Family Office Appetite for Digital Assets grows, FTX mega-raise, and Elon is back

Hartmann Capital Newsletter, Monday July 26, 2021

In this issue

Almost half of Goldman’s family office clients planning crypto allocation

Massive private fundraises bode well for crypto asset markets

Elon Musk holds ETH, BTC and DOGE.

This week’s blog: “Crypto Risk Management Part II – Illiquidity“

Announcement - Hartmann Capital Opens Second Round of Analyst Incubator

Market by numbers

Bitcoin stabilized, while Ethereum, Decentralized Finance (DPI) and the Metaverse (MVI) rebounded from a poor showing last week.

Goldman Sachs says family offices favoring crypto allocation

Goldman Sachs released a report this week revealing that more HNW wealth managers as well as family offices are contemplating an allocation to digital assets. While only 15% were already involved, about half of the pre-eminent TradFi bank’s large clients are trying to understand how to get their clients involved in the crypto space.

The two main drivers behind a proposed investment are (1) the potential for high inflation/low-to-negative real rates and (2) the expectation that crypto will be the “new new thing”, just as the internet has been since the turn of the millennium.

News like this strengthens our conviction at Hartmann Capital that an allocation to the digital asset class is essential for all investors. Not only are institutions entering the market, especially in Bitcoin, the potential for the mass involvement of HNW retail should drive market and price growth in the coming years. We are early.

The more than 150 family offices surveyed included just over one fifth managing more than $5 billion and two-thirds managing over $1 billion.

In related news, JP Morgan announced that it has allowed its wealth management clients to purchase crypto-asset funds by Grayscale and Osprey.

Massive private fundraises bode well for crypto asset markets

Several private fundraises each in their own way provide evidence that institutional investors have faith that crypto asset trading is still in its formative stages and set for exponential growth.

Sam Bankman-Fried’s centralized exchange FTX raised $900 million in Series B financing at an $18 billion valuation. FTX’s digital asset spot and derivatives trading averages $10 billion per day, with over 1 million registered users. Though volumes have fallen since the May correction, big names such as Sequoia and Softbank believe interest in crypto, and therefore market volumes, will rise again this year and beyond. The cash is earmarked for acquisitions and partnerships.

Many non-fungible tokens (NFT) markets stabilized and even risen sharply in recent months, even as interest and pricing in decentralized finance has weakened. The number one NFT issuance and trading platform OpenSea announced this week a series B raise of $100 million. The deal, led by a16z and including Ashton Kutcher and Shopify’s Tobi Luetke, makes OpenSea the first true NFT “unicorn”, with a valuation of $1.5 billion.

Some of the cash will go to deploying on lower-cost chains, as small-value NFT trading is not suited to the high gas fees of the Ethereum blockchain. OpenSea recently opened trading on the Polygon side-chain, ideal for smaller transactions.

OpenSea is the clear number one by user base and volume (see 30-day volume ranking below):

The OpenSea fundraise has two implications. Firstly, it shows that smart money like Andreessen Horowitz (a16z) believes that the “Metaverse”, including collectibles, is set for exponential growth. Secondly, the raise is evidence that crypto is reaching tech-size valuations, and therefore cannot be ignored by any investor who is allocated to the private capital markets. OpenSea’s potential rivals TradFi and fintech private companies. Looking back, we believe this OpenSea news, when added to the recent success of the crypto game Axie Infinity, is a coming-of-age moment for the Metaverse.

Other fundraises this week included $21 million for Thesis, a crypto venture studio, and $27 million for decentralized identity solution Magic. Big names such as Naval Ravikant and Tiger Global were involved.

Elon Musk owns Doge, ETH and BTC

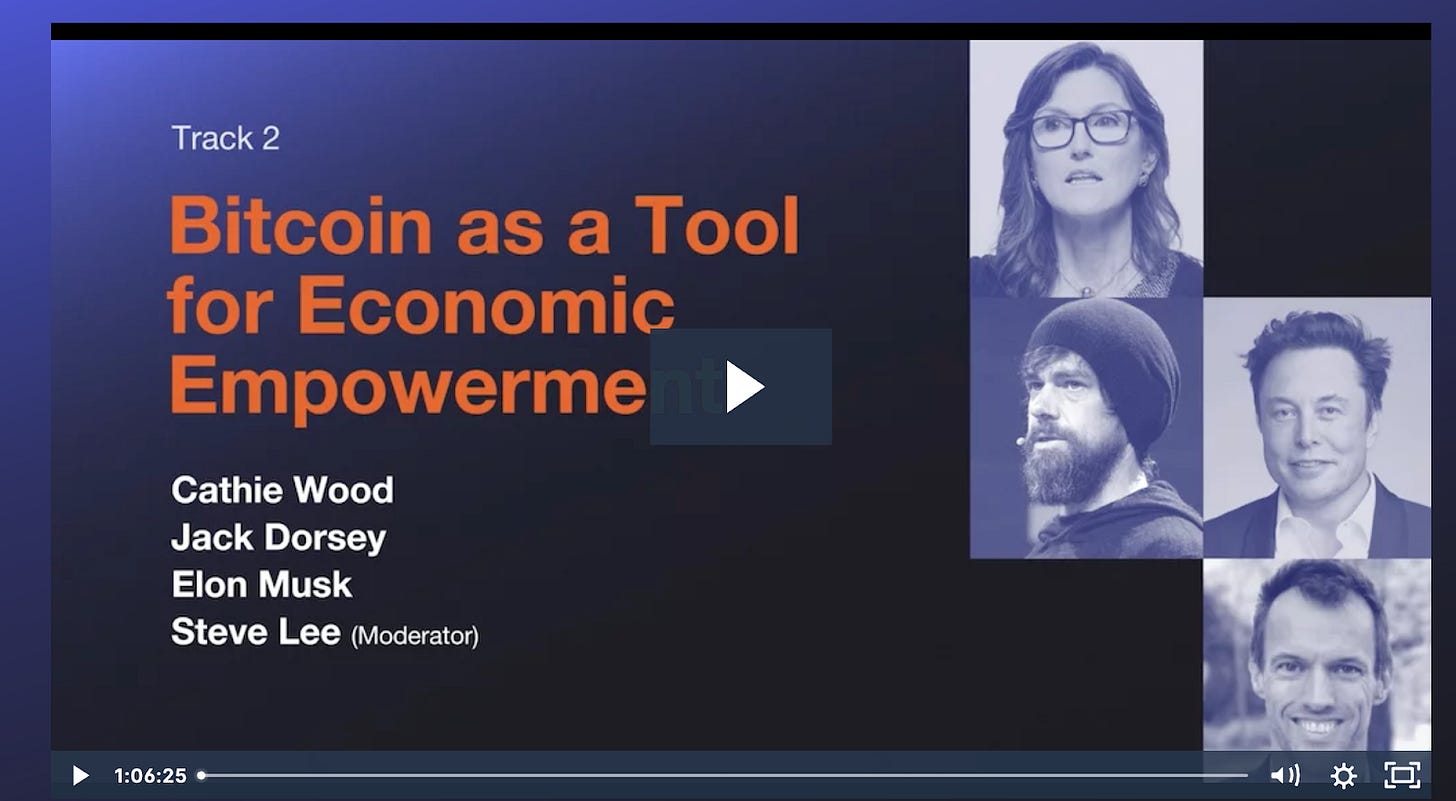

When Elon Musk tweets or speaks about crypto, crypto natives and the masses alike (still) pay attention. Informative or not, he is always entertaining. The “Doge-father’s” discussion with Twitter/Square founder Jack Dorsey and ARK Invest’s Cathie Wood at The B Word conference was no exception.

Elon has been blamed for the Bitcoin “fear, uncertainty and doubt” that contributed to the price correction beginning in April as well as the pump of the pretty-much useless Dogecoin. This week he revealed that aside BTC and Doge, Musk also holds ETH. Importantly, he focused on the potential for BTC’s carbon footprint to improve, and did not preclude allowing BTC as a means of payment for his company’s products. SpaceX and Tesla both own Bitcoin.

Jack Dorsey sees Bitcoin becoming the “internet currency”. He has positioned his payments company Square to offer it to all of its customers, and believes that crypto adoption will lessen Twitter’s reliance on advertising. ARK Invest’s Wood continues to allocate funds under her control to crypto. As we keep repeating, the institutions are here!

Blog post: “Crypto Risk Management Part II – Illiquidity”

Hartmann Capital’s flagship fund, Hartmann Digital Assets is a hedge fund focused predominantly on liquid strategies. Alpha opportunities in crypto VC and in illiquid tokens must be approached carefully to mitigate illiquidity risk. This week’s blog [link] presents the opportunity set in illiquids and outlines our approach to managing our VC and small-cap positions.

Announcement - Hartmann Capital Opens Second Round of Analyst Incubator

After completing training and hiring the first cohort of digital asset analysts, Hartmann Capital is opening up for four new analyst in training positions for August till December 2021. Candidates are expected to have fluency in digital assets and DeFi or the Metaverse, however we do not require degrees or prior employment in the digital asset space. Candidates will work alongside the analyst team and will be assigned a full-time analyst to shadow. Remote and/or in-person, with weekly stipend. Apply here.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.