by a Maker vault.

Like much of AAA-rated TradFi, the yield on the tokens is negligible, so it’s hardly in Maker’s interest to get involved. The rate on the bonds is actually ZERO. The trade size is also miniscule: Only 20 million DAI is contemplated in the MIP.

Like many RWAs, the execution risk and costs are very high. Unlike the previous investments, the bonds are extremely low risk. The same can not be said of Maker’s first foray, into subprime mortgages.

On the other hand, it would mark the beginning of a partnership between mainstream TradFi and DeFi in a landmark trade.

More traditional firms go crypto 2: VISA

This week VISA also showcased its commitment to crypto payments. VISA had previously partnered with Coinbase, Circle and BlockFi to enable the settlement of liabilities with dollar pegged stablecoin USDC, and last month bought an NFT for a collection.

This week the payments giant announced that it deployed its first smart contract on Ethereum Testnet that accepts Ether and USDC.

The testnet contract is a stepping soon towards fulfilling VISA’s ambition to being the bridge between crypto-to-crypto and crypto-to-fiat payments, just as they are for fiat payments. VISA has previously articulating this vision, stating

Visa could potentially help become a bridge between one digital currency on one blockchain and another digital currency on another blockchain.

VISA is also focused on facilitating CBDC payments, not only within a country but between jurisdictions. In fact, their "Universal Payments Channel" (UPC) is planned stand between all payments, globally. While this centralization is anathema to crypto natives, it can’t be denied that fiat-to-crypto onramps (and especially offramps) are needed, and the more seamless the better.

Bridging is also a challenge that CEXs and fintechs are trying to solve centrally and trusted. VISA may put them all out of business.

US crypto ETFs imminent?

When US ETF? For years, US investors have had to watch as smaller countries have been able to purchase cryptocurrency ETFs. Canada has five. The SEC likely sees custody, liquidity and valuation issues as counter to the protections for investors required under the Investments Company Act of 1940, which has frustrated crypto advocates and investors alike.

A window may have opened on this front however. Commodity ETFs that reference the futures market are ubiquitous, and have no known operational issues. The BTC and ETH futures markets are liquid, transparent, centrally cleared and subject to regulatory oversight.

Twice SEC Chair Gary Gensler has come out in support for a Bitcoin futures ETF; Once in August and again last week. In prepared remarks on Wednesday, he sounded positive:

Earlier this year, a number of open-end mutual funds launched that invested in Chicago Mercantile Exchange (CME)-traded bitcoin futures.

Subsequently, we’ve started to see filings under the Investment Company Act with regard to exchange-traded funds (ETFs) seeking to invest in CME-traded bitcoin futures. ... I look forward to staff’s review of such filings.

Will a futures ETF bring new investors into the crypto shere? It turns out, the Bitcoin futures mutual funds Gensler mentioned are not particularly popular. One fund has only $15 million in AUM after two months.

In any event, a futures ETF is better than no ETF. The only issue is if the SEC feels approving a less popular alternative diverts attention away from the lack of true asset-backed ETF approvals.

Blog this week: “Views from Messari Mainnet, Part I: The rise of multi-chain ecosystems”

From Sunday night to Wednesday night last week, three of us from Hartmann Capital attended crypto market portal Messari’s Mainnet conference. This week we highlight our favorite themes from the event. While crypto is going multi-chain at a faster pace than many expected, the winners are going to need strong communities of top devs while also offering a compelling reason for users to jump chains. Terra and Solana look like winners, with the strongest sponsorship, top devs building world-beating apps, and unique value propositions. Who else will join them?

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.