DeFi makes the Economist Cover Story as Wall Street wakes up to Crypto

Hartmann Capital Newsletter, Friday September 17, 2021

📈 Meet us in NYC: Part of the Hartmann Capital team will be visiting NYC for the annual Messari Mainnet conference this week. If you are a qualified purchaser (an individual or a family-owned business that owns $5 million or more in investments), reach out to us today as we are conducting research on the gaps in digital asset product offerings available to help us better serve our clients.

In this issue

Crypto Love: The Economist on DeFi. Time Magazine on Vitalik Buterin. Billionaire Hedge Fund Managers Believe in Crypto. Equity Trading Firms Launch Crypto Arms. Is the Mainstream Far Behind?

Crypto Asset Investors Pivot (Yet Again)

This week’s blog: Who Wins in a Multi-chain World?

Market by Numbers

Digital assets shrugged off a declining US stock market to post decent gains. For the second week in a row, metaverse assets underperformed.

Crypto Love: The Economist on DeFi. Time Magazine on Vitalik Buterin. Billionaire Hedge Fund Managers Believe in Crypto. Equity Trading Firms Launch Crypto Arms. Is the Mainstream Far Behind?

Bitcoin and Etheruem were ground-breaking innovations, but it has taken a while for any good news to trickle down to TradFi and the mainstream press. Of course, there has been no shortage of naysayers and FUD. “Bitcoin is only good for money laundering”, is the common refrain. Crypto is still under assault from regulators, especially in the US. But now there are signs that the tide is turning. Several favorable views of crypto and DeFi have been spotted this week, and we were reminded by several keynote conference speakers, world class investors all, that digital assets must be considered an important component of any portfolio.

Ethereum co-founder Vitalik Buterin was named one of Time’s 100 most influential people. As Alex Ohanian wrote in the magazine,

What makes Vitalik so special, though, is that he is a builder’s builder. No one person could’ve possibly come up with all of the uses for Ethereum, but it did take one person’s idea to get it started. From there, a new world has opened up, and given rise to new ways of leveraging blockchain technology—some of which I’ve invested in. Whether it’s startups like Sorare reinventing fantasy sports or Rainbow users showing off their NFT collections, none of this would’ve existed without Vitalik’s creation.

More guarded in their praise of crypto are the editors and writers at the newspaper that all self-appointed elites and wannabes read, the Economist. Skeptics always, they wrote this week,

The rise of an ecosystem of financial services, known as decentralised finance, or “DeFi”, deserves sober consideration. It has the potential to rewire how the financial system works, with all the promise and perils that entails. The proliferation of innovation in DeFi is akin to the frenzy of invention in the early phase of the web. At a time when people live ever more of their lives online, the crypto-revolution could even remake the architecture of the digital economy.

As with the internet in the 1990s, no one knows where the revolution will end. But it stands to transform how money works and, as it does so, the entire digital world.

All of this educated mainstream media attention, as opposed to scaremongering at less well-informed publications, must be viewed in the context of the interest that the lords of finance have taken in crypto. While regulators appear to be scared and confused, investors that are not afraid to place extremely large bets on themselves and their ideas are becoming more and more bullish by the day.

Anthony Scaramucci’s Skybridge Capital hosted its annual SALT conference this year, attracting an A-list speaking roster. Given the hedge fund founder’s support for and investments in crypto assets, there were the expected panels on institutional investing in the space as well as the risks and rewards from the likes of Galaxy Digital an ex-Fortress founder Micheal Novogratz, FTX’s under-30 multibillionaire Sam Bankman-Fried, Pantera Capital’s founder Dan Morehead, as well as a variety of NFT experts.

But the most newsworthy comments came from TradFi icons, Ray Dalio of Bridgewater and Steve Cohen of Point72, who both expressed extremely strong bullish views on the crypto asset space, and not just Bitcoin.

While Cohen had previously announced that he was investing in Radkl, a digital asset-focused investment firm spun out of trading firm GTS, at SALT he outlined his plans to build crypto trading into his hedge fund.

GTS joins mega-trading firms Jump Capital and Jane Street in announcing forays into crypto assets.

Crypto Investors Pivot (Yet Again)

DeFi summer 2020 launched a revolution in crypto finance. Sushi’s “vampire attack” on the tokenless Uniswap proved what Compound (COMP) and Synthetix (SNX) had indicated earlier: Governance tokens as user incentives could drive customer acquisition. A long bull market ensued before taking a breather beginning with the May 2021 correction. Dominant DEX Uniswap’s UNI token, for example, is down 40% from its May all-time highs.

Soon it was NFT spring and summer 2021. High profile artists such as Beeple and old school profile pics (pfps) like Cryptopunks led the way, breaking price records day after day.

New creations appeared on Ethereum and, eventually, on all chains. New NFT issuance broke Solana and caused skyrocketing gas prices on Ethereum. It was an absolute frenzy of speculation and on-chain action.

The NFT market has calmed somewhat, leaving an opening for the new new thing. Punks, for example, are consolidating after a bit of a correction, in ETH terms.

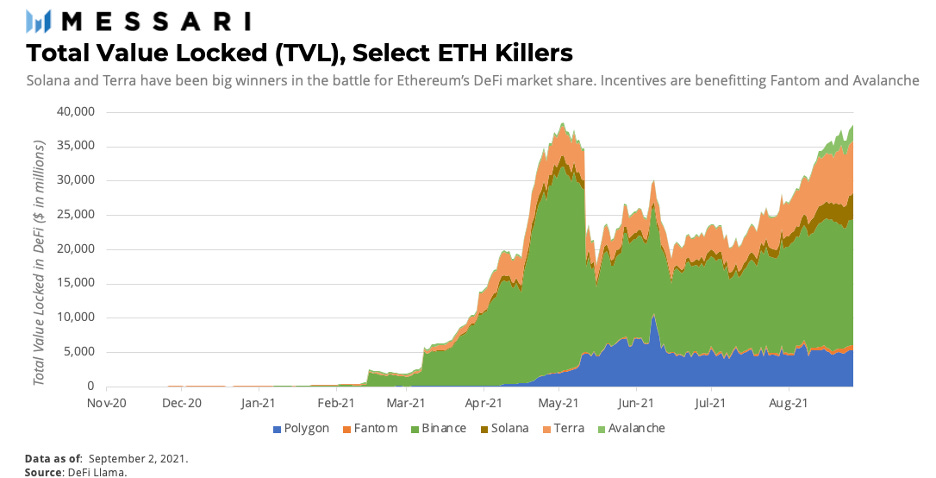

That new thing appears to be layer 1 native tokens and newly-launched DApps. Layer 1 blockchains form the base on which smart contracts can be executed. For many years, Ethereum has been the dominant platform, but has recently given up a third of its dominance, first to Binance Smart Chain and now to select few challengers such as Solana and Terra.

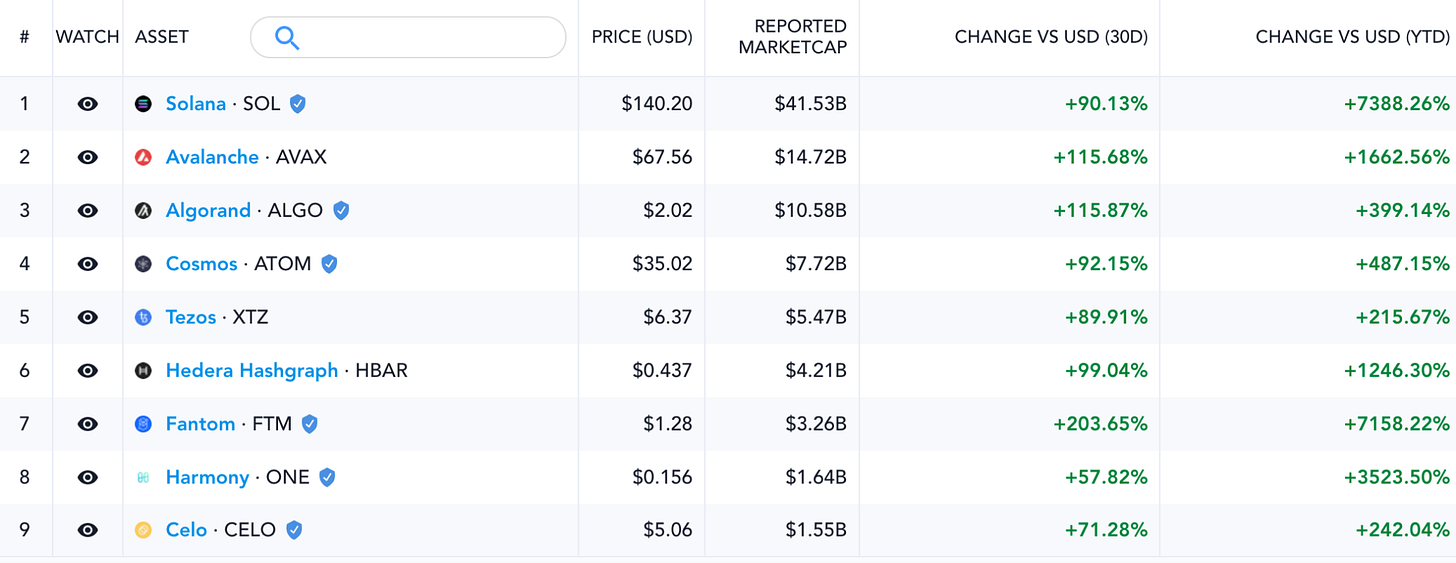

New incentive program announcements and VC interest have propelled many of the so-called “Eth-killer” challengers to all-time highs. Those that remember how incentives drove Polygon adoption and its token higher than initially expected have been drawn to the new chains.

Avalanche’s AVAX and Solana’s SOL have doubled over the last 30 days, while Fantom’s native token has tripled. Lesser known chains such as Hedera Hashgraph, Celo and Tezos have also made significant gains this month.

One lesson here is that there are always opportunities in the crypto space. When one door closes another one opens. The rotation from DeFi to NFTs to layer 1s has produced many winners, even as others consolidate. The lull in top tier NFT pricing corresponds with the recent layer 1 bull run. Another lesson is that the momentum in a subsegment isn’t permanent. DeFi is making a comeback while some layer 1s (e.g. Harmony, Near and Fantom) have underperformed this week.

It is our thesis that only a few of these layer 1s will end up with a critical mass and network effects in the new multi-chain world. Watch out for chains that are simply copy-pasting Ethereum’s DeFi and NFT ecosystem.

Those that succeed will have more to offer. Chains specializing in products and markets that Ethereum is less well-suited for include Solana (high frequency trading on-chain DEXs), Terra (complete financial markets and TradFi links for its stablecoins), Secret (on-chain privacy), and Arweave (permanent storage). Each of these chains is also backed by solid teams and communities.

Blog this week: Who Wins in a Multi-chain World?

Speaking of the layer 1 bull run, finding value in such a market segment is one of our key roles as digital asset managers. Amid all of the hype and large incentive budgets, there are always tokens to own and tokens to avoid. This week’s blog dives into “Eth-killer” blockchains, explaining how we view the ever-expanding set of standalone blockchains and the tokens we favor now.

Hartmann Capital Weekly written by Head of Communications, Rasheed Saleuddin, PhD, CFA

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.