ETH becomes Deflationary, TradFi goes DeFi, and Decentral Gaming Accelerates

Hartmann Capital Newsletter, Friday 9th July, 2021

In this issue

EIP-1559 is almost here. What does it mean for Ethereum and ETH?

Aave Pro and Compound Treasury: Bringing DeFi with Ethereum security to TradFi institutions

The “Metaverse” is exploding: Pokemon-like Axie Infinity hits 250,000 active users

Circle goes public in SPAC deal: Valuing the crypto and fintech company at 4.5 billion

This week’s blog: 2021 Themes in Crypto Investing

Market by numbers

Top DeFi tokens caught a bid this week (up 22%), beating layer 1 assets such as BTC and ETH. The major decentralized lenders and exchanges finally outperformed after lagging since March.

EIP-1559 is (almost) here

It’s been two years since founder Vitalik Buterin proposed an Ethereum Improvement Proposal (numbered 1559 - we’re now at 3607) to make “gas” (transaction fees) more predictable on the Ethereum mainnet, the key DeFi network. Assuming no last minute objections, 1559 will go into effect with the “London” upgrade on August 4, 2021, at Block 12,965,000.

Currently, users bid for blockspace for their transactions using a first-price auction: Each proposes a gas fee and the miners choose the highest ones. This system is known to be inefficient, and results in lower-priority/lower-value transactions competing directly with users willing to pay more for immediate and more certain execution.

EIP-1559 divides the current fee for a transaction into a BASEFEE and a tip. The BASEFEE is automatically adjusted for network congestion, increasing both transaction certainty and fee transparency. Those who want to prioritize their transactions will still need to add a tip, so it is likely that overall fees will not drop for a given amount of traffic.

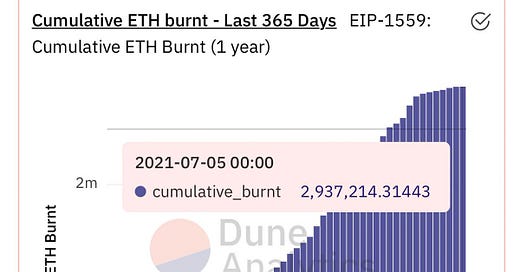

What has Ethereum bulls so excited is that the BASEFEE, paid in ETH, will be burned (sent to a dead address, reducing supply) rather than paid to miners. One crypto Twitter commentator has shown that almost 3 million ETH (worth over $6 billion dollars) would have disappeared if EIP-1559 had been in force for the last year. Furthermore, miners will have less ETH to sell (to fund their business, for example), removing a source of downward price pressure from the ETH market.

EIP-1559 anticipates perhaps the most bullish change ever to the Ethereum blockchain, the move from energy-intensive Proof-of-Work to Proof-of-Stake (PoS). Over 6 million ETH are already locked into staking contracts, running Ethereum 2.0 (Eth2) PoS validators in testnet. The success in getting EIP-1559 onto the Ethereum mainnet has caused the market to now expect the switch to PoS in late 2021.

It’s been suggested that EIP-1559 and PoS together will reduce issuance by 90%, the equivalent of three Bitcoin “halvings”. Every four years, Bitcoin issuance falls by half, and as miners have less to sell, BTC generally rises, with a lag. With issuance declining to near zero and some being burned under EIP-1559, most bulls expect prices to skyrocket.

Crypto’s high yields and security come to TradFi institutions

The two dominant crypto token lending protocols have both announced traditional finance “fintech” front ends with the required controls and admin, to allow institutions to access DeFi directly. This is very big news, as decentralized finance’s (DeFi) two hurdles to mainstream adoption are (1) the complexity and risk involved in self-custody solutions and (2) the previous inability of crypto markets to ensure users are compliant with all relevant rules and regulations.

Compound Treasury is working with institutional custodian Fireblocks to offer 4% yield on a USD pegged stablecoin, USDC. Dollars will go in, and dollars will come out, even if USDC is the token actually used to earn the yield.

The front-end UI handles all the heavy lifting. Fireblocks will KYC/whitelist all participants and provide AML and anti-fraud controls. Using a fintech front end and Fireblocks support will add centralization. Under the hood, however, immutable smart contracts govern the deposits.

Current, a fintech neobank, will offer Compound’s yield product to its more than 2 million users in the US with the look and feel (UX) of a TradFi savings product.

The other big lender, Aave, has countered with Aave Pro. While Compound Treasury is a for-profit company (and in a way unrelated to the decentralized Compound protocol), Aave Pro will be governed on-chain by the current AAVE tokenholders. Aave Pro is also working with Fireblocks to provide traditional financial institutions and their clients a whitelisted regulatory-compliant pool for borrowing and lending crypto tokens, including Bitcoin and Ethereum – not just USD-pegged stablecoins.

Having a TradFi front end allowing access to DeFi has become known as the “DeFi mullet”: Fintech in the front, crypto in the back. These two underlying crypto protocols hold around $20 billion in assets, so this is a big deal. Is this the moment we will look back on as the moment when crypto finance went mainstream?

Circle goes public at a valuation of $4.5 billion

Speaking of USDC and its role in on-boarding institutions into DeFi, the second of the two members of the USDC Centre Consortium, Circle, has agreed to be acquired by a SPAC in a deal valuing the crypto fintech at $4.5 billion.

While the other member, Coinbase, is now also public, Circle is more of a crypto-native business than simply a tech platform to trade crypto. Besides being co-issuer of the USDC stablecoin, Circle provides APIs and settlement services for USDC to DApps and exchanges such as NBA Topshot and FTX. It also is growing its tokenization business, aiming to bring more TradFi securities on-chain.

USDC increased its market share in USD stablecoins this year by 50%, with $22.6 billion currently in circulation. Management expects to quadruple issuance by 2023!

Axie Infinity, a Metaverse Success Story

While Circle, Aave, Fireblocks and Compound focus on bringing crypto to traditional finance, Axie Infinity has quietly been bringing crypto to gamers. Success has come very quickly to this crypto-native Pokemon-like game.

Gamers earn the SLP crypto token that can be traded for other crypto assets or off-ramped to fiat currencies, on centralized exchanges. This has allowed players in countries such as the Philippines to earn a living playing the game. As Axies are a road to profitability, the best Axies are trading above $100,000, and land in the Axie metaverse has been trading above $600,000.

There are currently over 250,000 daily users, from all over the world. Unlike centralized platform games, Axies and land are non-fungible crypto tokens that are owned outside of the game, generally on the Ronin side chain. Yet users might not even know they are participating in the crypto revolution.

This week’s blog: “Themes in Crypto Investing”

Axie Infinity’s success is further explained in this week’s Hartmann Capital blog [link], where we set out and explain the four major themes in crypto driving our investment process: decentralized finance (DeFi), the decentralized internet (DWeb), the Metaverse of crypto gaming, entertainment and collecting, and privacy solutions.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.