Double Issue: Meta, Worldcoin, NFT.NYC, and the greatest Trade in History?

Hartmann Capital Newsletter, Sunday November 7th, 2021

In anticipation of our second fund launch, Hartmann Metaverse Ventures I, things have been busy at Hartmann Capital, so we unfortunately missed you last week. To make up for it, we hope you enjoy this double issue! Current LPs will receive advanced access to our new offering in the coming weeks.

In this issue

Facebook signals its move to dominate the metaverse

How not to launch a decentralized token: Worldcoin

Ethereum all-time highs

NFT.NYC reveals crypto’s future

The best trade ever? SHIB owner makes billions in a year

Blog this week: Vulcan Forged: Investing in the Next Generation of Play-to-Earn

Market by Numbers

Ethereum hit an all-time high, as did the US stock market. The NASDAQ has quite the run, up 24% on the year.

The Metaverse extended its post-facebook/Meta rally this week. Investors are looking to the future, focusing on improving virtual experiences and the pipeline of new play-to-earn games.

Top Gaming and Metaverse tokens, by market capitalization

Our blog this week sets out the case for Vulcan Forged, a P2E gaming ecosystem that has the potential to be the next Axie Infinity. Decentral Games is another Hartmann Capital favorite.

Facebook signals its move to dominate the metaverse

The biggest news this week had to have been the announcement that Facebook is changing its name to Meta, with Mark Zuckerberg presenting its view of the future of the metaverse in a short video that included the Facebook founder playing poker with a robot and having a business meeting in a 3d virtual world.

It had been obvious for some time that Facebook was moving in the direction of virtual reality ever since it acquired Oculus VR in 2014. There was also a run of VR acquisitions over the past two years. Hints of a brand change and refocus on the metaverse have come thick and fast throughout 2021. It will invest $50 million into VR research and partnerships, and hire 10,000 in Europe to support the new VR effort.

While nobody should have been surprised by the move, crypto builders were vocally critical of the rebrand. Even super angel investor Jason Calacanis was livid, and had this to say:

Crypto interpreted Facebook’s move as evidence that the metaverse will dominate the future of socials and gaming, and bid up decentralized gaming and virtual world tokens (see above). It is our firm belief that the metaverse will be better served by giving ownership (and portability) of in-game assets and rewards as well as control over aspects of the experience to the players.

In our blog we identified a metaverse summer, in reality it will be a metaverse generation. Play-to-earn (P2E) games such as Axie Infinity have shown crypto devs the way. Different decentralized versions of the metaverse are coming, from stunning AAA games from Illuvium and Star Altas to collectible card games Gods Unchained and Parallel. In all cases, players will own their assets and contribute to development.

While Facebook is already as immensely unpopular in Washington as on TikTok, and is anathema to young crypto devs, the move to Meta has sounded an alarm. War is coming. We are backing the devs that are building an open metaverse rather than the re-hashed Web 2.0 closed platform version.

How not to launch a decentralized token: Worldcoin

It is possible that Facebook has a rival for the title of most evil empire in the eyes of the crypto native.

Worldcoin, in its own words, is a “coin for humanity” backed by every major VC firm, who together get 20% of tokens. Again in their own words:

Worldcoin is a new, collectively owned global currency that will be distributed fairly to as many people as possible.

To ensure against Sybil attacks – that one person could get more than their fair allocation – Worldcoin is using multi-level marketing-like to distribute the coin in person in return for biometric information. Contractors pay Worldcoin for the right to distribute the tokens, in return for iris scans.

And here is the most dystopian part of the story. The contractors use “the Orb”, a shiny machine to record an iris scan for each token.

The machine creates a unique hash for each unique scan, ensuring that someone doesn’t sign up twice. Worldcoin insists that the iris scan itself is not saved, but privacy advocates are not impressed. They’re also not impressed with the MLM-style sales process, nor the high VC participation.

The Defiant has a very good analysis of the whole Worldcoin effort here.

Ethereum all-time highs. Other chains do even better.

Two weeks after Bitcoin made a new all-time high (ATH), it was Ethereum’s turn. Though some claim it touched its ATH the same day as Bitcoin two weeks ago, ETH broke well through its old record, pulling back very little since.

Ethereum outperformed Bitcoin by 3x year-to-date, moving from .025 BTC/ETH to 0.075.

And once again there is talk of ETH flipping BTC in market cap. Such expectations may be a little premature, however. ETH got as close to 80% of BTC market cap in 2017 before rapidly retreating. A major rally and then rejection also occurred in 2018. The long bear market favored the original cryptocurrency. It took the renewed 2020-2021 bull market to get ETH back to 50%, where it has failed twice now to get above that level.

In pullbacks, Bitcoin tends to outperform. There is no doubt we are in a heady “altcoin” market. Major Ethereum competitors Solana, Luna and Polkadot also hit all-time highs this week. Total market cap is now just under $3 trillion, a record high.

Solana has been on fire. Not only is it home to several of the fastest-growing DEXs, its NFT collectibles have gained traction. According to Delphi Digital, Solana has come from nowhere to challenge the top 4 NFT blockchains, with only Ethereum as the sole non-NFT specialist in the mix.

Solana and Terra (LUNA) have, along with Fantom, been by far the best performing L1 blockchains in terms of price over the past year..

It’s now clear that it will be a multichain world, and that Solana and Terra have distinctive ecosystems as well as strong leadership that should keep the competition at bay. Avalanche looks to be the EVM-compatible winner for now. However our bet is that Fantom will snatch that position soon.

NFT.NYC reveals crypto’s future

Is there a better way to celebrate the coming of age of non-fungible tokens than a huge party in NYC? Well, yes. If we were there. Alas, a second fund does not launch itself.

What other event could possibly host a teen influencer (Miss Teen Crypto), the founder of the most popular P2E game (@jihoz from Axie), rappers (Busta Rhymes and Timbaland), famous Russian protesters (Pussy Riot) and director Quentin Tarantino? The answer is NFT.NYC.

We’ve spoken before about how NFTs allow holders to prove ownership, which is especially important for play-to-earn games. However, NFT.NYC showed that creators are finally waking up to the opportunity to dispense with middlemen. As Busta Rhymes said at the conference, “You get to keep the rights to your shit … you get to laugh to the bank!” Tarantino was there to plug his newest NFTs in collaboration with Secret Network, based on never-before-seen cut scenes from Pulp Fiction.

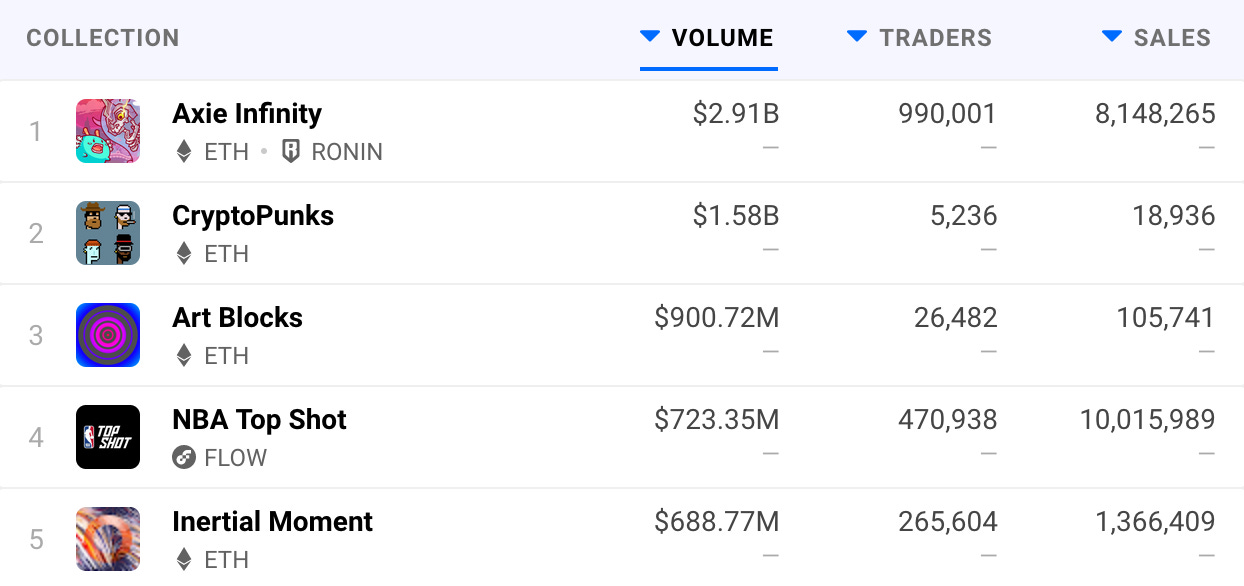

The rewards for creators are huge. Not only are the best in high demand, but many NFTs pass on royalties every time a secondary sale is made. And given the ease in ownership transfer, trade is common. Artblocks, a generative art platform, has nearly a billion dollars in sales even though the total value outstanding is closer to $400 million.

Given the real world and crypto celebrities in attendance, turnout was huge and diverse. Where else could a Bored Ape mingle with a pixelated Punk or a long-lost Marcolian from a post-apocalyptic earth? They came for the music, including sets by DJ and NFTer Steve Aoki, yacht parties with the Bored Ape Yacht Club, hackathons, and to meet the faces behind the avatars.

NFTs are big business, and will be bigger business. The dominant marketplace OpenSea has traded $10 billion in NFTs. Axie Infinity's P2E game platform has attracted nearly $3 billion in NFT volume. More than $1 billion in Bored Apes have traded.

Mainstream companies like Nike, Reddit, Adobe, Gamestop and even Disney are getting involved. Mainstream creators likewise. Coinbase and FTX recently introduced NFT platforms for the masses. Where this is money to be made, you’ll find VCs, and the biggest firms such as Andressen Horowitz (a16z), who recently raised a $2 billion crypto fund, have been extremely active in NFTs. Animoca, an early Axie Investor, has been in 26 deals. According to Pitchbook, a16z has participated 40% of all VC deals by value for NFT companies, with the latest being $150 million for Mythical Games. The deal valued Mythical at $1.25 billion, triple the valuation in June of this year.

Creating or buying NFTs on many platforms requires very little knowledge of crypto. NBA TopShots and Axie Infinity are seamlessly introducing an entirely new user base of non-natives to decentralized ownership. While the best of crypto art and collectibles still requires some crypto knowledge (mistakes are as easy to make with NFTs and with any crypto asset), that is changing with the entry of the big exchanges.

NFTs are an integral element of the push from centralized platforms – in art, music, publishing and gaming – to a decentralized blockchain based world of full ownership rights without centralized gatekeepers and toll-takers. Every artist will be their own Spotify, or Sotheby’s, or Random House. Every collector or fan will have provable and, more importantly, tradable, on-chain ownership of their products.

One SHIB trader makes billions

Crypto has been known for years for its ability to make billionaires. Two of the most well-known are the founders of two of the top exchanges, but many more early Bitcoiners and even much later arrivals have stayed silent.

What is less common is for one trader to go from rags to generations wealth in just over a year. 70 trillion Shiba Inu (SHIB), a meme-coin that is actually a meme of a meme coin, purchased by one wallet in August of last year were worth over $5 billion last week. The coins cost $3,400. That’s a more than 4,000,000x.

Many in the space question whether the trader had lost the keys, or perhaps had passed away. But this week over $2 billion of that SHIB was moved to four wallets. The trader is not dead, and the news of some of SHIB’s market cap appearing active put pressure on the price. Still, what a trade, even at $4.1 billion.

This Week’s Blog: Vulcan Forged: Investing in the Next Generation of Play-to-Earn?

In July we wrote that crypto will not only have a great influence on the financial world, but also on the metaverse and especially the gaming market. This week we discuss Hartmann Capital’s latest investment and activist partnership with P2E gaming studio Vulcan Forged. We believe it could be the next play-to-earn success, rivaling Axie Infinity.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.