Breaking Out - The 4th Epoch of Crypto

Hartmann Capital Quarterly Insights - Volume 3, Q2 2020

To Investors and Colleagues,

2020 has been a year of statistical outliers.

Record unemployment, record monetary easing, pandemics, riots and civil unrest, negative oil prices, 4 of the 25 worst trading days for the US stock market… as well as the strongest 50 day rally for the S&P500.

The dichotomy of the last two in particular has Wall Street stumped.

Historians will have a field day exploring where their models broke or what caused these seismic shifts across the board.

But until then, it’s our job as asset managers to find alpha amidst the madness.

While we spent much of the past 3 months uncovering the countless theses that could guide markets this week, this month, this year, I ultimately found truth in our very own maxim at Hartmann Digital Assets that’s been printed on our documents for over a year:

The future belongs to those who invest in it.

The truth is, nobody knows what will happen tomorrow.

Maybe there will be another riot. Maybe there will be another stock market crash.

But over the next 24 months, we can say with certainty that there will be innovation.

Elon will keep building rockets getting us closer to Mars. Bezos will keep expanding the Amazon empire.

And ultimately the money will flow to those that innovate and accrue value.

While people are distracting themselves betting whether or not Hertz will go bankrupt or recover, the real alpha lies in betting on the future that most are too distracted to see right now.

In this quarterly update, I will share with you some of my findings of not just why but also where within the digital asset sector we see immense asymmetric opportunities that have gone vastly unnoticed.

We believe that no investment offers the same asymmetric returns as the digital asset space. We continue to put our money where our mouth is and as nearly every month for the past two years, management is investing additional personal capital into the fund. We also continue to be deep in the green for 2020, despite unprecedented events.

I hope you enjoy this update and it helps you see the future more clearly.

Because while it may be cloudy right now, the future is brighter than it seems,

Sincerely,

Felix Hartmann, Managing Partner

Why Crypto Assets are One of the few Investable Assets in the Current Economic Climate

In a world that is seeking alpha, we’ve entered a chapter that seems to have so little left. And while alpha appears to be a rare find at this time, the world has more cash than ever before after trillions of dollars in stimulus injections. Let’s explore where bored money could go:

Bonds: Interest rates are in the gutter. A 10-Year-Treasury now only pays ~0.64% interest. Match that with inflation and you’re running a deficit.

Currencies: Many currencies other than the US Dollar have a significant chance of currency collapse. Below you can see the national currencies from Turkey, South Africa, Iran, Brazil, Russia, and Nigeria lose 55% to 93% of their value against the US dollar since 2013.

And while the Dollar is unlikely to collapse, we are printing more of it than ever before in history.

Real Estate: The least liquid of all investments. Real Estate is currently undergoing a seismic shift as we are starting to see migration patterns out of urban cities into less crowded cities and states. COVID proved that you can do your job remotely, and big cities like New York will feel the pinch. Riots in larger cities are not helping this cause either. The value accrual mantra of Real Estate “Location, location, location” literally may lose a lot of its weight in a more digital world. To make things worse Home-Price Index is at similarly overvalued levels compared to the Consumer Price Index as in 2008.

Equities: Non-tech stock fundamentals are hemorrhaging yet the Fed stimulus has driven prices up far detached from reality. Tech stocks have entered Fantasy Land with Zoom (ZM) now having a PE ratio of 2,100… (for reference Ben Graham, mentor of Warren Buffett and author of the classic, the Intelligent Investor recommended looking for stocks with a PE ratio of 9 or below). You could surely short the markets, but that too comes with unlimited risk should Jerome Powell keep firing off rounds off ink on his magic money printer. Not even dividends are part of the deal anymore.

Commodities: Global demand has been strangled. Oil already crashed below $0 once this year. Physical commodities come with expenses making them a pricey long term buy and hold especially when prices are continuously dropping.

Gold: Resistant to the Fed, yet already at around a $11 Trillion Dollar Market Cap. One deals with the caveat of having to choose between seizability by centralized ownership and illiquidity/untransferability when personally holding physical gold. Still, gold surely deserves a partial allocation in anyone’s portfolio in an era of global monetary experimentation. But it will serve more of a hedge than an investment.

Crypto Assets: Digital gold opportunity in bitcoin with nearly 1/100th the market-cap of gold. Resistant to the Fed. Transferable and unseizable. High growth tech opportunities in ether and DeFi that can change the world with a cumulative market cap less than Zoom.

As you can see, it’s a rare setup where most asset classes are either bland, risky, uncertain, or all of the above. Once more institutions wake up to this and notice that Crypto Assets provide a mix of growth, value and inflation protection all at once, the asset class is primed for a massive move in this 24 month period. And cryptos’ global presence provides a geo-political moat as tensions tend to accelerate their adoption rather than stifle it.

In fact it’s no longer what if. In the past Quarter we had hedge fund titan Paul Tudor Jones officially allocated his fund into bitcoin, and Renaissance Technologies, now the biggest hedge fund in the world, get approved to trade bitcoin futures. The first big players are accumulating, not tomorrow but today. And their foresight will likely pay off, and when it does, all the vanilla equity funds out there will copy the legends and follow suit. No one wants to be first. But also no one wants to be last.

Bitcoin’s Unprecedented Supply/Demand Economics

This month something incredible happened. Every 4 years the bitcoin algorithm halves the supply flow of bitcoin. The last time this happened was in 2016. Now it happened again. As a result, bitcoin for the first time has an inflation rate lower than Central Banks, and nearly on par with Gold.

What’s more stunning than a 1.5% inflation rate though, is the enormous institutional demand. One of the most popular venues for institutions to get a bitcoin allocation is through Grayscale, which provides a number of exchange traded products such as the Bitcoin Trust, GBTC. And Grayscale alone has bought more than 150% of the bitcoins being mined since the halving. Meaning one company alone is soaking more coins out of circulation than mining is replacing. Square, Inc. bought up similar numbers to Grayscale back in Q1 making current supply flow a tiny stream compared to demand. Add major players like Paul Tudor Jones starting the institutional buying spree, there’s only one way for bitcoin.

Ethereum’s Meteoric (Fundamental) Rise

In a world where nearly everything seems overpriced, we find ether to be in an incredible position for asymmetric returns. All its fundamental KPI are up, its 3 year anticipated 2.0 upgrade is scheduled to go live this year, and its price is back to May 2017 levels leaving incredible upside. We are betting big on Ethereum and its layer 2 stack as we believe price will soon catch up to fundamentals. Here’s a few key factors that we believe most have not caught onto yet:

Stablecoin Settlement

Stablecoins have become incredibly popular around the world. They essentially are dollars that exist outside the reach of the banking system and move swiftly at close to 0 cost across the Ethereum blockchain. In February they had a cumulative market cap of around $5 billion. Now they make up over $11 billion. And while transactions only cost cents, those cents go to the Ethereum network, which with the right volume can turn into millions of dollars in daily economic activity. As more money leaves the banks and goes digital via stablecoins, the more earnings Ethereum accrues.

Bitcoin on Ethereum

Yes you read that right. More and more bitcoin is moving onto Ethereum. While bitcoin makes great digital gold, the Ethereum stack offers countless ways to use that digital gold beyond just holding. More on that in a second. The fact remains that we are seeing a massive spike in bitcoin moving onto Ethereum right this moment. And just like the settlement of stablecoins, ether will accrue more value when more of bitcoin’s economic activity moves onto the Ethereum network.

Decentralized Finance

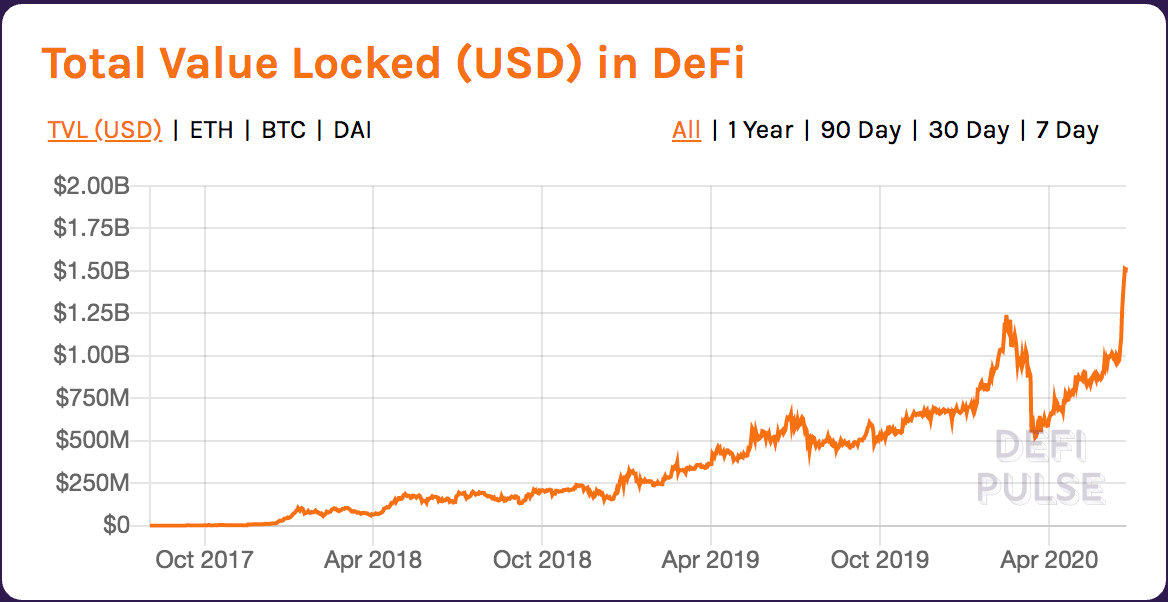

I could write and entire report on Decentralized Finance (in short DeFi), and I probably will one day, but today I will share the cliffs-notes. We’ve been following the DeFi space for nearly 2 years now, and while things were uncertain and clunky then, we’ve seen an incredible growth in adoption, UI/UX, and interoperability.

In terms of adoption we saw assets locked in DeFi rise from $1bn to $1.5bn in June alone. This is comparable to a bank having $1.5bn in client assets. Except this one is decentralized. DeFi did in 2 years what Lending Club did in 5.

In terms of UI/UX, crypto has long suffered from developer-centric designs that are… well… functional. When I ran my first Ethereum node in early 2017 the apps and tools we worked with looked like they were stolen from the 90’s. Today the designs are comparable with those of Robinhood and leading fin tech companies.

ETH 2.0

With the launch of ETH 2.0 (scheduled for July 30th), Ethereum will switch onto proof of stake. This means no more miners and instead stake holder validation. Therefore it is projected that anyone owning 32 ether and running a validator node can earn an estimated 4-10% APY (via collected fees from all of the above as well as newly minted ETH tokens). This staking revenue will add additional demand for ether as we experienced when Tezos popularized its staking.

Technical Analysis

From a charting perspective ether is ripe for a massive breakout. It’s still down 76% against bitcoin since the ratio peaked in January of 2018. At the same time the ratio has made continuously higher lows for 10 months and is about to break both its major multi-year resistance, as well as the 200 3 day moving average. When ether breaks out we imagine it will recover a lot of the ground it lost against bitcoin over the years.

Alt-coin Graveyard Capital Redistribution

All the alt-coins in circulation are worth nearly $100 billion, down from their peak of $500 billion. Of those, roughly $30 billion are allocated to ether and its DeFi layer 2 stack. The other $70 billion are mostly stuck in dead protocols that have accomplished close to nothing over the past 3-4 years, or alternatively have no way of accruing value for their token. I am not in the mudslinging business, so I won’t name any names (I’ll surely short them), but I could certainly write a trilogy on why Ripple is not worth $8 billion. It stands to reason that countless of these “ghost-town” layer 1 protocols, will lose market share and see all that capital flow over into the protocols that are seeing real value accrual via network fee earnings. As I said back in December of 2018 “This is the period when […] many projects will have failed. This is the ideal time to start looking for the projects that are still working hard despite the financial pressure. At this time we will start strategically buying into quality projects whose prices got decimated during the market sell-off, but are still progressing fundamentally.” That time has finally come.

We are excited for the countless opportunities the digital asset markets are presenting and are honored to be stewarding capital in these emerging markets on your behalf.

To a bright decentralized future,

Felix Hartmann, Managing Partner

TIMESTAMP 06/22/2020:

DJI - $26,024

S&P - $3,117

BTC - $9,685

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.