(I hope you’ve been enjoying our new Hartmann Capital Weekly compiled by our new Head of Communications. However once a month, as usual, you’ll hear my personal thoughts on the market. I hope you find it insightful!)

To Investors and Colleagues,

I am always fascinated by how repetitive this market is without a fault. Overnight critics in a bear market turn into overnight supporters in a bull market. It can seem overwhelming trying to navigate the sentiment of this market as an outsider, as mainstream media seems to change their tune faster than Floridian clouds decide whether it’s time for sunshine or rain (…we’ve been getting daily 5 minute flash rains at the new Miami office, for those not familiar with Floridian climatology).

In the 80’s Reagan used to get the moniker of being the ‘Teflon President’ because no bad news would stick to him. Bitcoin in many ways has a similar characteristic. When market sentiment is bullish, no bad news can shake Bitcoin off its path. To quote my market update from May 2019

“Against all expectations Bitcoin continued what seemed like an already over-extended rally to $5,200, thrashing through its major resistance at $6,000 only to ascend to $7,000, $8,000, and even peak above $9,000 for a few minutes. What is most impressive is that it did so at a time when all our worst nightmares came true: A US Congressman threatened to ban Bitcoin, the biggest crypto exchange got hacked for deca-millions, and the leading stable coin got found out to not be backed fully by USD.“

However the same counts in reverse when sentiment turns bearish. No matter how good the news are, the market does not seem to care as it is looking for reasons to be bearish. Look no further than the avalanche of good news happening in the last few weeks which we reported on in our last two weeklies (1 & 2).

While it’s impossible for us to always perfectly nail when the macro sentiment shifts, I wanted to use this month’s market update not only to explore one of the most powerful metaphors that dispels half of the worries and concerns fueling the bearish sentiment out there, but also highlights one of the thought experiments that fuels my personal multi-year conviction why digital assets will succeed, even during the darkest times like November 2018 and March 2020.

Let’s go back in time to one of the most famous experiments in Game Theory… the Prisoner’s Dilemma.

I hope you enjoy,

Felix Hartmann, Managing Partner

Game Theory 101: The Prisoner’s Dilemma

To understand the ‘Crypto Opposition’s Dilemma’, which we will explore shortly, let’s explore one of the most classical experiments in Game Theory. The infamous ‘Prisoner’s Dilemma’.

The setup is following:

You and an acquaintance are down on your luck and decide to rob a gas station. You end up getting caught in the act, however all they can prove at that point is that you trespassed.

In order to nail you for your attempted robbery, they put you and your accomplice in two separate rooms and interrogate you.

Both you and your accomplice are offered a deal:

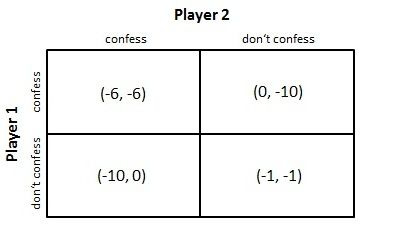

If you both confess, you walk away with 6 years in Jail. However if your accomplice confesses and you lie, you will go to jail for 10 years (nearly twice as long!) while he walks free.

Only if you both lie and don’t confess will you walk away with just 1 year each for trespassing.

What do you do? Think for a second.

While your first instinct might be “Duh! I’d lie! It’s the best outcome for everyone!”, you must remember that you cannot coordinate with your accomplice and cannot force or convince him of your strategy. You are either at the whim of his decision, or you optimize for what’s your best outcome.

And human nature, and thereby game theory, looks to play for the best outcome for oneself. You want to minimize your time in jail and while you can’t guarantee he will keep quiet, your outcome possibilities of 6 or 0 years if you confess is strictly dominant to the outcomes of 10 or 1 years if you don’t confess. So you confess.

Why does any of this matter? What if I told you that this basic premise of coordination failure is the source of nearly all lesser than ideal outcomes for us as individuals? Let’s explore…

The Banker’s Dilemma

Hundreds of banks get caught committing all sorts of ills against their customers, from extortionary interest rates on credit, to a laundry list of account and transfer fees, to limited banking hours, and miserable service. Out of rebellion rises a competing financial system, let’s call it, hmm… DeFi?

Of course the banks would make the most money if they would all coalesce and ban this ‘evil’ DeFi together.

But alas there are hundreds of banks all over the world and coordination is just downright impossible, especially since whichever bank chooses to comply with the new DeFi system is likely going to steal countless customers from those trying to ban it as it is now able to offer cheaper, faster, and better services.

In this example you merely take the game theoretical matrix from above and replace ‘confess’ with ‘adopt’ and replace ‘don’t confess’ with ‘ban’.

But wait… what if this isn’t even theory?

When I started Hartmann Capital in early 2018, every major bank from J.P. Morgan to Wells Fargo would kick every single crypto company such as ourselves to the curb.

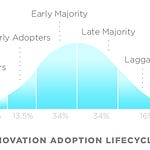

“See the banks won’t allow it” every middle of the bell-curve semi-intellectual would proclaim.

Fortunately that is not how the world works. Because for every bank that has a lot to lose, there is a bank that stands a lot to gain from adopting this new asset class. And that is exactly what Silvergate Bank did.

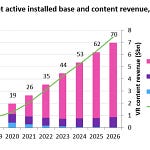

Back in 2018 when we became a customer of Silvergate Bank, Silvergate was a small privately owned bank that was just 30 years old. Small banks historically don’t make it, and the big ones merely become bigger. Well, Silvergate decided that if everyone will turn away crypto firms, they will simply bank ALL OF THEM. And that’s essentially what happened. You were hard pressed to find a crypto company in 2018 that did not have a Silvergate bank account.

And while J.P. Morgan was busy proclaiming that Bitcoin is a fraud, Silvergate was busy collecting major customers like Coinbase (who still uses Silvergate today). As a result J.P. Morgan is now a laughing stock in the digital asset space that no one would bank with even if they paid us, meanwhile Silvergate has since gone public and saw its stock skyrocket to a $3bn market cap with deeply rooted loyalties in the digital asset space.

Silvergate was merely one of the first adopters in a big way that made obstruction (think ‘don’t confess’) too expensive to continue for major banks like J.P. Morgan and co. A new wave of banks, especially in the neo-bank sector is looking to tap into the powers of DeFi to offer better services to its customers.

Look no further than Metropolitan Commercial Bank’s neo-bank product ‘Current’ which just partnered with Compound Finance, a leading DeFi protocol to offer its customer a 4% APY savings account. Go take a lap ‘Marcus’ by Goldman with your lousy .5% APY.

The Sovereign Nation’s Dilemma

You got time for one more? Ah, the question I’ve been asked perhaps as much as “What’s your name”…

“But what if the government bans Bitcoin?”

There’s 191 states with undisputed sovereignty in the world. As we figured out by now in order for a ban to work every nation needs to ban Bitcoin, in order not to invoke the game theoretical positive incentives for those that adopt early, and negative incentives for those that ban at first and either adopt late or fail to adopt.

Again, middle of the bell-curve intellect will have you think that it is naive to believe the government won’t ban Bitcoin. But believing in global coordination is the ultimate naivety.

Here is a list of things 191 nations cannot agree on:

The legality of Cannabis and other drugs (some places its legal, others you lose your head)

…

And you think they are going to come together and ban Bitcoin? That’s rich.

Especially when the first dissidents such as El Salvador have emerged and made Bitcoin legal tender.

So emerges the Sovereign Nation’s Dilemma…

A nation that bans digital assets and technologies like Bitcoin and DeFi, while others embrace it risks:

Financial loss as other nations acquire these assets driving prices up while the banning nation and its people will be left empty-handed.

Talent loss as some of the brightest minds will leave the banning nation to take their talents to a country that is embracing the technology. We saw this for decades with Silicon Valley globally, and post-Covid even domestically with Miami.

Production (GDP) loss as the next ‘FAANG’ sized crypto networks or even deca to hecta billion unicorns like Coinbase will find a home and pay taxes elsewhere.

Don’t get me wrong, a ban by the US or China will always provide a short term blow to prices. But long term it’s a non-event. The digital asset space does not need any one country. But every country needs the digital asset space. Disagreeing with that statement is equal to saying that “my country will be just fine without the internet”.

Those that adopt will flourish, and those that attempt to ban, will just like in the prisoner’s dilemma, rot in prison for the next ten years as the rest of the world takes a lap on them in technological progress.

Would they prefer to coordinate and get away with a ‘lesser sentence’? Of course, but not only is coordination game-theoretically nearly impossible due to human nature, but more so we are already past the point of coordination with dissidents in banking like Silvergate and nation-states like El Salvador.

Final Thoughts:

It’s often not as simple as it seems. While at first questioning the powers of the state seems like naivety, the true naivety is believing in the ability of human coordination through inefficient political bodies. Part of the reason why crypto-economic systems are so effective and paradigm shifting is that they are able to accomplish global coordination between strangers that have never and will never meet by properly utilizing crypto economic incentive structures to create functioning and flourishing digital economies.

The questions addressed in this letter are likely the most common questions I have received repeatedly in the last 5 years educating about the digital asset space. If some of these thought experiments did not click the first time I recommend going back and re-reading. Because when it clicks it becomes so obvious why a lot of the innovations in this space are long term inevitable, and why every major correction, as we saw in May and June are historic opportunities to take advantage of major market mispricings.

Recent Write-ups:

TIMESTAMP 07/05 2021:

DJI - $34,786

S&P - $4,352

BTC - $34,700

For questions reply via email or write me on twitter @felixohartmann

BTC: 33nf4wqwxpS6i3Zwu3toUXxirVj2gWEzi8

ETH: 0x618Ac2930aBd91a486C672f42066190532cFE850

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.